The shares of NVIDIA (NASDAQ: NVDA) announced last week that Deepseek in China has succeeded in developing AI chatbots that only use only a small part of the necessary computing skills for existing models. I was shocked.

Maximize portfolio using data -driven insights.

Utilizing the power of TipRanks, a data -type tool, the best performance, it helps to find the best performance and make investment decisions based on information. Move the stock pick and compare it with the recommended items of the top wall street analyst in the smart portfolio.

DeepSeek’s efficient AI models have a major threat to the NVIDIA market to reduce the demand for NVIDIA’s high -end GPUs. NVDA shares have fallen by 22 % since the announcement and have sank to the lowest level since September.

Do investors need to worry? The answer is loud, according to one investor known for the wealth of the pseudonym MMMT.

“Deepseek’s AI model uses the NVIDIA Corporation chips, so we are trying to assume NVDA’s premium evaluation and future demand,” he warns investors.

MMMT believes that DeepSeek’s threats appear in various ways. Above all, if the computing power required to reach the same level of AI performances is low, huge maintenance with hyper -color begins to decrease.

In addition, investors may be more fashionable for inexpensive chip models, and more expensive competitors (among AMDs) may succeed in chewing NVIDIA market share in the next few years. It is pointed out that it is expensive. This concludes that MMMT assumes that NVIDIA can continue to enjoy 75 % gross profit margins in the future.

In addition, many of the major NVIDIA customers are in the process of developing their own custom chips. “If you understand that a handful of NVDA customers have invested billions of bills in their own chip production, we must ask the future execution of this business,” said MMMT. Masu.

Finally, with the advent of generic AI software, the CUDA software leading the NVIDIA industry is reduced, and high -tech companies can easily execute hardware on alternatives.

“During the high -tech revolution IN, the wise heart in the world is all competing to break the NVDA moat, and to be honest, it will be impossible for NVDA to overturn all of them,” investors. Conclusion. NVDA shares strong sales. (Click here to see the MMMT Wealth results)

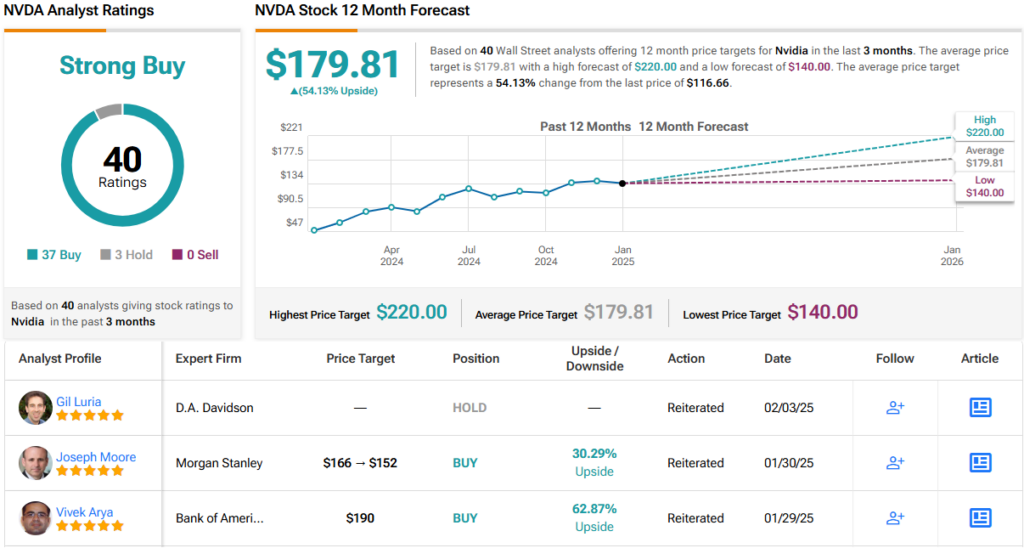

However, Wall Street is firmly in NVIDIA BULLS. Of the 40 analysts, 37 recommends purchasing, and the three hold it and give the stock a powerful purchase consensus rating. The average of the 12 -month average price target of $ 179.81 means nearly 54 % of the potential rise. (See NVDA stock prediction)

To find a good idea for trading AI shares with an attractive evaluation, access the TipRanks tools that connect all TipRanks’ best stocks to buy the best shares of TipRanks.

Disclaimer: The opinions described in this article are only the opinions of investors who are notable. Content is intended to be used only for information provision. It is very important to perform your own analysis before investing.