BOE, a major Chinese LCD and OLED display manufacturer, is considering manufacturing glass core substrates for next-generation domestically produced processors, Nikkei reported. The company plans to launch a pilot production line for glass core substrates in the second half of 2025, which will make the company stand out in the semiconductor industry and align it with major companies such as Intel, Samsung, and TSMC.

“BOE is shifting its resources from displays to focus on semiconductor-related technologies,” an executive at a major display and chip equipment supplier told Nikkei.

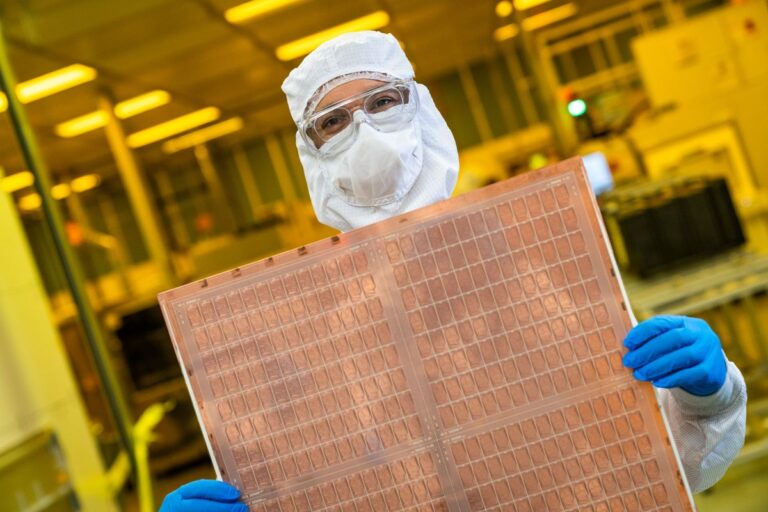

The report, citing two people familiar with the matter, said BOE plans to set up the production line later this year, but BOE has not confirmed this to Nikkei. On the other hand, the company is familiar with working with rectangular panels and, as one of the world’s largest manufacturers of LCD and OLED panels, knows how to manage yields. However, the fundamental differences in glass composition and the stringent precision demands of semiconductor packaging require extensive research and development, rework, and new process technologies.

However, the potential payoff is large. If these technical and economic hurdles can be overcome, panel-level packaging on advanced glass could unlock next-generation performance and cost advantages in chip assembly.

Reflecting its changing priorities, BOE is reportedly working with suppliers to procure semiconductor equipment for panel-based chip packaging technology, according to Nikkei Asia. Executives at a major supplier of display and chip manufacturing equipment noted that BOE is reallocating resources away from displays to focus on semiconductor technology, the report said.

Another executive at a company specializing in chip-making tools said many display makers, not just BOE, are trying to establish a presence in the semiconductor industry. However, BOE is seen as having a better chance of success due to its extensive resources and proactive approach to achieving technological breakthroughs. According to the Nikkei Shimbun, the source added that BOE is dedicated to researching innovative materials such as glass core substrates. Boyce Fan, vice president of research at TrendForce, echoes this view.

He said Chinese display manufacturers are expanding into the semiconductor field, and BOE is leading the way with its advanced capabilities and rich resources. Fan emphasized that significant progress in this area cannot be achieved quickly, as the process requires thorough testing of the technology and sufficient customer demand to make it a reality.

New challenges = new opportunities, big opportunities

Glass substrates have advantages over organic substrates, such as superior flatness for improved lithographic accuracy and increased dimensional stability of interconnects. These qualities are critical for next-generation systems-in-packages (SiPs) with dozens of chiplets. Additionally, according to Intel, glass substrates have excellent thermal and mechanical stability and can withstand high temperatures, which is particularly beneficial for data center applications. Finally, it promises to support up to 10x higher interconnect density, which is essential for improved power delivery and signal routing in advanced SiPs.

For BOE and other display panel manufacturers, there are challenges associated with transitioning away from LCD and OLED production. This is due to the need to deal with materials that are being researched but not yet mass-produced. AMD’s patents show that the company is researching glass substrates made from materials such as borosilicate, quartz, and fused silica. These substrates are characterized by remarkable flatness, dimensional stability, and good thermal and mechanical stability, thus offering significant advantages compared to conventional organic materials. Borosilicates, quartz, and fused silica may offer some advantages for displays, so BOE and its rivals may be researching and developing them, but it remains to be seen how close they are to mass production. It’s not obvious.

U.S. government regulations on China’s semiconductor sector have slowed its development somewhat, but have also opened the door to entry into the industry for companies that are confident they will not face significant competition. Now that major chip designers and manufacturers are no longer able to supply major Chinese companies, domestic companies have full rights to develop advanced computing platforms without significant risk of losing contracts to Western companies. are. For companies like BOE, that can well justify spending on research and development of new materials and manufacturing techniques, as well as re-equipping factories.