An alarming precedent has been set by the market leader in innovative technology and innovation.

Investors were all smiles as 2024 came to a close. The mature stock-driven Dow Jones Industrial Average, the benchmark S&P 500 and the growth-driven Nasdaq Composite closed last year up 13%, 23% and 29%, respectively.

There were many catalysts for the second year of Wall Street’s bull market rally, including Donald Trump’s November victory (stocks soared during his first term in the White House) and excitement over stock splits. . But at the top of the list is the euphoria surrounding the rise of artificial intelligence (AI).

Image source: Getty Images.

Using AI to enhance software and systems has the potential to help them become more proficient at tasks and learn new skills, giving this technology a stratospheric ceiling. In award sizing, PwC analysts predict that AI will add $15.7 trillion to global gross domestic product by 2030.

No company has been a more direct beneficiary of the AI revolution than semiconductor giant Nvidia. (NVDA -1.10%). Since the start of 2023, the market value of NVIDIA stock has increased by approximately $3 trillion, and as of January 10th, the stock price is up 830%.

But is Nvidia’s incredible rally too good to be true? Let history be the final judge on whether Nvidia stock will fall below $100 per share in 2025.

Nvidia’s business expansion is textbook

Before delving into the details of what’s to come, it’s important to understand how we got here. Nvidia’s rise to briefly becoming the largest publicly traded company in the United States is all about its leading role as the “brains” of high-computing data centers.

According to a study conducted by semiconductor analysis company TechInsights, shipments of graphics processing units (GPUs) for data centers in 2022 and 2023 were 2.67 million units and 3.85 million units, respectively. Nvidia’s GPUs were responsible for all but 30,000 GPUs shipped in 2022 and 90,000 GPUs shipped in 2023. Enterprises can’t take full advantage of Nvidia’s Hopper (H100) chips and next-generation Blackwell GPU architecture.

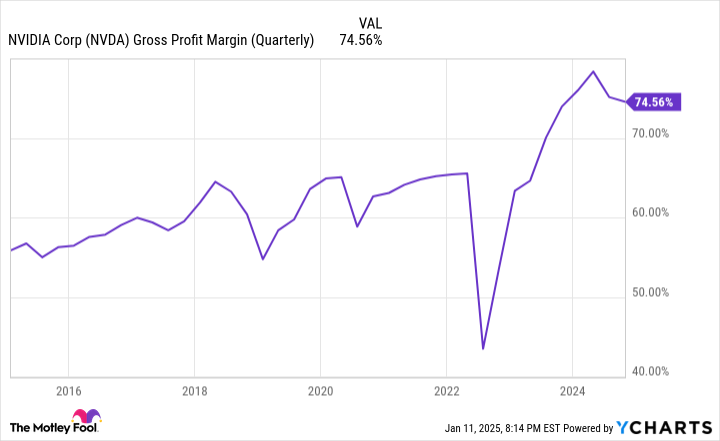

The company’s insatiable demand for hardware has translated into tangible profits. With demand overwhelming supply, Nvidia is charging $30,000 to $40,000 for its ultra-popular Hopper GPU. By the way, this is well above Advanced Micro Devices’ $10,000 to $15,000 price range. (AMD -1.05%) acquired the Instinct MI300X GPU. The price increase translates into a noticeable increase in Nvidia’s gross profit.

Additionally, the company’s CUDA software platform has played a key role in maintaining customer loyalty to its ecosystem of products and services. CUDA is a toolkit that developers use to maximize the computing potential of Nvidia GPUs and build large language models.

Finally, Nvidia has had the benefit of being the AI-GPU supplier of choice for some of America’s most influential companies. The company’s top customers by net revenue include many members of the Magnificent Seven, including Microsoft, Meta Platforms, Amazon, and Alphabet.

Image source: Getty Images.

History looks back on Nvidia’s parabolic rise

Now that we have a better understanding of where Nvidia has been and how it got to this point where it trades at nearly $136 per share, let’s look to history as a guide.

Over the past few decades, no matter how promising the next breakthrough technology, innovation, or trend, there has always been competition waiting behind the scenes for a chance to grab a piece of the proverbial pie. .

For now, Nvidia is the undisputed provider of GPUs in AI-powered data centers. However, as new competitors enter the field, its dominant market share is virtually certain to weaken. For example, AMD is ramping up production of the MI300X and the newly introduced MI325X, which are significantly cheaper and likely more available than Nvidia’s chips. Companies not interested in waiting until Nvidia’s backlog is cleared may consider lower-cost alternatives like AMD.

Additionally, all of Nvidia’s top net sales customers are developing AI chips for use in their data centers. Chips being developed in-house by Microsoft, Meta, Amazon and Alphabet won’t match the computational speed of Nvidia’s Hopper or Blackwell GPUs, but they will be cheaper and more available. In other words, it begins to minimize the AI-GPU shortage that drives much of Nvidia’s pricing power and gross margin improvement.

If the AI-GPU shortage ends, Nvidia’s gross profit will likely come under pressure. NVDA Gross Margin (Quarterly) data by YCharts.

Adding to the history of inevitable competition, the past three decades have seen worrying precedents set by market leaders in the next big investment trends.

In the mid-1990s, the Internet began to provide new ways for businesses to connect with their customers. But it took years for most businesses to figure out the best way to monetize their online storefronts. The Internet positively changed the growth trajectory of American companies, but this did not occur until the dot-com bubble burst.

The events of a bubble burst and the next big investment trends have been closely linked for decades without exception. While not a comprehensive list, we have seen bubbles burst in genome sequencing, business-to-business e-commerce, nanotechnology, 3D printing, blockchain technology, the metaverse, and more.

The common denominator in all of these high-priced manageable trends is that investors overestimate the adoption and early-stage utility of technology and innovation. All disruptive technologies and innovations take time to mature, and artificial intelligence doesn’t seem to have reached that stage yet. Most companies still don’t have a clear strategy for how to generate positive returns from their AI investments.

History tells us that market leaders in the next big trend typically lose more than 80% of their value on a peak-to-trough basis when the bubble bursts. Fortunately for Nvidia, it has established business segments, such as GPUs and virtualization software used in gaming and cryptocurrency mining, that could halt its decline.

Nevertheless, history is very clear that parabolic early stage gains are not sustainable for market leaders in the next big trend, which is why NVIDIA stock could fall below $100 in 2025. becomes very realistic.

Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Sean Williams has held positions at Alphabet, Amazon, and Meta Platforms. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.