Several developments appear to be driving the rise of AI specialists.

Nvidia (NVDA 3.43%) The stock hit a new all-time high on Monday morning, emerging from a mid-December slump and rising as much as 5.3%. As of 1:19 p.m. ET, the stock was still up 4.7%.

As shareholders eagerly await updates from the company’s rockstar CEO, several things have happened to elevate the artificial intelligence (AI) chip maker’s standing.

CES kickoff

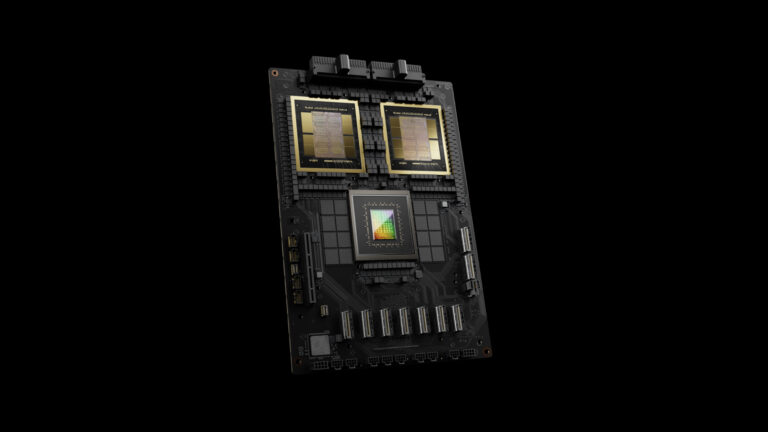

CES is one of the world’s largest technology-focused events. The annual trade show brings together many of the latest developments in technology, with some of the biggest companies in the industry in attendance. Nvidia CEO Jensen Huang is scheduled to kick off the event with a much-anticipated keynote speech on Monday night. Huang is expected to provide insight into AI adoption and demand for Nvidia’s recently released Blackwell processors, and may also provide details about the upcoming Rubin platform. There are also rumors that Huang may announce the development of an AI-centered CPU.

Despite their excitement over Huang’s arrival, Nvidia shareholders had another reason to be excited. Global electronics company Hon Hai Precision Industry Co., Ltd. (also known as Foxconn) said yesterday that strong demand for its AI-centric servers drove record fourth-quarter results, and management said the growth spurt would continue into the first quarter. He announced that he expected it. Nvidia supplies Foxconn with much of its graphics processing units (GPUs) used to power AI in cloud and networking devices, which bodes well for the chipmaker.

Is Nvidia stock a buy near all-time highs?

Evidence suggests that AI adoption is still in its infancy and that Nvidia is a key player in this space. A P/E ratio of 59x may seem expensive, but looking ahead, NVIDIA plans to sell for just 34x next year’s forward P/E, which is a far more reasonable multiple. Additionally, over the past 10 years, NVIDIA’s price-to-earnings ratio has averaged 59 times, suggesting that the stock is not overvalued from a historical perspective.

According to Big Four accounting firm PwC, the value of the AI market is expected to reach $15.7 trillion by 2030, which also suggests that “AI is still in its very early stages.” .

Given its important role in advancing AI, I think Nvidia stock is a buy.