Openai is working with Taiwan Semi for its own custom chips.

When it comes to artificial intelligence (AI) chip stocks, my guess is that names like Nvidia, Broadcom, or advanced microdevice come to mind first. All three companies play an integral role in providing data centers with modern AI hardware, but these chip designers need to provide plenty of credit to the casting services of Taiwanese semiconductor manufacturing. (TSM) 3.10%)).

One of the things that make Taiwanese cicadas so unique is that their services are not in demand only from traditional semiconductor companies. In fact, Openai tapped Taiwanese cicadas for an important collaboration. Let’s explore how Openai and TSMC are working together and evaluate why this partnership is profitable for Taiwanese cicadas in the long term.

How do Openai and Taiwanese cicadas work together?

Openai’s flagship product is a large-scale language model (LLM) called ChatGPT. It uses the generated AI to answer any kind of queries at a fast speed. The seemingly endless knowledge of ChatGpt gives the appearance of a modern online encyclopedia, but there is actually quite a bit of technical processes going on in the background.

The internal data center resides in an advanced chipset known as the Graphic Processing Unit (GPU). This runs an algorithm to handle data workloads to help users feed answers to questions quickly. Currently, NVIDIA and AMD are major players in the data center GPU market. Therefore, both companies have enormous leverage for their customers regarding pricing capabilities.

However, more companies are turning to custom silicon solutions, particularly to move away from excessive reliance on Nvidia. Openai is the latest in exploring the development of its own custom chipware.

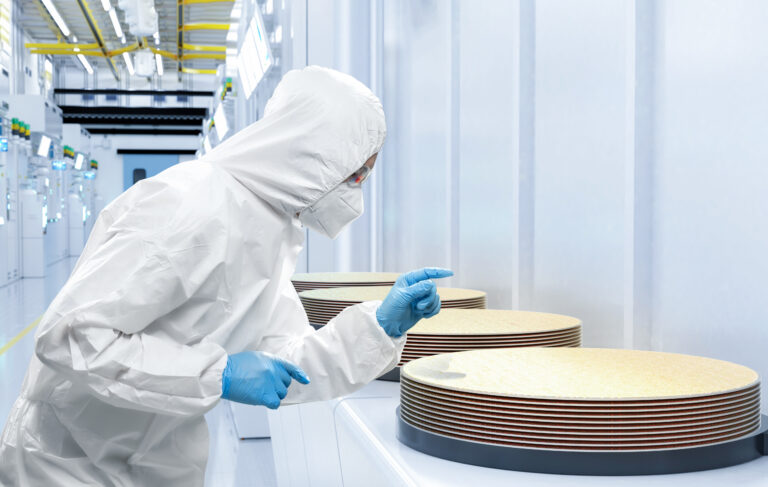

Image source: Getty Images.

How strategic does this make sense for Openai and TSMC?

Openai’s choice to work with TSMC is no surprise at all. In addition to Legacy Semiconductor Companies, Taiwan Semi has reportedly worked closely with Amazon, Alphabet, Apple, the Meta platform and Microsoft. Each of these customers is exploring alternative solutions to the Nvidia architecture.

When it comes to Openai, remember that the company has a close relationship with Microsoft, especially considering Hyperscaler has invested $10 billion in ChatGpt makers. For me, my interest in Openai’s own chipset is simply expanding Microsoft’s custom chipware development and a $80 billion planned AI infrastructure spending this year.

What does this transaction mean to Taiwanese cicadas?

Industry research suggests that the Taiwan semi-finals order an estimated 60% share of the casting market, which is ahead of rivals such as Intel and Samsung. In my eyes, TSMC has been able to build its lead, mainly thanks to the rising demand for equipment sold by NVIDIA, AMD, Broadcom and other traditional semiconductor businesses.

Hyperscalers and adjacent AI developers are also carving out pockets in silicon space, so I think Taiwanese cicadas are in a favorable position to kick new gear and surge further ahead of the competition. Another unique angle to relationships with cloud infrastructure experts and developers such as OpenAI is diversifying TSMC’s revenue base.

I think Openai is making a clear choice by choosing to partner with TSMC to realize its chip design. Furthermore, as AI workloads continue to skyrocket and become more complicated over time, my view is that additional chip designs will continue for years to come.

Therefore, I think the agreement with Openai could lead to more chipware architectures for TSMC’s long-term outlook.

Randi Zuckerberg, a former director of market development, Facebook spokeswoman and sister to Metaplatform CEO Mark Zuckerberg, is a member of Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of Motley Fool. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Intel, Meta Platforms, Microsoft, Nvidia, and Taiwanese semiconductor manufacturing. Motley Fool recommends Broadcom and the following options are recommended: A $395 call with Microsoft for January 2026, a short $27 call with Intel for February 2025, a $405 call with January 2026. Motley Fools have a disclosure policy.