Both NVIDIA (NVDA) and Super Micro Computers (SMCI) have increased rapidly in the report that the new artificial intelligence (AI) data center system equipped by the two companies is ready to release.

Maximize portfolio using data -driven insights.

Utilizing the power of TipRanks, a data -type tool, the best performance, it helps to find the best performance and make investment decisions based on information. Move the stock pick and compare it with the recommended items of the top wall street analyst in the smart portfolio.

NVIDIA shares have increased by 5 %, and supermicro computer shares have increased by 7 % on that day. The rise was born after the announcement that NVIDIA’s new AI data center system of Super Micro Computer, equipped with NVIDIA’s Advanced Blackwell microchip, is now ready to ship.

The SUPER MICRO product is an AI data center that can execute NVIDIA’s Blackwell chips on a large scale, and has now reached a “complete production availability”. The news has reduced concerns about the demand of NVIDIA chips and reduces future sales of the AI server of Super Micro Computer, which runs microchips and processors.

Blackwel chip demand

NVIDIA is a great bet on advanced Blackwell series chips. Tip demand continues to exceed the supply. The company explains the difficulty of strengthening the supply chain on a large scale if many custom components are needed to build a product.

For Super Micro Computers, the Blackwell -based AI data center system is a bright place in the continuous trouble of the company. In December last year, Super Micro said that it would take the end of the difficult year to take a financial and legal leadership team. The company is also facing a survey by the US Department of Justice about financial reporting.

NVDA shares have risen 80 % in the last 12 months.

Do you buy NVDA inventory?

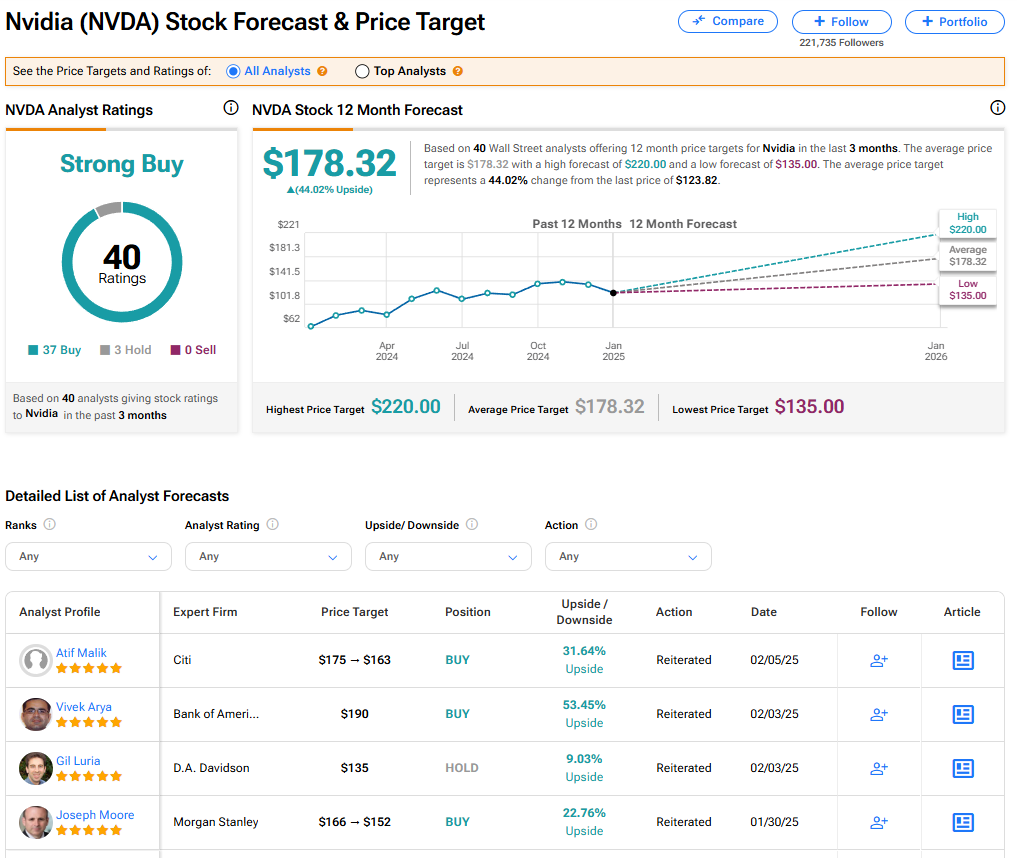

NVIDIA’s shares are currently consensed to rating strong buying among analysts in 40 Wall Streets. Its rating is based on 37 purchases assigned in the last three months and three hold recommendations. The average NVDA price target of $ 178.32 means 44.02 % upside from the current level.

Read more of the evaluation of NVDA stock analysts