Key takeout

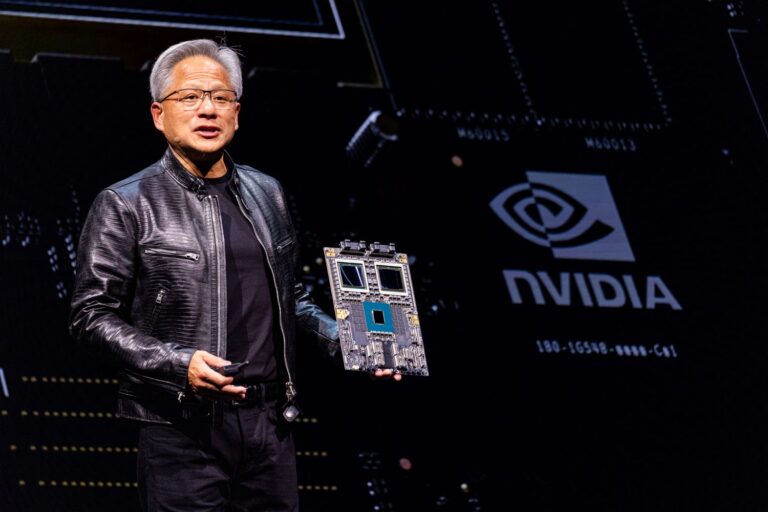

NVIDIA (NVDA) is scheduled to report fourth quarter results after the market closed on Wednesday. Analysts are broadly bullish about AI chip makers stocks.

All but one of the 18 analysts who cover inventory tracked on Visible Alpha issues a “buy” or equivalent rating, with one analyst giving stocks a “hold” rating It’s there. The consensus price target of around $175 means a 30% increase from Friday’s closing price.

Analysts at Wedbush and Oppenheimer, who repeated their $175 price target on Thursday, will see an increase in demand for the company’s sophisticated chips as increased spending on AI infrastructure could lead to another strong quarter That suggested.

Estimates compiled by Visible Alpha show that Nvidia is projected to increase its record quarterly revenue of $38.32 billion. Net income is expected to rise to $21.08 billion from $12.84 billion the previous year.

A UBS analyst who maintains a $185 price target said “investment expectations have risen a bit recently,” adding supply chain improvements could potentially increase sales of Nvidia’s Blackwell line He said. UBS almost doubled its estimate of Blackwell’s contribution to fourth-quarter revenue from the previous $5 billion.

Oppenheimer also showed that the rapid rise in Chinese AI startups can ultimately prove “positive” for chipmakers.

Nvidia’s shares fell 4% at $134.43 on Friday amid a wider decline in the market. They have acquired about three-quarters of value in the last 12 months.

Update – Feb. 21, 2025: This article has been updated since it was first published to reflect more recent stock value.