Nvidia leads in the chip space, but may have better stocks than looming into the background.

Over the past few years, semiconductor inventory has been some of the biggest beneficiaries of AI (AI), the latest megatrend in the market. In particular, suppliers of graphics processing units (GPUs) to data centers such as Nvidia and Broadcom have witnessed unusually high profits compared to those found with the S&P 500 and Nasdaq composites.

However, in the background, casting experts in Taiwan’s semiconductor manufacturing (TSM) -0.42%)) – Known as TSMC – it has quietly emerged as a leader in chip space in itself. The best part? Stock is still cheap and dirty. This is why I think Taiwanese cicadas will be the best performance chip stock in the next decade.

Why TSMC appears ready to thrive

Data Center GPUs are the key hardware that drives all kinds of exciting generation AI applications. In this sense, companies like Nvidia, Broadcom, and Advanced Micro devices should all be considered leaders when it comes to use cases such as large-scale language models (LLM) and machine learning training.

But what you may not know is that each of these companies actually rely heavily on Taiwanese semi to produce their chipware. TSMC specializes in Foundry Services and creates chipsets for many different semiconductor providers across use cases across computing, mobile devices, cloud infrastructure, and more.

This claims to be the current photographs of Taiwanese cicadas, but what’s even more intriguing is the future outlook. According to a priority survey, the total market for addressable markets (TAM) for AI chips is expected to reach around $1 trillion by 2034. This is about 10 times the current estimated size.

Also, considering cloud hyperscalers such as Amazon, Alphabet and Microsoft are expected to spend $200 billion in chips north in 2025, the AI chip market will expand exponentially over the next few years. I think it will be possible. .

TSM revenue (quarterly) data from YCHARTS.

The idea to understand here is that a surge in demand for chips from Nvidia and its peers is a particularly good honour for the Taiwan semi-finals, as it is deeply embedded in the ecosystems of many major semiconductor companies. To highlight how important TSMC is to other chip companies, consider that it accounts for more than 60% of the chip manufacturing market.

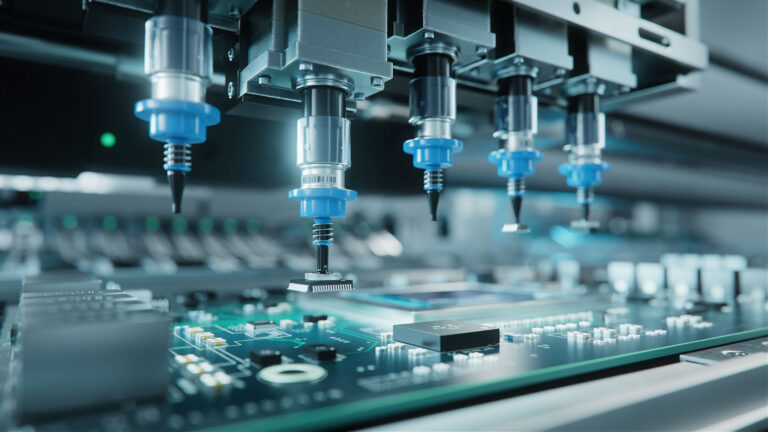

Image source: Getty Images.

Why I think TSMC will produce a higher return than nvidia

The chart below shows the price and earnings between NVIDIA and TSMC over the past few years. Taiwan’s semi-stocks are generating returns that will capture the market, but they are not even close to what Nvidia investors have experienced.

TSM data by YCHARTS.

The AI chip market is expected to continue growing, but I think the growing competition from AMD and custom silicon providers used by HyperScalers will be a headwind for Nvidia in the coming years. In contrast, Taiwanese cicadas are in a position to actually benefit from increasing competition in the chip space.

Because of this, I think TSMC’s revenue and revenue acceleration will actually continue to rise. Nevertheless, TSMC is traded at multiples of 22.6 (P/E). This is very close to the average forward P/E of the S&P 500, located at 20.9.

In my eyes, TSMC is sitting in a favorable position to continue expanding its reach in the casting industry. The growing market for chips, highlighted by increasing competition in the AI realm, has become bullish as investments in the Taiwan semi-finals actually produces excellent returns for the S&P 500 in the long term.

However, I don’t think TSMC stocks have yet to have an “Nvidia moment.” For all these reasons, I think stocks are a simple opportunity and trade with bargains. Investors with a long term period may want to consider scooping up TSMC’s stock and holding it up right now.

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of Motley Fool. Adam Spatacco has positions for Alphabet, Amazon, Microsoft, and Nvidia. Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Microsoft, Nvidia, and Taiwanese semiconductor manufacturing. Motley Fool recommends Broadcom and the following options are recommended: A $395 call with Microsoft length for January 2026, a $27 call with Intel short for February 2025, a $405 call with January 2026. Motley Fools have a disclosure policy.