Unlock Editor’s Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

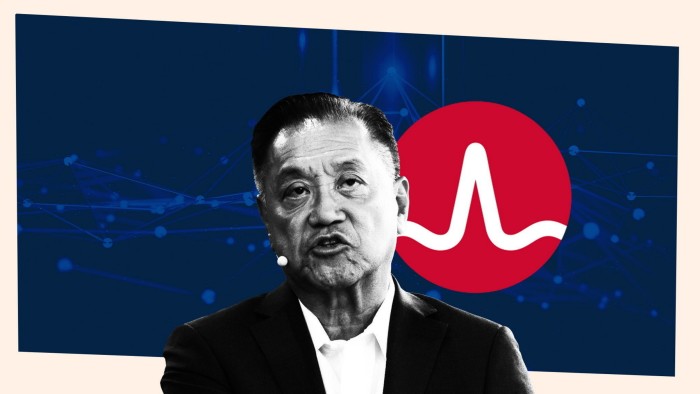

Big Tech’s spending frenzy on artificial intelligence will continue until the end of the decade, according to Broadcom’s head, whose AI chip business could be valued at $1 trillion on growing investor excitement It is said that the price has skyrocketed more than the dollar.

Broadcom CEO Hock Tan told the Financial Times that Silicon Valley customers are developing AI infrastructure investment plans “on a three- to five-year rush.”

“They’re fully invested,” he says. “If they run out of money or the shareholders stop doing this, they’ll quit.”

Tan’s comments come after Broadcom’s stock price soared 24 percent in one day last Friday after it was revealed that Broadcom’s AI revenue rose 220 percent to $12.2 billion in fiscal 2024. Served.

This increased the company’s market capitalization by more than $200 billion, making the chipmaker’s market capitalization above $1 trillion for the first time. Tan told investors last week that Broadcom expects to generate tens of billions of dollars in additional annual revenue from AI chips by 2027.

Broadcom has not disclosed the names of its chip customers, but analysts say the Silicon Valley-based group is working with Google, Meta and TikTok’s parent company ByteDance to accelerate training and deployment of AI systems. The company has designed a custom processor to do this.

OpenAI and Apple are also working with Broadcom as technology companies seek alternatives to Nvidia, the $3 trillion chipmaker that dominates the market for powerful processors needed to train large language models. It is reported that the company is developing its own AI server chip.

Mr. Tan’s decades of experience in the semiconductor industry and a string of deal deals have brought him to Silicon Valley, the ailing U.S. semiconductor maker whose CEO Pat Gelsinger abruptly resigned earlier this month. There is widespread speculation that Broadcom may step in to rescue Intel.

However, Tan downplayed the possibility of Broadcom acquiring Intel, saying the company has its “hands full” with AI semiconductors. “That’s driving a lot of my resources, a lot of my focus,” Tan said, adding that his involvement with Intel was “uncalled for.”

“An agreement can only be reached if it is practicable,” he said. “Power means someone comes to me to ask. There’s one thing I’ve learned since Qualcomm: don’t make hostile offers.”

In 2018, Broadcom’s $142 billion hostile takeover bid for rival semiconductor company Qualcomm was blocked in an unprecedented intervention by then-U.S. President Donald Trump.

Tan is also busy completing the integration of VMware, the cloud software company that Broadcom acquired last year for $69 billion. Nevertheless, he said he is “open to the possibility of acquisitions,” whether it’s hardware or software, adding that “we’re sort of in consideration mode.”

This year has seen unprecedented investment in data centers by Big Tech companies and AI startups like OpenAI and Elon Musk’s xAI to create and run AI models at scale bigger than ever before.

xAI’s “Colossus” facility in Memphis boasted 100,000 Nvidia graphics processing units when it went online in September, setting a new standard in the race for AI computing power.

But by 2027, Tan said, Broadcom customers will have built clusters of up to 1 million AI chips.

While “the jury is still out” on the value of generative AI in helping businesses reduce costs, Big Tech “hyperscalers” see a huge opportunity to generate more revenue, Tan said.

“They need to train[AI]on a scale the world has rarely seen before,” he says. “That consumes a lot of silicon. That’s where we come in.”

Many of the recent advances in generative AI have been driven by so-called scaling laws, where more data combined with more computing power yields smarter AI.

“They have a formula to keep it going and they haven’t reached the end of that formula yet,” Tan said. “All roads lead to the need for more computing chips.”

Recommended

He added that tech companies “are making very big bets over three to five years in a great hurry because they think the technology is in their hands.” “There are only a few companies doing this, but they could become very large consumers[of AI chips]because the profits are huge.”

Even a million chips may not be enough to achieve OpenAI and rival AI startup Anthropic’s ultimate goal: to create a general artificial intelligence smarter than humans. “I don’t think anyone knows,” Tan said. “But this opportunity is too hard to resist, so I say let’s give it a try.”

Despite Broadcom joining an elite group of just eight U.S. companies valued at more than $1 trillion, Tan said he felt there was “nothing new.”

“Value is in the eye of the beholder. We have to learn not to get too attached to it,” he said. “But that’s a great assessment. . . . I don’t think I’m alone in believing there’s still power left in generative AI.”