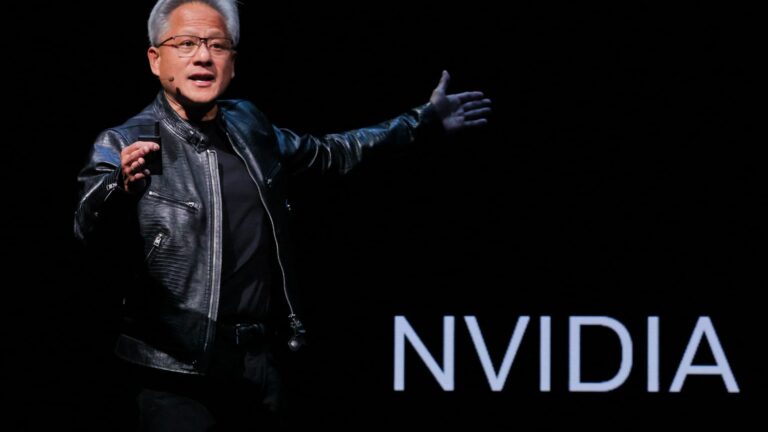

The biggest call on Wednesday Wall Street is as follows: If you buy a loop that the cruise company is sufficiently located, you will start buffet holdings. “The buffet is relatively reduced, and our opinion is the smallest public cruise line, and it operates important river -based operations, so there is a better prospect of growth.” Bank of America. Following the company’s “solid” profits on Tuesday, he repeats the alphabet because he says he is sticking to the alphabet. “We believe that we may be underestimating the advantages of AL’s overview for searching in 2025.” WELLS FARGO following Tuesday’s profits. He says he is sticking to AMD, so he has repeated advanced microdies. “I think the expected softened 1Q25 guide and/or expectation reset have begun to be considered positive setups, but the flat 1H25 to 2H25 data center guide may place AMD in a” proof “position. There is. WELLS FARGO has reduced the snap to an equal weight from overweight. “When SNAP enters the re -investment period, downgrades from OW to EW. The upward options are only banned from Tiktok in the United States, but the re -design of apps has become longer, and the growth of advertising profits is stubborn. Barchr’s is lower than the overweight, “I believe that the competitive environment is intensifying in 2025. Berkrazes have lowered Ferrari, which has been overweight, following the profits on Tuesday. “Some investors question the” quality “of beats and guides, and the remaining value is stubborn. Piper Sandler said that Simon’s property was upgraded over too much from a neutral piper, and the owner of the mall was looking at the growth of revenue. “Therefore, it seems that management is more comfortable running on an external front that seems to promote cash flow, so it seems that concerns about slowing in profits are softened. JeffERIES upgrades Mattel. Jefferies has upgraded the toy company following the profit, “After the powerful Q4 print of MAT and the aggressive sales growth, we have upgraded the mat. JPMORGAN upgraded Janus Henderson of Neutral JPMORGAN, and the asset management company is a “conversion story.” “We are upgrading Janus too much. Yanus considers the traditional asset management turn around story.” Piper Sandler starts Opera. The overweight Piper says that web browsing technical companies are fully positioned. “We will start OPRA with OW’s evaluation and $ 25 PT.” Rosenblatt has been downgraded to Spotify, which is mainly a Buy The Firm, which has been reduced in shares at the time of evaluation. “Spotify is very good, but after impressive step -up in 2024, profits are likely to decline in 2025. Explosive operation margin -Reduction -Copyright reduction. And the leverage of the copyrighted loyalty is the ratio of revenue -the normal level is upgraded from HOLD STIFEL, and the pool company is resilient. “We have reduced Hayw’s outlook, but we have upgraded stocks to maintain the target price of $ 16.50.” CITI’s downgrade is sold from Neutral Citi, according to Warby Parker. It is said that it is overrated. “We are downgrading WRBY for sales from Neutral. We are expecting a powerful 4Q24 of sales +16.5 % to 15.6 %, but there are 50 stock prices up to the level that seems to have been overrated in the past three months. The rise in the city MOLSON COORS to Neutral from SELL CITI has developed. “In the future, it will be easier to compare tap market share in the spring, and beer categories will easily circulate in the summer.” JPMORGAN repeats that NVIDIA is too fat, despite the appearance of DeepSeek. “The complexity of the model higher and the new innovation and the proliferation of inference applications should unlock the GPU’s strong demand. JPMORGAN says that Apple’s App Store Revenue looks solid in January. Therefore, Apple repeats Apple and repeats Apple’s App Store profits in January to 2.7 % M/M (historically seen from December to January). The average increased +2.3 %, and the revenue trend is +17.6 % Y/Y in January. UBS repeatedly emphasizes the 4Q results and commentary on the UBS, as they say that they support the shares of Chipotre. A modest margin up -the off -calendar/headwind of the weather has become heavier to the trend. He says he is looking at an important opportunity to expand the total margin. The company believes that the company has not only protected the business in the event of a potential transaction, but also reuses the microin barter/battery production capacity. It is also an opportunity. The lower Micro Device has become a neutral growth from BUY CITI. AMD reported the appropriate result/guidance driven by the increase in CPU (central processing unit), but AMD did not provide AI earnings guidance, and the AMD’s AI profit was 1H25 with margin dilution. It seems to be decreasing, “Leerink is upgrading REGENERON and surpassing the market performance, and investors should buy dip in Biotech Company. It has been upgraded to the outpoint and the PT has been raised from $ 762 to $ 834. “