With talk of more competition in the artificial intelligence (AI) space, Advanced Micro Devices (AMD) stock is under pressure. However, while analysts often consider the impact of the latest technological developments, the most important financial results will provide a clear indication of the company’s strong recent progress. I’m bullish on the company’s track record of exceeding and achieving targets, its valuation, and recognize that it doesn’t need to beat Nvidia in AI to be an attractive investment.

What AMD is good at

I’m bullish on AMD. This is due to AMD’s strong position in the computer processing unit (CPU) market and growing presence in the graphics processing unit (GPU) space. The Santa Clara-based company excels in manufacturing high-performance processors for both consumer and data center applications, and its Ryzen and EPYC product lines are a competitive advantage of Intel’s (INTC) products. offer an alternative. The company is focused on innovation and has created several industry firsts, including the first 64-bit processor and dual-core processor, which is an excellent track record for any company.

In the CPU space, AMD has been battling Intel for a while. While Intel remains dominant, AMD’s progress is commendable and the potential is huge. In fact, AMD overtook Intel in market capitalization about two years ago, reflecting the company’s very promising trajectory.

Meanwhile, despite Nvidia’s dominance in AI chips, AMD is positioning itself as a strong second choice in this rapidly growing market. Global spending on AI accelerators is expected to reach $400 billion by 2027, and there is significant growth potential if AMD can capture even a portion of this market. This is why we don’t need to beat Nvidia, which has a market capitalization 17 times higher, but simply secure share in this fast-growing market.

Additionally, the company’s open source development software, ROCm, provides flexibility that may be preferred over Nvidia’s own CUDA platform for some projects. I’m not saying that AMD’s software is better, but for some tasks AMD may prove more effective, and recent acquisitions have given it end-to-end AI capabilities. It could be improved.

AMD’s revenue projections are scary

AMD is a quality company, and that’s definitely thanks in part to Lisa Su, who has been the CEO of Practice since 2014. And this quality is reflected in AMD’s earnings forecast, which is full of potential for the next five years.

For fiscal year 2024 (reported February 4), analysts expect earnings per share (EPS) of $3.32, representing a 25.4% year-over-year increase. This growth is expected to accelerate in 2025, with EPS estimated at $4.99, up 50.1%. Meanwhile, revenue forecasts follow a similar upward trajectory, with revenue forecasts of $25.7 billion in 2024 and $32.2 billion in 2025, representing year-over-year growth of 13.1% and 25.7%, respectively. Additionally, AMD has consistently exceeded or matched revenue estimates over the past nine quarters.

Looking further ahead, AMD’s EPS is projected to reach $11.59 by 2028, and its revenue could reach $56.5 billion, significantly higher than it is now. We believe AMD’s expanding presence in the data center and AI markets will drive this long-term growth. The company expects to sell at least $4.5 billion of data center GPUs in 2024 and double its 2023 results.

Is it possible that AMD is cheaper than JP Morgan?

I’m also bullish as AMD’s valuation is becoming increasingly attractive. The forward price/earnings (P/E) ratio of 36.6x carries some risk, especially with respect to executing its growth strategy, but based on expected earnings in 2028, this P/E ratio drops to 10.5x. That means this year’s forward P/E ratio is 43.8% above the sector average, while medium-term earnings growth is 184% above the sector average.

I’m particularly encouraged by the company’s forward price-to-earnings (PEG) ratio of 0.82, which is significantly lower than the sector median of 1.87. The PEG ratio compares a stock’s P/E ratio to its expected earnings growth rate, and while values below 1 were initially thought to be attractive, this is certainly no longer the case. Many companies with long-term growth tailwinds trade at much higher PEG ratios, as indicated by sector averages.

Additionally, some analysts have suggested that the valuations of these AI stocks are unsustainable, with AMD’s future return falling below JPMorgan’s (JPM) in 2028.

Is AMD stock a buy, according to analysts?

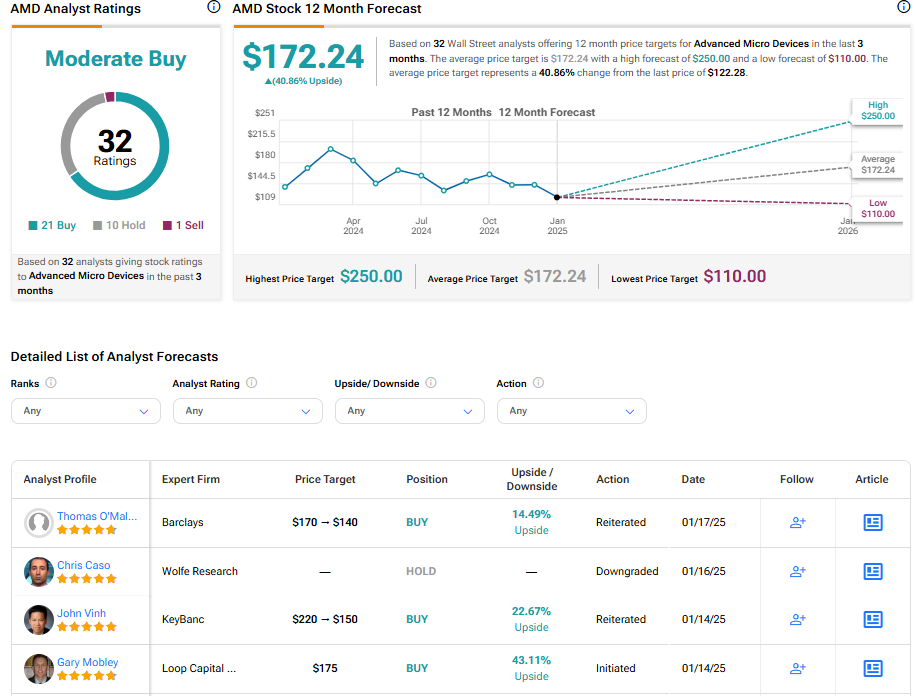

At TipRanks, AMD is rated a Moderate Buy, based on 21 Buy, 10 Hold, and 1 Sell ratings assigned by analysts over the past three months. AMD’s average price target is $172.24, suggesting 40.86% upside potential.

See more AMD analyst reviews

AMD stock conclusion

I’m bullish on AMD because of its focus on innovation, impressive revenue growth projections, and expanding presence in AI and data centers. The company’s ability to consistently exceed expectations, coupled with its attractive long-term valuation, is encouraging and is expected to reflect the company’s investment potential. It doesn’t need to outperform Nvidia, but AMD’s strategy to capture share in the rapidly growing AI market will be the driving force behind its growth.