Investors craving a boring background for this week’s Nvidia revenue can forget about it. The main source of Hoopra is Chinese startup DeepSeek, which rattled club stocks late last month with the claims of a more efficient AI model. Nvidia’s next-generation Blackwell chip platform also faces rollout constraints. In other words, CEO Jensen Huang can talk a lot about Wednesday evening, when the dominant manufacturer of artificial intelligence chips delivers fourth quarter results. For the November-January period, Wall Street expects NVIDIA to report 84 cents of revenue on $3.805 billion, meaning growth of 61.5% and 72% year-on-year respectively. I will. Nvidia is also planning to look at the 2026 figures for the first time. The consensus estimate of the company’s first quarter revenue, closing in April, is approximately $42 billion. The initial market panic via DeepSeek has subsided, with Nvidia’s stock wiping out most of the 18% in the first week of Fallout, trading every Monday for around $135. Stock went down from $142.62 on January 24th, then closed at $116.66 on February 3rd. AI investor. But in about 48 hours, Wall Street analysts will have the opportunity to finally ask Huang, widely regarded as an AI visionary about Deepseek’s impact on Nvidia’s business. The reason Nvidia’s shares plummeted following the arrival of Deepseek is that the claims of efficient, low-cost AI models are probably not as low-cost as initially expected, but to train and execute AI in the future. The concern was that it would be a major reduction in the number of advanced chips needed. Daily Applications, a process known as reasoning. The counterargument is that it is a cheaper AI model to develop and deploy, making AI more accessible and should encourage adoption by businesses and consumers, and ultimately requires a significant amount of computing power. . NVDA 1y Mountain Nvidia’s stock performance over the past 12 months. Huang’s only public comments about Deepseek were revealed last week in a tape conversation with DDN CEO Alex Bouzari. Comments may predict the debate that Huang will have in Wednesday’s call, so it’s worth exploring them. In an interview with DDN, Huang suggested that the stock market response to DeepSeek is based on an incomplete understanding of AI model training. Patterns in the dataset. The model relies on the patterns it trains to generate the output during inference. Huang says that many investors are unable to recognize that training is a multi-stage process, and as the first “pre-training” phase is followed by “post-training”, the model is fine-tuned and expanded into inference. It is optimized before it is. After training, “a place to learn to solve problems,” Huang said. “There are many different learning paradigms associated with post-training. In this paradigm, this technology has evolved so much over the past five years and computing needs have evolved intensively,” he added. With some of Deepseek’s innovations, “People were like, ‘Oh, my well, pre-training is much less.’ They forgot that it was really very intense after training,” he said. Huang also said that Deepseek’s top-end model, known as R1, is considered an inference model, breaking down user prompts into small pieces and spending more time “thinking” before generating answers. In general, these types of models can handle more advanced tasks than the models that first launched in late 2022 and driven Openai’s ChatGPT when it caused an AI boom. Openai launched its inference model later last year and released a new version in January. “Inference is a rather computationally intensive part,” Huang said. “So I think the market responded to R1 with ‘Yes, AI is over… there’s no need to do any more computing.’ It’s exactly the opposite. “Nvidia’s Blackwell launch will also be a considerable focus on Wednesday evening. And as far as the short-term financial impact is concerned, it is heavier than Deepseek. Nvidia’s fourth quarter revenue guidance included a guidance of around $37.5 billion, slightly lower than the current consensus, at least “billions of dollars” of Blackwell sales. Blackwell, who took over Nvidia’s hit hopper lineup, entered full production in the fall. By early January, fans told the Las Vegas CES trade show that “all cloud service providers” were “on and running” Blackwell-based systems. However, the process of manufacturing and installing cutting-edge Blackwell products, a full server rack version known as the GB200 NVL72, faces several challenges, analysts say. For example, server manufacturer Hewlett Packard Enterprise announced its first GB200 shipment within two weeks. However, that does not mean there is a risk of a complete lack of Nvidia’s quarterly figures or the first quarter guidance for the first quarter of April. In a note last week, analysts at KeyBanc Capital Markets said that despite low GB200 rack shipments, the H20 chips were shipped to Chinese customers, in addition to another relatively simple Blackwell product called the HGX B200. He said he expected it to be “upside down.” In fact, Keybanc said the emergence of Deepseek caused a “surge in demand” for the H20, a throttleback version of Hopper chips aimed at complying with US trade restrictions on advanced AI chip exports to China. He said that. While the US is growing belief that it will strengthen export controls in response to deep shakes, China appears to be a source of strength soon. The move from Hopper to Blackwell is “a little more creepy than expected,” Merius’ research analyst wrote to his client on Monday. “However, the sales outlook remains excellent for the F2Q26. And for the Blackwell Ultra (GB300), which was announced at the GPU Technology Conference (GTC) in March and is likely to be shipped at (end of the calendar year). , already there’s a lot of chatter. “GTC is Nvidia’s annual developer conference and product show and Tell. Putting it all together, Merius suggested that Nvidia’s guidance for the April quarter may not exceed the consensus of the recent years as investors have hoped for. But thanks to Blackwell’s realization, analysts argued, it wouldn’t take long for a “really big bump” to become a “really big conflict” of revenue. Bottomline’s Nvidia investors get their hands full on Wednesday evening. As Jim Kramer wrote in his column on Sunday, “I feel that the setup is inadequate for this quarter.” Certainly, Deepseek Saga over the past few weeks tested the resolve he recognized at last week’s monthly meeting. However, he said his belief in Huang’s stewardship in the company remains strong. So he designated Nvidia the stock from the start: “Own it, don’t trade it.” The good news is that there are so many questions surrounding Nvidia’s revenue report that investors are finally trying to get answers directly from Huang and respected financial chief Colette Kress. We were waiting for it. (Jim Cramer’s Charitable Trust is a long NVDA, MSFT. See here for a full list of stocks.) As a subscriber to Jim Cramer and CNBC Investing Club, you will receive trade alerts before Jim makes a transaction. Jim waits 45 minutes after sending a trade alert before purchasing or selling stocks in the Charitable Trust portfolio. If Jim talks about stocks on CNBC TV, he will wait 72 hours after issuing a trade alert before running the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with the disclaimer. Due to receiving information provided in connection with the Investment Club, there is no obligation or obligation of the fiduciary. No specific outcomes or benefits are guaranteed.

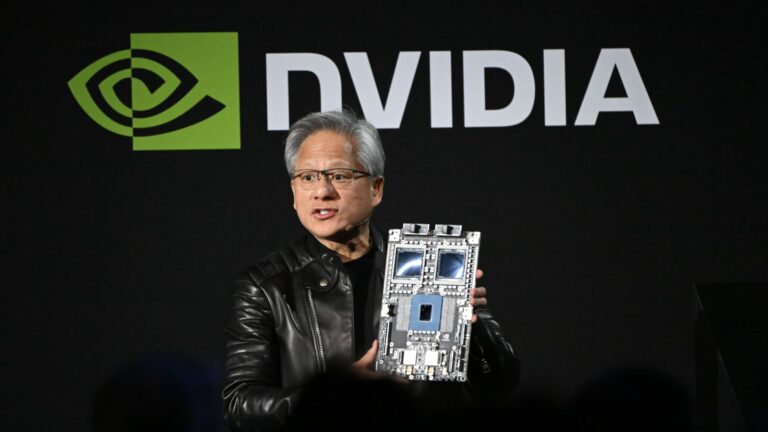

Jensen Huang, co-founder and CEO of Nvidia Corp., holds the AI accelerator chip for the data center, as he speaks at NVIDIA AI Summit Japan in Tokyo on November 13, 2024.

Akio Kon | Bloomberg | Getty Images

Investors long for a boring background nvidia This week’s revenue can be forgotten.