With earnings season underway and underway, we’ll soon learn how publicly traded companies ended in 2024. So far, analysts have set a high price tag predicting year-over-year growth. If achieved, this would make Q4 2024 the strongest quarter of revenue growth since 2021.

Ahead of the market:

Against this backdrop, let’s take a look at one of the driving themes behind the success of the past few years: artificial intelligence (AI). Beyond the headlines and hype, AI has provided a solid technological foundation for fundamental changes across a wide range of industries, from the digital world to healthcare, finance, education, and entertainment. AI is now everywhere you look.

This wave of innovation has gone unnoticed by market analysts. Many people are paying close attention to AI stocks, looking for insight into what’s next for investors. Among them is Cowen analyst Joshua Buchalter. He highlighted two AI Giants who deserve special attention as this earnings season unfolds.

Nvidia (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD), Buchalter’s top picks, are key players in the semiconductor space and integral to the AI revolution. Both companies are known for their high-end AI-enabled processors. Nvidia has been the industry leader for several years, but AMD is making a concerted bid to increase its market share.

As both companies approach their upcoming earnings reports, Buchalter’s analysis sheds light on what investors can expect, highlighting their growth trajectories and competitive strengths. Let’s take a closer look.

Nvidia

First, NVIDIA is an undisputed powerhouse in the semiconductor industry, with a market capitalization of $3.37 trillion, making it the second most valuable company on Wall Street after Apple. Nvidia has reached that dizzying height after an astounding 450% share price gain over the past three years – a period that coincides with the AI boom.

The company built its reputation on high-speed processors, GPUs that are very popular in the gaming industry, but these chips are also used in a wide range of other high-end computing applications, such as high-speed computing, data center server stacks, etc. It has been proven that it can also be applied. , AI, especially generative AI. Currently, the company’s data center business unit, which is closely tied to AI, accounts for the majority of Nvidia’s revenue, and the company controls more than 80% of the AI chip market.

Nvidia continues to benefit from continued demand for both its latest Blackwell series accelerators and its existing Hopper series. Blackwell’s chip was announced last March but faced production and delivery delays. Nvidia has started shipping Blackwell sample packs, and the company says demand for the new chip is strong.

Looking ahead, NVIDIA is expected to report its fourth quarter 2025 financial results at the end of next month, with Wall Street expecting revenue of approximately $38 billion and EPS of $0.85. If these forecasts hold true, revenue would increase 8.4% and EPS would increase 5% from $35.08 billion and $0.81 recorded in the third quarter of fiscal 2025.

Turning to Cowen’s view, we see that Analyst Buchalter cited the company’s consistently solid revenue and high demand for its product line, according to Nvidia.

“[We]expect solid print and guides, both continuing the company’s recent trends, to be ~$1 billion to $2 billion above consensus. Our checks show that Blackwell (currently GB200 starts in earnest in April and July), with some suppliers shifting allocations from Hopper-based platforms to Blackwell. It has been observed that (Indicating the health of the ramp, demand) NVIDIA’s revenue primarily comes from F1H26’s cruise control, as demand for Blackwell still significantly exceeds supply and the supply chain has not yet transitioned to Blackwell Ultra. We believe that it is,” Buchalter said.

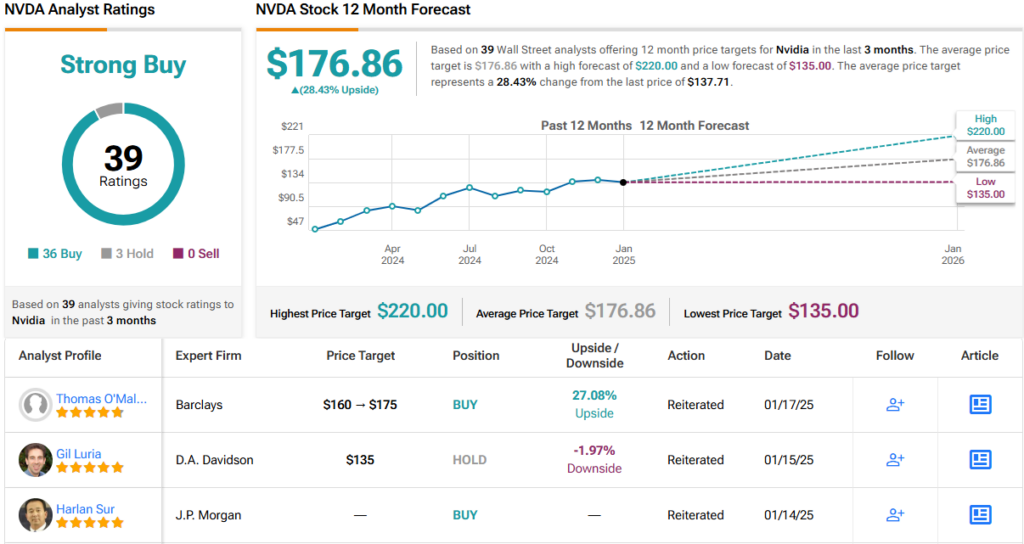

To this end, Buchalter rates Nvidia stock a Buy, designates it a Top Pick, and sets a price target of $175, implying a 27% one-year upside potential. I am. (Click here to see Buchalter’s track record)

Overall, NVIDIA has featured 39 analyst reviews, of which 36 are Buys and 3 are Holds, giving the company a consensus rating of Strong Buy. The current stock price is $137.71, and the average price target of $176.86 suggests an upside of 28% over the next 12 months. (See NVDA Stock Forecast)

advanced micro device

AMD, the second stock to watch, may not be in the Nvidia family, but it’s a solid operator in its own right. AMD has a strong reputation in the chip industry and has made a concerted effort over the past year to eat into Nvidia’s market share. The company’s challenge is built on its high-quality chipsets, particularly its lineup of high-end PC processors and AI-enabled accelerator chips.

Earlier this month, AMD announced several new products that align with this challenge. These include several new Ryzen chips for both business and consumer PCs, all designed to power next-generation AI applications. The new chips include AMD Ryzen AI Max, AMD Ryzen AI 300 series, AMD Ryzen 200 series processors, AMD Ryzen Ai Max Pro, AMD Ryzen AI 300 Pro, and AMD Ryzen 200 Pro series on the commercial side. In addition, the company also announced a stronger partnership with Dell. The Dell deal will see the PC maker put AMD Ryzen AI Pro processors into new Dell Pro computers. This will mark the first shipment of Dell’s commercial PCs with AMD Ryzen AI PRO processors.

These announcements mark a significant expansion in AMD’s push to expand its AI offerings. The company already has support from important customers such as Microsoft, Meta, and Oracle. These are all major enterprise consumers of high-end AI processors.

It should be noted that AMD has experienced sequential increases in both revenue and profits over the past two quarterly results. In late October, when the company announced its 2024 third-quarter results, sales reached $6.82 billion, an 18% increase from the same period last year and $110 million more than expected. Ultimately, non-GAAP EPS of 92 cents matched expectations.

Looking ahead, AMD is scheduled to announce its fourth quarter 2024 financial results on Tuesday, February 4th. Wall Street expects revenue of $7.53 billion and EPS of $1.09. This reflects a 10% increase in revenue and an 18% increase in EPS over the prior year. Q3 2024.

Even though AMD’s earnings are on the rise and its product line is seeing solid demand, the company’s stock price has fallen. AMD stock has fallen 23% in the past 12 months.

But Cowen analyst Buchalter seems to see an opportunity in AMD because of this. The analyst noted that the stock has underperformed and also noted that AMD has been successful in increasing its market share.

“Given the passionate backdrop surrounding AI, the “insatiable” demand for computing, and the very high bar set by the recent momentum in the ASIC space, we expect (sic) the inline print/guide to sell well. I am. AMD’s progress has been steady, which has seen its stock drop over the past three months, but it doesn’t necessarily have the same step capabilities as its AI Compute peers. Our check results indicate continued positive demand for MI300/325 products among AMD’s key customers. That said, a more seasonal gen-purpose Server CPU and stubborn softness in Embedded (and typically weak 1Q25 seasonality in Client) are partially muting AMD’s ongoing share gains (eg. AMD’s significant enterprise PC win with Dell). As a result, we take our above-Street estimates down slightly while maintaining our AI accelerator estimate of $5B/$10B/$15B for 2024/2025/2026,” Buchalter stated.

These comments support Buchalter’s buy rating on AMD, which he complements with a $150 price target that suggests the stock will appreciate 23.5% in one year.

Overall, AMD has a consensus rating of Moderate Buy based on 32 recent analyst reviews, including 21 Buys, 10 Holds, and 1 Sell. The stock is currently trading at $121.46, representing a one-year upside of approximately 42%, based on an average price target of $172.24. (See AMD stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.