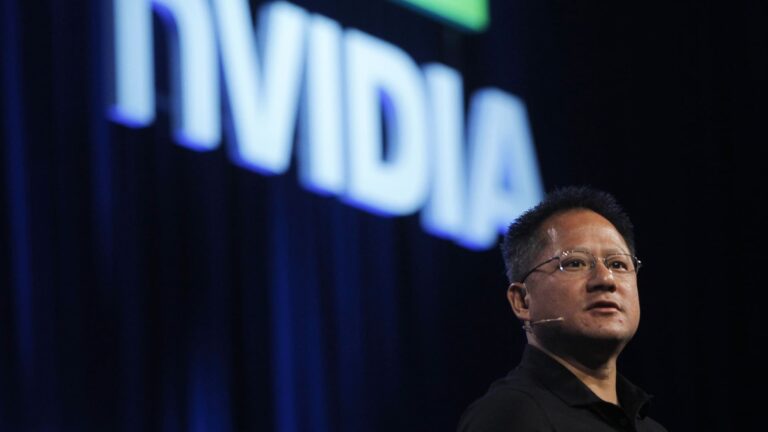

Here are the biggest calls on Wall Street on Friday: RothMKM is launching Quanta Services as the infrastructure company said it is best for data centers and AI. “Power is a key bottleneck in the AI/DataCenter theme, and PWR is one of the best companies to support accelerated electrical infrastructure buildouts with key market shares for utilities and renewable energy. ” Morgan Stanley repeats Nvidia because overweight Morgan Stanley said that “another pivotal moment of AI” comes when Nvidia reports its revenue next week. “Nvidia is the mainstay of AI moving forward or moving lower.” CLSA upgrades Alibaba to make strong purchases from CLSA out-of-performance, and the Chinese online marketplace is “the demand for AI applications.” “We’re in the best position to take advantage of the surge.” “Upgrade Alibaba from O-PF (Outperform) to a high belief O-PF, raising the target price from USD 125 to USD 165.” JPMorgan upgrades overweight Grab Holdings from Neutral JpMorgan, Investors said they should buy a dip of stocks from Singapore’s high-tech company following earnings on Thursday. “We continue to believe that Grab can leverage network effects to build on market leadership while optimizing monetization and spending. Upgrade Grab to OW.” Goldman Sachs I upgraded Terreno Realty Corp to buy from Neutral Goldman and upgraded the Real Estate Investment Trust after earnings. “We expect industrial absorption (i.e., occupied square feet) to improve in 2025. This will make the sector more constructive. By company-specific standards, TRNO is currently in the industry’s coverage of industrial REITs. We believe it’s best positioned among them. Bank of America repeats Apple as it described its expansion of Apple’s ecosystem as “opens a massive potential revenue stream on Apple TV+ on Android.” It’s there. “Apple recently announced the availability of the Apple TV app on Android mobile devices….. HSBC upgrades Unity to buy from HSBC, and HSBC plays games following the “strong” revenue beat. I upgraded the developer software company. “The Unity engine, which shows the momentum and expansion of new ad models, is a potential game changer, TD Cowen, repeats Amazon over and over. Genai Capex (AVG) ’26 -’30.” Wells Fargo has made Stagwell equal Wells Upgrade to overweight, marketing and marketing and communications companies upgrade STGW from equal weight to overweight Celesta as overweight JPMorgan said that electronic manufacturing services companies are best positioned. Morgan Stanley repeats overweight a company that dubbed TSM the catalyst-driven idea, saying investors should buy stocks before they win NVIDIA, with Dec-25 price target of $166 , repeat investments in AI infrastructure. . “If NVDA guidance exceeds expectations, TSMC’s stock price is expected to rise,” Bank of America repeatedly blocked, saying on Thursday that investors should buy DIP following revenue. So I’ll repeat the block. “XYZ is underestimated and we continue to think of it as a high quality business model. The focus is on 1Q acceleration for both Square and Cash apps (this seems plausible), and 2 hours of 2 hours. Investor Day. Keep Buying.” Cantor Fitzgerald said that Neutral from Overweight Cantor from Rivian is seeing too many negative catalysts after Thursday’s revenues in downgrade of EV. Ta. “From OW, the company has made its way into neutral due to reduced vehicle delivery, reduced EDV (electricity supply van) delivery and worsening macro conditions including the implementation of incremental tariffs and the possibility of eliminating the $7,500 EV tax credit (from OW). ) It’s downgraded.’ JPMorgan repeats Walmart as investors said on Thursday that they should buy the DIP following the revenue. “Objectively, I think the WMT story is pretty much intact, as it is a question of how we see reinvestment in a half- and half-empty discussion of glass.” UBS, which states the Pizza Company Domino’s Buy reiterates that it is suitable for growing sales in the same store. “We believe DPZ is located to accelerate the US SSS (same store sales) momentum supported by multiple initiatives.