Unlock Editor’s Digest for free

FT editor Roula Khalaf has chosen her favorite stories in this weekly newsletter.

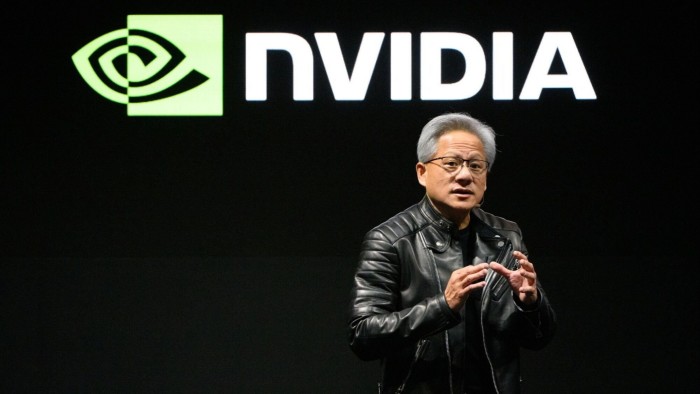

In a quiet whisper, has investor enthusiasm for NVIDIA cooled a bit? The chipmaker is riding a boom in demand for chips that power artificial intelligence. The stock has soared 180% this year, lifting about a fifth of the S&P 500’s gain in the process.

But Nvidia’s trading volume has slowed in recent months, with the average number of shares traded down 40% compared to the first half of this year. Over the past six months, the company’s stock has risen just 3% compared to the S&P 500’s rise of more than 11%. NVIDIA stock actually fell by about 9% last month.

The exit may just be a year-end profit taking, but it comes as investors consider how AI developments will play out in 2025. This is perhaps one of the biggest calls investors have to make in the new year, given how important technology is to generating profits.

“There’s a tension between momentum and valuations, which is very strong in the early stages of technology adoption,” said Joe Davis, chief economist at Vanguard. His team has mapped the impact of technology adoption since the Industrial Revolution and recently warned that the market could be affected in the future. Given the early stages of AI development, we are ahead of the curve. “If I had a longer view, I think a smart investor would say, ‘Okay, who’s going to use that technology?’ Who’s going to develop that technology?”

So far, the best-performing companies in the stock market have been companies like Nvidia, which acted as catalysts for the gold rush by selling shovels to speculators.

Investors are already backing energy companies, too, with nuclear operators Vistra and Constellation Energy both among the S&P 500’s top 10 performers this year. In a sign of the surge in power demand for AI-related applications, Microsoft signed a 20-year contract with Constellation in September that includes restarting the Three Mile Island nuclear power plant.

Jonathan Blum, infrastructure specialist and senior managing director at BlackRock, pointed to a recent meeting between OpenAI’s Sam Altman and the White House, where the AI pioneer agreed to support AI development. The company asked for help building a series of 5 GW data centers. For context, each would require the power of approximately five nuclear reactors.

“It shows us how difficult it is to build infrastructure and provide energy to it,” said Blum, founder of investment firm Global Infrastructure Partners. “We are seeing a potential opportunity for trillions of dollars of capital injection.”

Infrastructure in the sense of AI can also include groups such as cloud providers, data center owners, and security software companies. Palantir is the only sector in the S&P 500 that quadrupled, outperforming Vistra and Nvidia. value.

But investors will be looking to determine which companies will actually benefit from the use of AI. David Kostin, chief U.S. equity strategist at Goldman Sachs, believes there will be four stages in which investors will focus on AI this year: Nvidia, then AI infrastructure, AI revenue, and AI An overview of productivity improvement was provided. Now, he says, we are moving to the third stage.

“Our paper is looking at 2025 and we’re going to see a shift from beneficiaries…spending on infrastructure to spending on AI,” Kostin adds. . Potential winners at this stage include software and IT services companies that can generate revenue from AI-enabled products. Recent companies that Kostin’s team has focused on include Datadog, MongoDB, and Snowflake, which help enterprises manage cloud-based data and infrastructure. Microsoft also made the list.

Phase 4 is an industry that will be transformed by AI, just as personal computers and the Internet previously revolutionized the way we work.

“Ultimately, the bull case from here is the idea that we are moving back to corporate America, where companies are really focused on the hard things like productivity and efficiency. said Savita Subramanian, head of U.S. equities and quants. Bank of America’s strategy projects the S&P 500 index to rise about 10% next year. “While we believe AI is part of the productivity and efficiency story, there are also other routes to driving its benefits, such as digitization and automation. These themes are already coming to fruition. there is.”

There are many bold predictions about how AI will change the world. No one knows how much you will achieve. With that in mind, current productivity gains, measured through the revenue and cost line in quarterly updates, are a big draw for more cautious investors.

jennifer.hughes@ft.com