There are no guarantees on investments. That’s a hard truth we all have to learn. Some investments have low risk, while others have a high risk of things going wrong, but no investment is risk-free. When buying a stock, you should weigh its potential positives and profit potential without ignoring the negatives.

Today, many people are divided over Nvidia (NVDA 4.43%). After growing rapidly in recent years to become one of the world’s largest companies by market capitalization, bulls are pounding the table that the party will be here to stay in 2025. Bears are calling for a crash in NVIDIA stock, believing it to be overvalued. The two sides will certainly talk, but it’s impossible to guarantee what will happen to Nvidia in 2025. If stock prices could skyrocket or crash, how likely is either scenario?

Using history as a guide, let’s consider the likelihood of Nvidia stock crashing in 2025 and whether you should buy it in your portfolio today.

Decades of circular enterprise history

Nvidia has been one of the best performing stocks over the past few decades. The company’s stock price has increased 335,000% since going public in 1999, a compound annual growth rate (CAGR) of 30%. However, during this process, the stock price crashed many times. Defining a stock price crash as a drawdown of 50% or more, Nvidia has experienced four stock price crashes since going public: in 2001, 2008, 2018, and most recently in 2022. Yes, it was only a few years ago that Nvidia crashed. It is hated by the investment community.

Why do investors do this crazy thing? First, markets tend to work this way, even for the best companies in the world. Second, NVIDIA operates in a cyclical semiconductor industry. A cyclical industry is one in which the end market demand from customers is inconsistent, which results in volume fluctuations and fluctuations in the income statement. Semiconductors are cyclical because demand from buyers of computer chips is inconsistent. This can be seen in Nvidia’s revenue graph, which shows regular dips and declining revenue.

It’s been 26 years since Nvidia went public. In four of those years, stock prices plummeted. So it’s certainly possible that NVIDIA’s stock price flips south in 2025.

In fact, I think 2025 is the most likely year for stock prices to fall. Here’s why:

Care must be taken to sharply increase profit margins

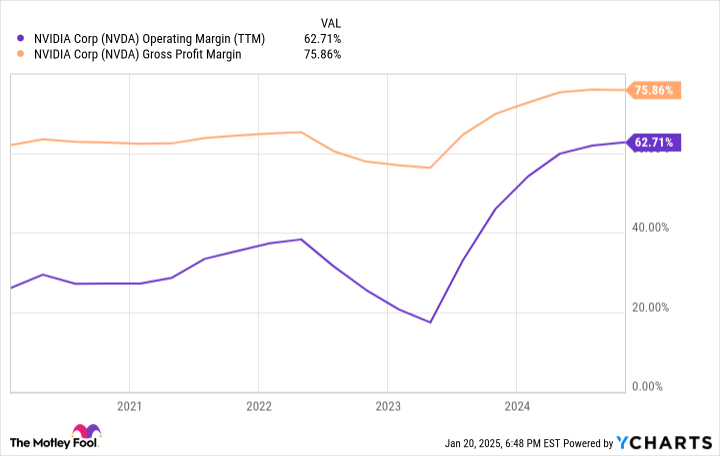

When looking at stocks that operate in cyclical industries, you need to analyze where they are in the cycle. In the case of NVIDIA, we are definitely trending up in the cycle. Revenues are soaring on the back of new demand for artificial intelligence (AI). Perhaps more importantly, the company’s operating margin is at an all-time high of 63%. This shows that the company is implementing significant price hikes due to customers’ insatiable demand for AI products.

Ultimately, Nvidia’s semiconductor supply will match customer demand. This will lead to more stable prices, slower revenue growth, and perhaps (at least in Nvidia’s niche) a shift in the semiconductor cycle. This doesn’t mean it’s a guarantee that Nvidia’s earnings will turn around in 2025, but it’s not impossible. This has happened multiple times over the past 25 years, usually during periods of rapid revenue growth.

This is the nature of investing in cyclical industries. Revenues may increase in the long run, but there will almost certainly be bumps along the way.

NVDA Operating Margin (TTM) Data by YCharts

Should you buy Nvidia stock?

At its current stock price, NVIDIA has a market capitalization of $3.5 trillion. Its price-to-earnings ratio (PER) is 54 times, which is nearly twice the S&P 500 index’s average PER of 30 times.

I think Nvidia’s revenue is likely to increase over the long term, which should lead to profit growth. However, the company currently boasts record operating profit margins, which will likely return to low levels once the AI boom stalls. If supply catches up with demand, as it eventually does with semiconductors, NVIDIA’s selling price and profit margin per chip could decline. This has been a double blow, with revenue headwinds due to lower sales and lower profit margins.

Nvidia’s net profit margin is currently 55%, giving it a profit of $63 billion on revenue of $113 billion. Even if sales slump to $100 billion in 2025, if profit margins return to 40%, net income will fall to $40 billion. Compared to the market capitalization of $3.37 trillion, the P/E ratio is 84 times. In this scenario, NVIDIA’s stock price would likely be lower.

This is a great business, but expectations are very high and a recession is likely in the near future. Don’t buy Nvidia stock today. If you like this company and think it’s a great business, wait until the end of the cyclical downturn in the semiconductor market to buy, rather than when it’s near its peak.