taktile We raised $54 million to help drive AI risk management tools.

The Series B round, announced Thursday (February 27), brings the company’s total funding to $79 million. Balderton Capitalthat led the round. The company says its funding comes at the moment when mainstream automation for high-stakes decision-making is in the cusp of breakthroughs.

“In the financial services and other regulatory industries, there are high interests and every decision is important,” the announcement said. “Established agencies face intense pressure AI-led fintech startup Innovate rapidly and challenge market share and margins. However, many companies struggle to adopt AI on a large scale. ”

Among the major obstacles, Balderton continues, with the lack of engineers with the skills to develop and maintain AI systems. And even the most advanced AI-based language models require higher accuracy, as they can manage only certain aspects of complex problems rather than provide a “completely reliable solution.”

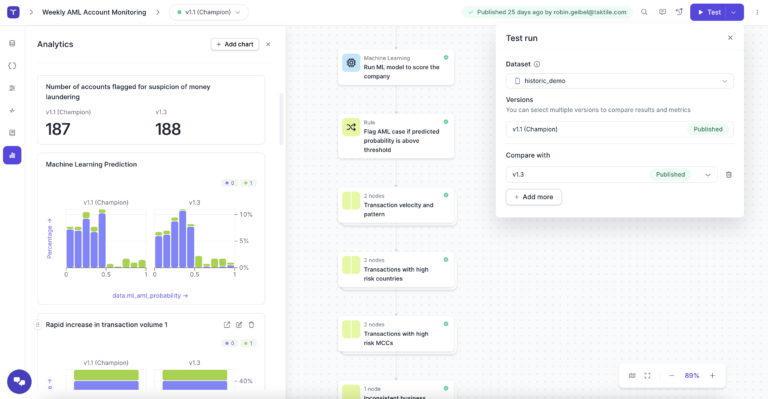

Taktile said, “We close this gap by equipping risk teams and their engineering counterparts with a shared platform.

The announcement also results from wrong decisions – loan defaults, fraud losses, compliance fines – TD Bank Payments related to $3.1 billion last year Money Laundering Anti-Money Laundering Failure In the US

“From the first day of our journey, we believed that by enabling organizations to make the best decisions for our customers, we could improve the lives of millions of people,” he said. Maik Taro Wehmeyerco-founder and CEO of Taktile.

“By managing experienced risk experts, even the most regulated companies in financial services can fully employ AI in their high-stakes workflows.”

PYMNTS looked into the role of AI in risk management and fraud detection last month in conversation Mark SandChief Technology Officer of STAX payments.

” The biggest red flag We are merchants with newly established banking relationships and websites. These temporal attributes often indicate injustice,” he said.

Sundt also described suspicious patterns of transaction fraud, such as large transactions and subsequent batch reversals and refunds sent to different credit cards.

“These scenarios require robust AI systems to detect and mitigate Fraudulent activities On a massive scale,” he told Pymnts.