Important points

It’s been a record-breaking year for artificial intelligence (AI) darling Nvidia (NVDA) stock, but the momentum may not be over yet.

Even though the recent sell-off has put the stock into correction territory, analysts remain overwhelmingly bullish on the company’s stock and are looking for further upside as demand for its AI chips continues to outstrip supply. I’m looking forward to it.

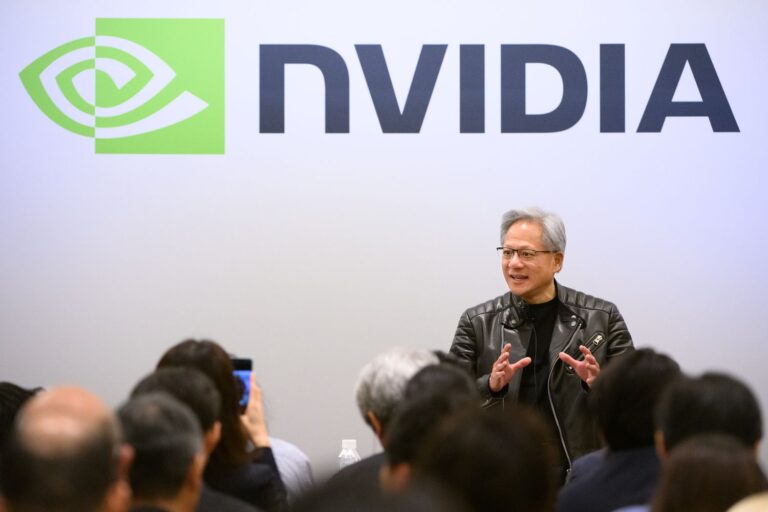

CEO Jensen Huang told investors last month that “the age of AI is here, and it’s big and diverse,” adding that the “exponential” growth in computing scale will drive NVIDIA’s He said he would benefit.

Analysts are overwhelmingly bullish on Nvidia’s upside potential. Of the 21 analysts covering the stock tracked by Visible Alpha, all but one hold a “buy” or equivalent rating, with an average price target of approximately $177 and Friday’s closing price of $134.70. That suggests an upside of more than 31% from the dollar.

Nvidia’s sales and stock prices hit record highs

The surge in demand for AI has pushed sales of Nvidia’s chips that support AI development and the company’s stock price to record highs this year, with the stock price more than doubling by 2024. This has raised the company’s value to a rich territory. , Nvidia is currently one of only three companies with a market capitalization of more than $3 trillion.

The company reported last month that its data center revenue more than doubled from a year earlier to $30.8 billion, with quarterly revenue reaching a record $35.1 billion in its fiscal third quarter.

On the company’s earnings call, executives said they were seeing “tremendous” demand for the company’s next-generation Blackwell AI system, which CEO Jensen Huang described as “an industry-leading He was called a “changer.”

In a note to clients in mid-December, Morgan Stanley analysts called Nvidia a “top candidate,” citing its R&D budget and strong relationships with major cloud providers, and cited the chipmaker’s short-term prospects for wrote that it expects to maintain AI leadership.

CEO Jensen Huang’s keynote speech in January could be a catalyst.

Citi is reminding customers that the next big event to boost stock prices could happen next month, with CEO Jensen Huang announcing at the Consumer Electronics Show (CES) on January 6th. ) and that he plans to give a keynote speech at the event.

Citi analysts expect that Hwang may issue higher forecasts for Blackwell’s sales at the event and highlight growth opportunities related to the growing demand for robots in businesses and industries. He said there was. According to The Verge, NVIDIA is also expected to announce new graphics cards, and may announce other products as well.

Goldman Sachs analysts also pointed to NVIDIA’s annual GPU Technology Conference (GTC) in March. At this year’s GTC, Nvidia announced its Blackwell platform, expanded partnerships with industry leaders, and more. (The fourth quarter financial report is scheduled to be released in February.)

Huang has previously said the company plans to release a new family of chips every year, and the chipmaker is likely to provide details about Blackwell’s successor, Rubin, in the coming months, with its release scheduled for 2026. He said it is scheduled for 2020.