LOS ANGELES (AP) — Nvidia on Wednesday reported a surge in profits and sales in the fourth quarter as demand for specialized blackwell chips that have continued to grow in artificial intelligence systems.

For the three months ended January 26th, the Santa Clara, California-based tech giant reached $39.3 billion in revenues of 12% since the last quarter and 78% over a year ago. It was adjusted for one-off items and earned 89 cents per share.

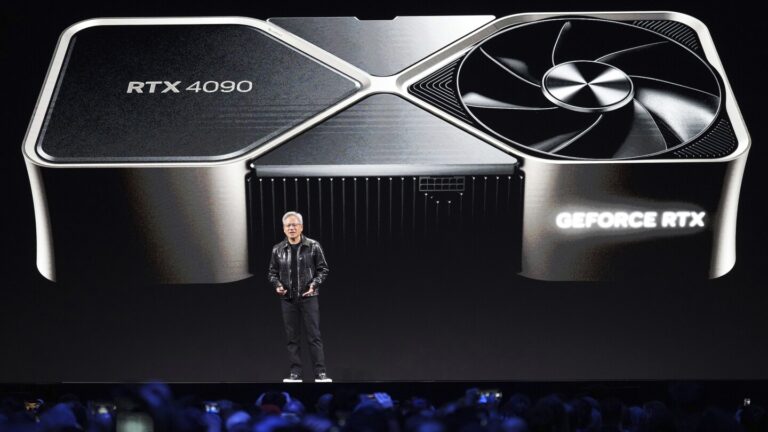

“The demand for Blackwell is surprising as AI adds another scaling method. With more training calculations, the model becomes smarter and the answer becomes smarter as the calculations for longer thinking increases,” said Jensen Huang, founder of Nvidia, in a statement.

Wednesday’s revenue report surpassed Wall Street’s expectations. According to Factset, analysts were expecting an adjusted profit of 85 cents per share with revenues of $38.1 billion.

The fourth quarter revenue is the company’s first report, as Chinese company Deepseek has developed a large language model that can compete with ChatGPT and other US rivals, but is cost-effective to train systems with fragments of data using NVIDIA chips.

DeepSeek’s frenzy has quickly wiped out $595 billion of Nvidia’s wealth. However, in a statement, the company praised Deepseek’s work as “a progress in excellent AI” that “is fully compliant with widely available models and export controls.”

Nvidia, the poster child of the AI boom, has grown into the second largest company on Wall Street. Value over $3 trillion – And the stock movement weighs more on the S&P 500 and other indexes than all companies except Apple.

Nvidia and other companies benefiting from the AI boom are the main reason the S&P 500 has recently risen to records after the record, with an update from last week. Their explosion of profits helped drive the market despite concerns about stubbornly high inflation and possible pain for the US economy from President Donald Trump’s tariffs and other policies.