Legendary fund manager Li Lu (backed by Charlie Munger) once said, “The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.” It’s only natural to consider a company’s balance sheet when you consider how risky it is, since debt is often involved when a business collapses. Importantly, ON Semiconductor Corporation (NASDAQ:ON) does have debt. But is this debt a concern for shareholders?

When is debt a problem?

Generally, debt only becomes a real problem when a company cannot easily pay off the debt, either by raising capital or with its own cash flow. The essence of capitalism is a process of “creative destruction” in which failing companies are ruthlessly liquidated by bankers. But a more common (but still expensive) situation is when a company needs to dilute shareholders at a cheap share price just to manage its debt. However, as an alternative to dilution, debt can be a very good tool for companies that need capital to invest in growth at high rates of return. The first step when considering a company’s debt levels is to consider its cash and debt together.

Check out our latest analysis for ON Semiconductor.

How much debt does ON Semiconductor have?

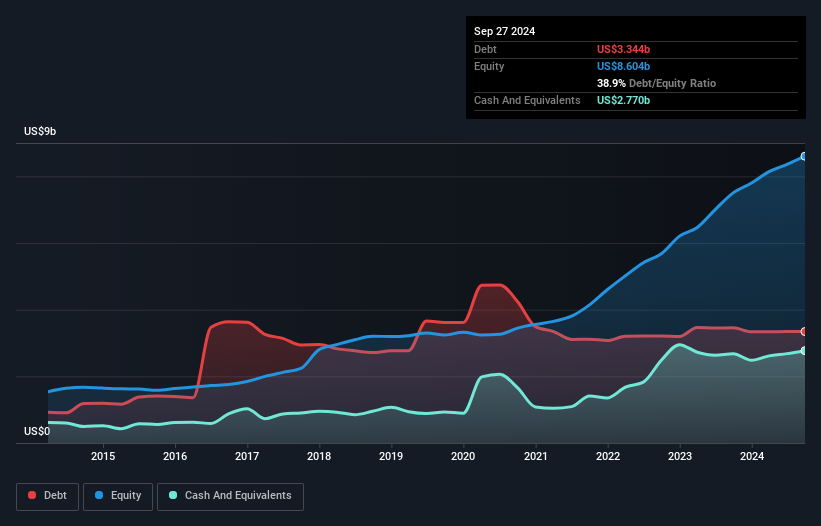

As you can see below, ON Semiconductor had debt of US$3.34b as of September 2024, which is about the same as a year ago. Click on the graph to see details. However, it did have US$2.77b in cash offsetting this, leading to its net debt of approximately US$573.4m.

How healthy is ON Semiconductor’s balance sheet?

The most recent balance sheet shows that ON Semiconductor had liabilities of US$2.13b falling due within a year, and liabilities of US$3.19b falling due beyond that. Masu. Offsetting these obligations, the company had cash of US$2.77b and receivables worth US$1.22b due within 12 months. So it has liabilities totaling US$1.33b more than its cash and short-term receivables, combined.

Of course, ON Semiconductor has a massive market capitalization of US$26.3b, so these debts are probably manageable. However, we recommend shareholders continue to monitor the balance sheet, as it has ample debt.

We use two main ratios to determine debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), and the second is how much earnings before interest and tax (EBIT) covers interest expense (or interest cover, for short). It’s about how many times you cover it. . Therefore, we consider debt relative to earnings, with or without depreciation.

ON Semiconductor’s debt-to-EBITDA ratio is low at just 0.21. But what’s really cool is that I actually received more interest than I paid last year. So there’s no doubt that this company can take on debt with the poise of a cucumber. In fact, ON Semiconductor’s saving grace is its low debt levels. That’s because the company’s EBIT decreased by 23% in the last twelve months. When it comes to paying down debt, a reduction in income is no more helpful than a sugary soda is good for your health. When analyzing debt levels, the balance sheet is the obvious place to start. But more than anything else, future earnings will determine ON Semiconductor’s ability to maintain a healthy balance sheet going forward. So if you’re focused on the future you should check out this free report showing analyst profit forecasts.

Finally, companies need free cash flow to pay down debt. Accounting profits alone are not enough. So we always check how much of that EBIT is converted into free cash flow. Looking at the most recent three years, ON Semiconductor’s free cash flow was 44% of its EBIT, which was lower than we expected. It’s not great when it comes to paying off debt.

our view

ON Semiconductor’s EBIT growth was materially negative in this analysis, even though the other factors we considered were significantly better. I’m especially dazzled by its interest cover. Considering all the factors mentioned above, we feel a little cautious about ON Semiconductor’s use of debt. While we understand that debt can improve return on equity, we recommend shareholders keep a close eye on debt levels to avoid increasing them. The balance sheet is clearly the area to focus on when analyzing debt. However, not all investment risk resides within the balance sheet, far from it. For example, we’ve discovered 1 warning sign for ON Semiconductor that you should be aware of before investing here.

If you’re more interested in fast-growing companies with rock-solid balance sheets, then check out our list of net cash growth stocks without delay.

New feature: AI stock screener and alerts

Our new AI Stock Screener scans the market for opportunities every day.

• Dividend powerhouse (yield 3% or more)

• Small-cap stocks that are undervalued due to insider purchases.

• High-growth technology and AI companies

Or build your own metrics from over 50 metrics.

Explore for free now

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.