Nvidia (NASDAQ:NVDA) stock soared 171%, passing the $3 trillion market cap milestone and ending 2024 on a high.

Don’t miss our new year offers:

The company’s impressive growth is being driven by surging demand for AI chips. In the third quarter of fiscal 2025, Nvidia reported a 94% year-over-year increase in revenue to $35.08 billion. Furthermore, its operating margin of 62% confirms its ability to not only grow sales but also turn this demand into significant revenue.

Nevertheless, despite NVIDIA’s dominant market position, top investor Kavena Research has expressed concern that the new year may not be as rosy as last year. .

“For a big selloff in 2024, we think NVIDIA will face conditions in 2025 that could challenge the company’s recent growth trajectory,” says 5 stars, in the top 4% of TipRanks stock pros. says an investor.

Cavenagh highlights several factors that could disrupt NVDA next year. Chief among them are the efforts of potential competitors such as Broadcom, Marvell Technology, and AMD to capture a larger share of the AI data center market.

“NVIDIA’s competitive moat is only sustainable if the company successfully reinnovates and improves its products every 12 to 24 months,” Cavenagh argues.

Zooming out, investors point out that much of Nvidia’s strong growth relies on massive capital spending from hyperscalers like Meta and Microsoft. Kavena is skeptical that history is just beginning when it comes to increased spending. That’s because doing so would severely limit free cash flow for these publicly traded companies.

“We don’t believe investors will tolerate a significant acceleration in capital spending,” Kavena said, adding that “NVIDIA’s revenue growth could slow sharply in 2025.”

Another area of concern for Kavena is the possibility of production disruptions next year. The investor cited previous issues with Blackwell GPUs and said the scale of demand, product complexity and tight timelines make future supply shortages very likely.

“I don’t think 2025 will be that easy for NVDA,” Kavena concluded, giving NVDA stock a Sell rating. (Click here to see Cavenagh Research’s track record)

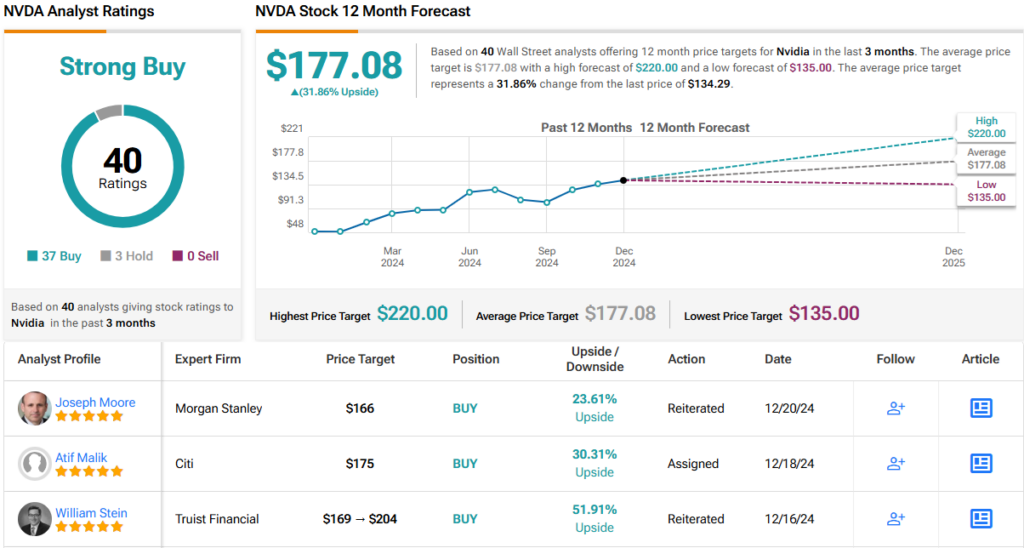

Meanwhile, Wall Street analysts see only clear skies ahead. NVDA holds a Strong Buy consensus rating with 37 Buy recommendations and 3 Hold recommendations. The company’s average 12-month price target of $177.08 suggests an upside potential of ~32% over the next 12 months. (See NVDA stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.