Semiconductor stocks are a great area to invest in. The industry is performing well with global sales increasing by 19% year-on-year in 2024, with further growth expected in 2025. World semiconductor trade statistics predict that the industry will reach nearly $700 billion in 2025. 627 billion in 2024.

Thanks to factors such as the expanding artificial intelligence market, this industry is likely to experience further growth in the coming years. To take advantage of this, two prominent semiconductor stocks to consider investing in are Advanced Micro Devices. (NASDAQ: AMD) and Broadcom (NASDAQ:AVGO).

Start your morning smarter! Wake up with breakfast news delivered to your inbox every market day. Sign up for free »

Both companies are seeing strong sales due to customer demand for AI-related products. But if you had to choose only one investment, which one would you choose? Let’s take a look at AMD and Broadcom to find the answer.

AMD’s AI approach

AMD specializes in semiconductor products for accelerated computing. Accelerated computing uses specialized components to speed up the processing of data-intensive tasks, such as those performed by AI.

AMD expects demand for accelerated computing to grow in the coming years to support the expansion of data-intensive applications, including AI as well as 5G wireless networks. Today’s computer hardware requires upgrades to support accelerated computing, providing a large market for AMD products.

Artificial intelligence is one of the biggest technologies that requires high-speed computing. That’s why demand for AI drove AMD’s revenue to a record $6.8 billion in the fiscal third quarter ended September 28. This represents an 18% increase over the previous year.

The company’s semiconductor products are highly sought after to increase the speed and efficiency of AI systems installed in data centers. As a result, AMD’s data center sales reached a record revenue of $3.5 billion, an increase of 122% year over year.

AMD is expanding its successful data center business through acquisitions. For example, the ZT Systems acquisition deal is expected to close in the first half of 2025. ZT Systems helps customers implement AI infrastructure.

Thanks to demand for faster computing, AMD expects fourth-quarter sales to reach $7.5 billion, up from the record $6.8 billion in the third quarter. This is a double-digit increase compared to the previous year’s $6.2 billion.

What drives Broadcom’s success?

CEO Hock Tan called 2024 “a transformational year for Broadcom.” This was driven by two key factors: AI and AI’s acquisition of VMware.

The company acquired VMware in November 2023. VMware provides virtualization software that allows IT organizations to run multiple operating systems on a single server. Broadcom is positioning this feature as a way for businesses to build their own private cloud computing environments rather than using public cloud computing environments owned by conglomerates such as Microsoft.

That approach is to attract customers. Broadcom’s infrastructure business unit, which includes VMware, reported revenue of $5.8 billion in the company’s fiscal fourth quarter, which ended Nov. 3, an increase of 196% from a year earlier.

As for AI, the semiconductor giant’s AI-related revenue increased 220% to $12.2 billion in FY2024, compared to $3.8 billion in FY2023. This demand for AI drove the company’s full-year sales to a record $51.6 billion, up 44% from FY2023.

Sales success helped the company generate strong free cash flow of $5.5 billion in the fourth quarter, up from $4.7 billion a year ago. As a result, Broadcom increased its dividend by 11% to $0.59 per share.

Choosing between AMD stock and Broadcom stock?

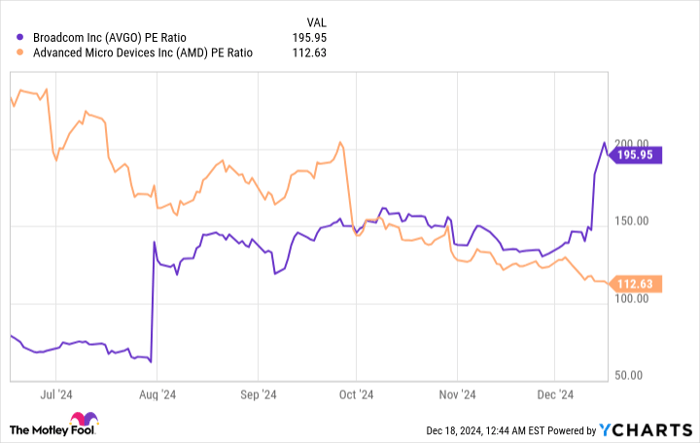

AMD and Broadcom are both great semiconductor companies, as evidenced by their strong revenue growth. Choosing just one or the other is a difficult choice, as it would be ideal to own both stocks. One factor to consider is valuation using the price-to-earnings ratio (PER).

Data by YCharts.

The P/E ratio indicates how much an investor is willing to pay for a dollar worth of earnings. As 2024 draws to a close, Broadcom and AMD’s price/earnings ratios are moving in opposite directions.

After Broadcom reported impressive fourth-quarter results, the company’s stock soared, hitting a 52-week high of $251.88 on Dec. 16. This also caused the P/E ratio to jump, making AMD stock look better as a result. current values.

On top of that, AMD has another potential advantage over Broadcom. Broadcom is particularly vulnerable to impending U.S. government tariffs and restrictions on exports of semiconductor products to China. About a third of sales are to Chinese customers. By contrast, AMD’s exposure to China is 15% of sales, about half of Broadcom’s.

Both companies have strong AI businesses, but AMD’s higher valuation and lower risk in China give it an edge over Broadcom as a better semiconductor stock to buy now. That being said, Broadcom is worth putting on your watch list to buy shares when the stock price drops.

Should you invest $1,000 in Broadcom right now?

Before buying Broadcom stock, consider the following:

Motley Fool Stock Advisor’s team of analysts has identified the 10 best stocks for investors to buy right now. Broadcom was not among them. These 10 stocks have the potential to generate impressive returns over the next few years.

Consider when Nvidia created this list on April 15, 2005… If you invested $1,000 at the time of recommendation, you would have earned $790,028.!*

Stock Advisor provides investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks each month. of stock advisor For the service more than 4 times The resurgence of the S&P 500 since 2002*.

See 10 stocks »

*Stock Advisor returns as of December 16, 2024

Robert Izquierdo holds positions at Advanced Micro Devices and Microsoft. The Motley Fool has positions in and recommends Advanced Micro Devices and Microsoft. The Motley Fool recommends Broadcom and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.