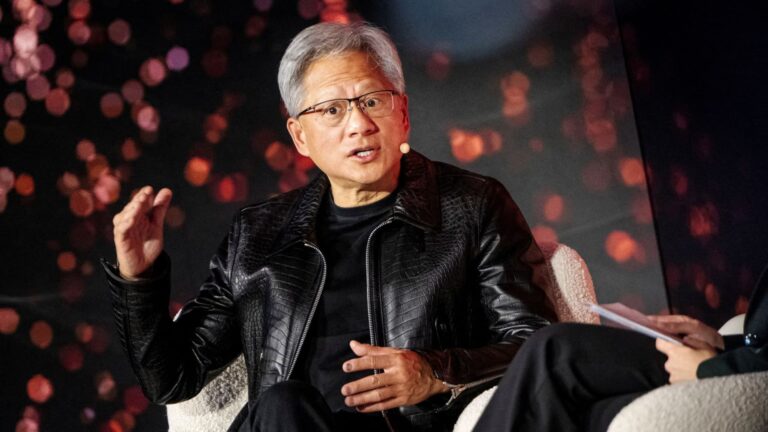

NVIDIA CEO Jensen Huang speaks at the launch of the supercomputer “Gefion” at the Wilhelm Lauritsen Terminal in Kastrup, Denmark, on October 23, 2024.

Ritzau Scanpics | Mads Klaus Rasmussen | Via Reuters

Quantum computing stocks fell on Wednesday Nvidia CEO Jensen Huang declared that a practical quantum computer is years away.

“If you say it will take 15 years for a very useful quantum computer, that’s probably sooner,” he said during NVIDIA’s analyst day. “If you say 30, it’s probably on the slow side. But if you picked 20, I think most of us would believe it.”

Huang said he believes Nvidia will play a “very important role” in developing computers and helping the industry “get there as quickly as possible.”

Righetti criticizes NVIDIA CEO Jensen Huang’s comments

Quantum computing stocks plummeted in response to this comment. righetti computing While plummeting by 40%, ion Q 37% reduction. D Wave Quantum fell more than 30%, and the Defiance Quantum & AI ETF fell 4%. quantum computingwhich announced an initial public offering to raise $100 million, fell 37%.

“I’m not surprised by today’s correction given that valuations are a little higher,” said Greg Busk, CEO of AXS Investments, calling the reaction a bit “overblown.”

“The general consensus is that mass acceptance of quantum computing is many years away, and there is no real news to back up today’s negative news,” he added.

Number of shares in the past year

The sector received a boost towards the end of 2024 as excitement around quantum computing exploded. google revealed its latest Willow chip and announced that it performed better in reducing errors than its previous chip in 2019. Many investors also expected this field to be the next big tech boom since the rise of AI in the wake of ChatGPT.

The excitement sent stock prices higher toward the end of the year, with Righetti and DWave rising 1,449% and 854%, respectively.

Proponents of quantum computing argue that the technology will be able to perform computing tasks that regular computers cannot perform, and will be able to process much larger amounts of data. However, many investors caution that it may be premature to rule out legitimate winners in this space and in real-world use cases.