NVIDIA Corporation’s NVDA leadership in the data center computing market, backed by significant investments in artificial intelligence (AI) infrastructure, offers a strong long-term advantage.

However, Rival Advanced Micro Devices, Inc. AMD could drag Nvidia closely together and fill the gap with next-generation innovations. In this connection, let’s explore better investment options –

Why you’re bullish on Nvidia & Amd

Deepseek’s claim that a massive language model (LLM) can be built for just $5.6 million has disrupt the AI landscape. After all, this is just a small portion of the amount that top high-tech companies in the US spend on power calculations to manufacture AI models.

Deepseek’s cost-effective LLM development claims have affected NVIDIA, where graphics processing units (GPUs) are important for Tech Space’s AI infrastructure buildout. However, this does not have a major impact on NVIDIA as lower costs promote the use of computing power. This is the bounty of the spectacular seven stocks. Additionally, Nvidia has ample resources to move towards a more cost-friendly product, enriching the AI ecosystem.

Despite Deepseek’s low-cost model, Meta Platforms, Inc. Meta and Microsoft Corporation MSFT have spent billions of dollars on AI infrastructure, highlighting Nvidia’s strong growth potential. Nvidia’s cutting edge blackwell chips are gaining popularity among leading tech players and are driving growth. These chips offer faster AI interfaces and better energy efficiency (Read more: Buy Nvidia Stock, Deepseek’s threat is exaggerated).

Meanwhile, AMD has benefited greatly from strategies that focus more on data center businesses and help clients implement AI. Last year was a transformational one for AMD, with increasing adoption of EPYC processors almost doubled annual data center revenue.

This year, AMD’s outlook is promising with the recent acquisition of SILO AI and ZT systems, helping customers develop AI systems. As we don’t forget, AMD is the forefront of PC central processing units with know-how and strong moats for X86 architecture licenses.

Why Nvidia is a better buy than AMD now

Both Nvidia and AMD stocks show promising growth, but if you have to choose someone, it must be Nvidia. This is because the industry is widely adopting NVIDIA’s CUDA software platform on AMD’s ROCM software platform. Cuda X gave Nvidia a strong competitive advantage, but the company’s dominant position in the expanding GPU space has created a wide range of moats.

Additionally, developers are likely to stick with CUDA for a hassle-free infrastructure migration, and for now they’re keeping AMD behind Nvidia in data center races. AMD’s $3.9 billion for the fourth quarter of 2024 is AMD’s $3.9 billion palace, adjacent to Nvidia’s $30.8 billion in the third quarter on October 27th. Nvidia plans to report its results for the fourth quarter on February 26th.

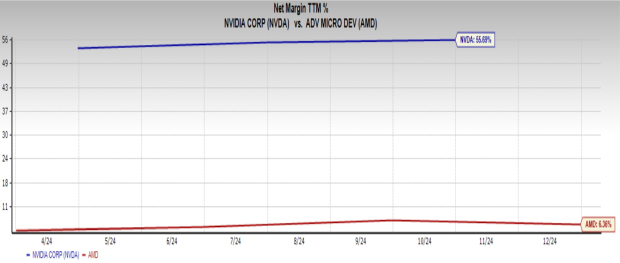

Anyway, Nvidia generates profits more efficiently than AMD. Nvidia’s 55.7% net profit margin is higher than AMD’s 6.4%, showing a higher margin.

Image Source: Zacks Investment Research

Therefore, Nvidia has Zacks rank #2 (purchase) correct. AMD carries Zacks rank #3 (hold). You can see the full list of Zacks #1 (Strong Buy) ranked stocks today here.

Seven Best Stocks in the Next 30 Days

Just released: Experts distill seven elite stocks from the current list of strong shopping for 220 Zacks Rank #1. They consider these tickers “probably in an early price pop.”

Since 1988, the complete list has more than doubled the market, with an average annual average of +24.3%. So, take seven immediate attention chosen for these hands.

Browse now >>

Do you need the latest recommendations from Zacks Investment Research? Today you can download seven best stocks over the next 30 days. Click to get this free report

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Nvidia Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the authors and are not necessarily Nasdaq, Inc. It does not reflect the opinions of