Most readers would already know that Tower Semiconductor (NASDAQ:TSEM) stock has increased by a significant 21% over the past three months. Given that stock prices are typically in line with a company’s financial performance over the long term, we take a closer look at financial metrics to see if they’re influencing recent stock price movements. I made it. In this article, we decided to focus on Tower Semiconductor’s ROE.

Return on equity or ROE tests how effectively a company is growing its value and managing investors’ money. In other words, this reveals that the company has been successful in turning shareholder investments into profits.

Check out our latest analysis for Tower Semiconductor.

How is ROE calculated?

Return on equity can be calculated using the following formula:

Return on equity = Net income (from continuing operations) ÷ Shareholders’ equity

So, based on the above formula, the ROE for Tower Semiconductor is:

7.9% = USD 206 million ÷ USD 2.6 billion (based on trailing twelve months to September 2024).

“Return” is the annual profit. So for every $1 of shareholders’ equity, the company generated $0.08 in profit.

What is the relationship between ROE and profit growth rate?

So far, we have learned that ROE is a measure of a company’s profitability. Now we need to evaluate how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company’s growth potential. Generally, other things being equal, companies with high return on equity and profit retention will have higher growth rates than companies without these attributes.

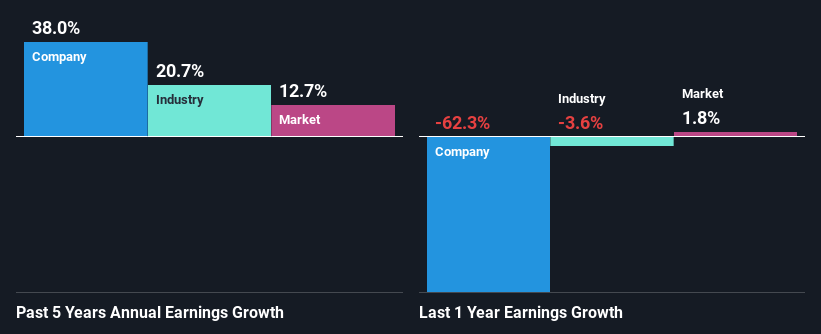

Tower Semiconductor’s earnings growth and ROE 7.9%

At first glance, Tower Semiconductor’s ROE doesn’t seem to be all that exciting. We then compared the company’s ROE to the broader industry and were disappointed to find that the ROE is lower than the industry average of 11%. However, we’re pleasantly surprised to see that Tower Semiconductor has grown its net profit by a strong 38% over the past five years. Therefore, there may be other reasons behind this growth. For example, the company’s management may have made good strategic decisions, or the company’s dividend payout ratio may be low.

We then compare it to the industry’s net income growth rate, and we see that Tower Semiconductor’s growth rate is quite high when compared to the industry average growth rate of 21% over the same period, which is great.

Earnings growth is a big factor in stock valuation. It’s important for investors to know whether the market is pricing in a company’s expected earnings growth (or decline). Doing so will help you determine whether a stock’s future is promising or ominous. One good indicator of expected earnings growth is the P/E ratio, which determines the price the market is willing to pay for a stock based on its earnings outlook. So you might want to check whether Tower Semiconductor is trading on a high P/E or a low P/E relative to its industry.

Is Tower Semiconductor making effective use of its internal reserves?

Tower Semiconductor does not pay regular dividends to shareholders. This means that the company reinvests all of its profits back into the business. This is likely what is driving the high earnings growth rate discussed above.

summary

Overall, we feel that Tower Semiconductor has some positive attributes. Despite the low rate of return, the fact that the company reinvests a very high portion of its profits back into the business has undoubtedly contributed to the company’s high profit growth. Having said that, a review of the latest analyst forecasts indicates that the company’s future revenue growth is expected to slow. Are these analyst forecasts based on broader expectations for the industry, or are they based on the company’s fundamentals? Click here to be taken to our analyst forecasts page for the company .

Evaluation is complex, but we will simplify it here.

Discover whether Tower Semiconductor is undervalued or overvalued with a detailed analysis featuring fair value estimates, potential risks, dividends, insider transactions, and financial condition.

Access free analysis

Do you have feedback on this article? Interested in its content? Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.