Nvidia (NVDA -3.12%) is the undisputed leader in today’s artificial intelligence (AI) chip market. The company has experienced impressive growth in both revenue and revenue, and the expectation of even greater growth in the future is why many investors are hesitant to buy the stock despite its high valuation.

Nvidia’s two main competitors, Advanced Micro Devices and Intel, are hoping to chip away at some market share. While some customers may want to diversify their supply chain and explore cheaper options, Nvidia’s recently announced new graphics cards suggest that the company doesn’t intend to simply relinquish market share. It shows that there is no.

New Nvidia cards are cheaper than expected

One way AMD and Intel could potentially win over customers is by offering more affordable chips. Nvidia’s high-performance chips are in high demand, but they don’t come cheap. Tech companies developing AI models and chatbots have shown they are willing to pay a premium for chips, especially if AMD and Intel can prove their chips are not major downgrades. Price may play a larger role in purchasing decisions. From Nvidia’s latest products.

However, NVIDIA is being a little more aggressive on pricing. On January 6th, the company announced its latest GeForce RTX 50 cards, and to the surprise of some analysts, many of them, despite offering significant performance upgrades, It was said to be cheaper than the previous RTX 40 series.

Nvidia also announced Project Digits, the first desktop computer it produces. However, it’s not cheap at $3,000 and is primarily designed for programmers.

Nvidia can be aggressive as it boasts high margins

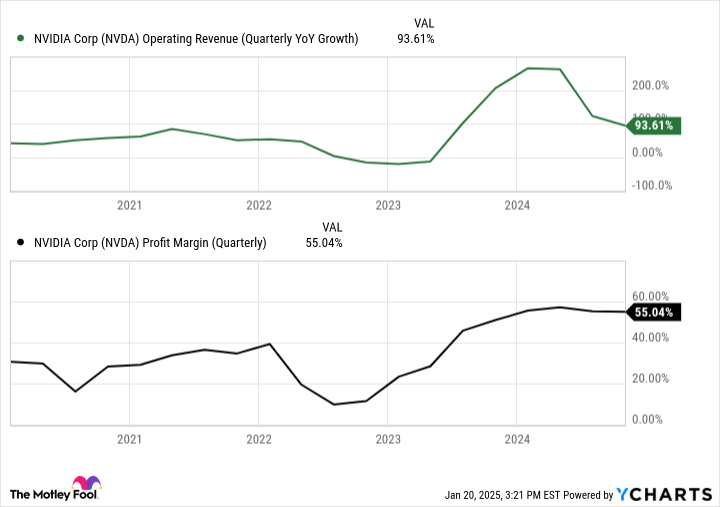

When a company is large and profitable, like Nvidia, it is in a better position to compete on price and pursue more aggressive opportunities. The company has not only grown its revenue significantly over the years, but also improved its profit margins.

NVDA Operating Revenue (Quarterly YoY Growth) data from YCharts.

With such high profit margins, the company believes it can still maintain a high level of profitability and is able to offer some products at lower prices. Doing so could thwart competitors, since AMD and Intel’s chips may not be relatively cheap enough to win customers.

There are reports that AMD is delaying the official launch of its new Radeon RX 9000 series chips due to Nvidia’s announcement and resulting pricing pressure.

Should investors stock up on Nvidia stock?

Nvidia’s stock price has hit a plateau over the past three months, and investors seem to be showing some hesitation about buying the company at current levels. The company, with a market capitalization of $3.4 trillion, trades at a forward price/earnings ratio of 32 times, slightly above the Technology Select Sector SPDR fund’s average of 30 times. However, given Nvidia’s rapid growth, its price-to-earnings ratio is 32 times. , a slight premium over the average tech stock may indeed be warranted.

Given the long-term growth opportunities ahead for Nvidia, it’s hard not to like this stock as a long-term buy. The company’s financials are strong and we expect sales and profits to increase further in the coming years as NVIDIA looks to become more aggressive in pricing and expanding growth opportunities. is not unreasonable. Overall, it could be a good growth stock to buy and hold, despite its high valuation.

David Jagielski has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, and Nvidia. The Motley Fool recommends the following options: February 2025 $27 short call on Intel. The Motley Fool has a disclosure policy.