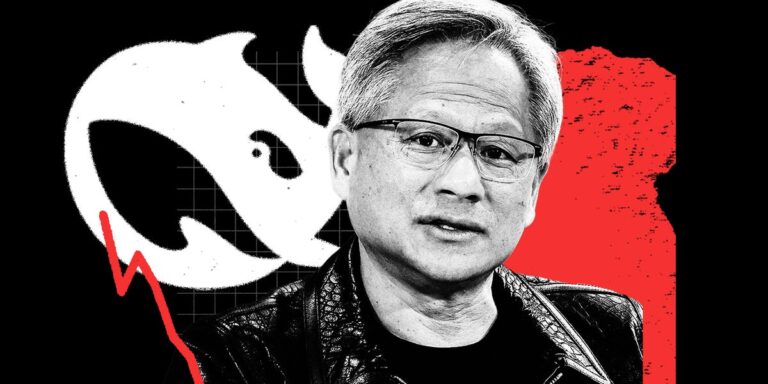

Nvidia’s stocks fell 8% on Monday, deepening trends in the bare market, which has been in steady since early January. The latest Tumble is concerned about NVIDIA’s fourth quarter revenue and profit margin expectations.

Nvidia’s shares deepened on Monday, trading at $114.51, down 8% in the session.

Stocks of artificial intelligence GPU makers officially entered the bear market last week after falling more than 20% from their daily highs in early January.

The losses have intensified last week. The stock price fell 18% over the next seven days, dropping sharply from its closing price of $140.11 on February 20th.

Nvidia’s fourth quarter earnings report launched its latest weakness in the stock last week. The report won analyst estimates and included solid positive guidance, but failed to meet Wall Street’s most lofty expectations and raised concerns about profit margins.

On Monday, investors also appeared worried about reports that Nvidia’s overseas AI chip sales were leaking to China.

The Wall Street Journal reported that Chinese tech companies are getting Nvidia’s Blackwell GPUs despite tighter US export controls.

According to the report, the Blackwell server, which includes eight AI GPUs, can acquire more than $600,000 in China, while the company’s previous generation hopper server can sell domestically for around $250,000.

Chinese black market traders have secured tips through intermediaries in Malaysia, Vietnam and Singapore, the report said.

Bloomberg also reported on Nvidia’s overseas chip sales on Monday, noting that Singapore has launched a fraud investigation into whether servers shipped to Malaysia from Dell Technology and Super Microcomputers house Nvidia chips that are prohibited from entering China.

Technical signals are flashing warning signs as traders digest the latest decline in Nvidia’s stock on Monday.

Nvidia’s stocks have not reached a significant resistance level of around $130, but are now below the 50- and 200-day moving averages.