The Magnificent 7 Stocks: Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platform (META), Microsoft (MSFT), NVIDIA (NVDA), and Tesla (TSLA) are known for: A well-known technology company. Market power, innovation, and influence on the Nasdaq (NDAQ) and S&P 500 (SPX) indexes. In 2024, semiconductor giant Nvidia led the pack with 171% growth, driven by the AI wave. Use TipRanks’ stock comparison tool to compare 3 Magnificent 7 stocks with a consensus rating of “Strong Buy” and a Smart Score of “Perfect 10” to find the stocks with the most upside potential, according to analysts. It is said to choose.

Nvidia (NASDAQ:NVDA)

NVIDIA stock has soared more than 132% thanks to strong demand for advanced GPUs (graphics processing units) needed to power AI models. The company’s impressive revenue and profit growth in recent quarters reflects the solid momentum for NVDA’s GPUs due to the ongoing generative AI boom. Thanks to this AI tailwind, Nvidia has overtaken iPhone maker Apple (AAPL) to become the world’s most valuable company with a market capitalization of $3.61 trillion.

We have high expectations for the company’s Blackwell platform in the future. The company is also expected to benefit from a recently announced AI infrastructure project in the US called Stargate.

Is NVDA a good stock to buy?

Barclays analyst Thomas O’Malley recently highlighted semiconductor stocks to watch in 2025, including Nvidia. Analysts said Nvidia remains the dominant player in AI computing. He expects the company’s data center computing business to grow nearly 60% year over year in 2025 due to advances in next-generation GPUs and network architectures.

O’Malley expects the company’s Blackwell products to generate about $15 billion in revenue in the first quarter, a number that could more than double from the previous quarter. Additionally, analysts expect strong upside in H2 2025, supported by solid momentum in the B200 cycle and growth in the B300/Ultra products.

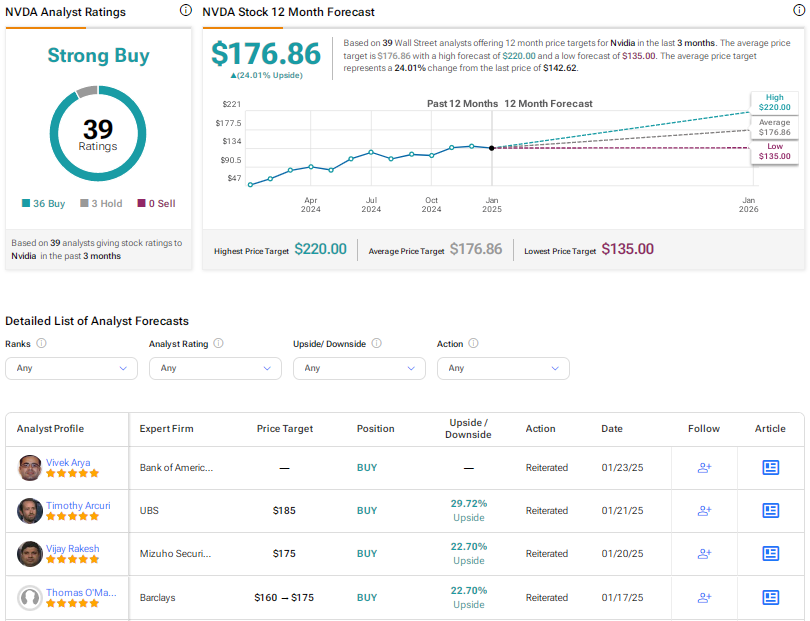

With 36 buys and 3 holds, the consensus rating for NVIDIA stock is a Strong Buy. NVDA’s average price target of $176.86 implies 24% upside potential.

See more NVDA analyst reviews

Alphabet (NASDAQ:GOOGL)

Alphabet’s stock price has increased about 35% over the past year. The company reported better-than-market third-quarter results, with its cloud division growing 35% year-over-year and its search and YouTube businesses continuing to perform well.

Despite investor concerns about increased competition and regulatory pressure in the search space, Alphabet is optimistic about maintaining its advantage through its AI products.

Alphabet is scheduled to announce its 2024 fourth quarter financial results on February 4th. Analysts expect the company’s EPS (earnings per share) to increase by more than 29% year-over-year to $2.12. The company expects fourth-quarter sales to rise 12% to $96.62 billion.

What is the target price for GOOGL stock?

Ahead of Alphabet’s 2024 Q4 earnings announcement, Trust Securities analyst Youssef Squali reiterated his rating on the stock as a “buy,” with a price target of $225. Analysts expect fourth-quarter results to reflect continued momentum in search, YouTube and cloud, with continued focus on AI.

Notably, Squali expects GOOGL’s fourth-quarter 2024 results to be broadly in line with Street expectations, with low double-digit revenue growth. Additionally, analysts expect operating margins to be above 30%, as efforts to contain operating expenses are expected to more than offset increased capital spending.

Overall, Alphabet stock has a Wall Street consensus rating of “Strong Buy” based on 24 buys and 8 holds. GOOGL’s average price target of $217.93 indicates upside potential of approximately 9% from current levels.

See more GOOGL analyst ratings

Metaplatform (NASDAQ:META)

Metaplatform’s stock price has risen 66% over the past year, driven by the company’s streamlining efforts and a rebound in ad spending. But regulatory pressures, heavy losses at the Reality Labs division (more than $58 billion in operating losses since 2020) and heavy investments in AI could limit the stock’s upside this year.

On Friday, Meta CEO Mark Zuckerberg said the company plans to invest $60 billion to $65 billion this year in capital expenditures to build out its AI infrastructure. Zuckerberg believes 2025 is “the defining year for AI.” The company expects its large-scale AI investment to drive innovation and future growth.

Meanwhile, Metaplatforms is scheduled to announce its Q4 2024 results on January 29th. Analysts expect the social media giant to report fourth-quarter EPS of $6.75, up 27% year over year. Sales are expected to increase 17% to $46.97 billion.

Should you buy, sell, or hold META stock?

Citi analyst Ronald Josey has a $75 price target on META stock after Zuckerberg announced $60 billion to $65 billion in capital spending to support the company’s product roadmap. We reiterated our Buy rating and called the stock a Top Pick. Joshi said Meta’s 2025 capital expenditures are slightly higher than his $58.5 billion estimate, but that “newer product vectors are emerging, such as search (powered by Meta AI) and agents (powered by AI Studio). “We expect these investments to drive continued engagement growth and monetization benefits,” he added. , Enterprise (with Rama 4), etc. ”

Overall, Wall Street has a consensus rating for META stock at a Strong Buy, based on 40 Buys, 3 Holds, and 1 Sell rating. META’s average price target is $692.23, implying about 7% upside potential.

See more META analyst reviews

conclusion

Analysts are very bullish on the three Magnificent 7 stocks featured here, but even after an impressive rally over the past year, they see more upside potential for NVDA stock. Nvidia continues to capture solid demand for advanced GPUs in the AI space and is well-positioned to maintain its leadership in the semiconductor market through continued innovation and strong execution.

disclosure