Semiconductor stocks have skyrocketed over the past two years thanks to a surge in demand for artificial intelligence (AI).

Over the past two years, technology stocks have generated significant gains. Since ChatGPT was commercially released on November 30, 2022, index They boast total returns of 70% and 47%, respectively.

Semiconductor stocks are among the technology sector’s biggest risers. Semiconductors play a critical role in the development of generative AI, from providing memory and storage for data workloads, to running complex algorithms on graphics processing units (GPUs), to training and inferring models. Given this set of features, you may be wondering which areas of the chip space are best to invest in.

In my opinion, Taiwan Semiconductor Manufacturing (TSM -3.36%) will be the most powerful company in the semiconductor industry over the next decade. Below, we’ll break down what makes TSMC such an attractive long-term opportunity and assess whether the stock is worth buying now.

What makes Taiwan Semiconductor unique?

As mentioned above, there are various pockets in the area of the chip. While companies like Nvidia and Advanced Micro Devices focus on GPU design, Broadcom plays a key role in providing networking equipment for data centers. Additionally, Micron’s chips specialize in data and storage management for data workloads. In fact, there are good reasons to invest in these companies.

However, none of the businesses outlined above are immune to the cyclicality of the semiconductor industry and the increasing competitiveness of various aspects of the chip environment.

Taiwan Semiconductor may not be completely immune to these factors, but I view the company as much more isolated and less vulnerable. The reason is that Taiwan Semiconductor’s fabless manufacturing process plays an important role in various chip applications and AI systems.

TSMC makes products for Nvidia, AMD, Broadcom, Amazon, Qualcomm, Sony and others, according to company filings. Furthermore, given that TSMC has an estimated 90% share of chip production, we think this highlights how important the company is to the world’s largest semiconductor player.

Image source: Getty Images.

Investment in AI infrastructure will provide long-term tailwinds

This year, Nvidia will introduce its long-awaited Blackwell GPU infrastructure. Industry analysts report that Blackwell is already sold out for next year. Meanwhile, Nvidia is already developing a successor GPU called Rubin, which could launch sometime in 2026. Additionally, AMD plans to launch two new GPUs called MI325X and MI400 between 2025 and 2026.

To me, Nvidia and AMD represent the two most obvious near-term tailwinds for TSMC. However, there are some other subtle clues as to why TSMC is well-positioned over the long term.

Hyperscalers such as Microsoft, Amazon, Alphabet, Oracle, and Meta Platforms have all indicated that increased spending on AI infrastructure will be a theme in the coming years. I see these capital expenditure (capex) investments being a big catalyst for TSMC as more AI datacenter and GPU architectures begin to enter the market.

Should you buy Taiwanese semiconductor stocks now?

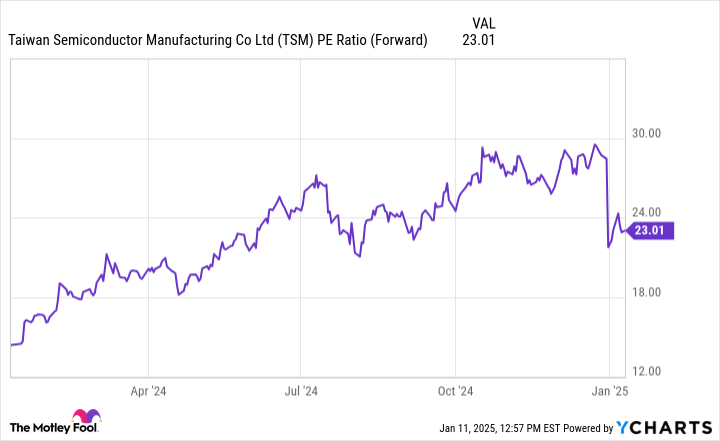

Over the past 12 months, TSMC stock has increased 107%. However, despite this market-beating performance, the company trades at a modest P/E ratio of just 23 times forward earnings. To put this in perspective, this is the same as the S&P’s average forward P/E ratio. 500.

TSM PE Ratio (Forward) Data by YCharts

TSMC’s valuation has expanded significantly over the past year, but the company’s earnings have been accelerating faster than its stock price. Given how important TSMC will become as spending on AI infrastructure continues to rise over the next few years, I think the company’s earnings power will increase significantly.

For me, Taiwan Semiconductor Manufacturing Co. is a stock to take and buy, and a stock to hold for years to come as the AI story continues to unfold.

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Adam Spatacco has held positions at Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.