As the old adage goes, past performance is no guarantee of future results.

There’s no denying Nvidia is a technology powerhouse (NVDA -2.25%) So far, it has been at the center of the artificial intelligence (AI) movement.

That processor is the heart of most data centers. The company’s stock price has remained hidden from the market as a whole since early 2023, when the artificial intelligence revolution was in full swing. The stock price has increased over 800% in the last two years. In comparison, the S&P 500 rose 58% over the same period.

However, as always, things change. Competition creeps in. Technology evolves. Investors’ euphoric interest in the stocks of industry leaders fades as customers begin to think of more concrete solutions to their unique challenges.

Those considering entering or owning Nvidia stock may want to consider Marvell Technology, another top growth prospect in the technology industry. (MRVL 10.79%).

Get up close and personal with Marvel technology

Don’t you know? You’re not alone. Its market capitalization of less than $100 billion doesn’t attract much attention, especially when compared to Nvidia’s market value of $3 trillion. Marvell also hasn’t exactly caught the eye of the many hedge funds and asset managers who keep their finger on the pulse of the proverbial “next big thing.” The Motley Fool recently looked at the hedge fund holdings of 16 different billionaires and found that the company wasn’t a key position for any of them, but maybe it should be.

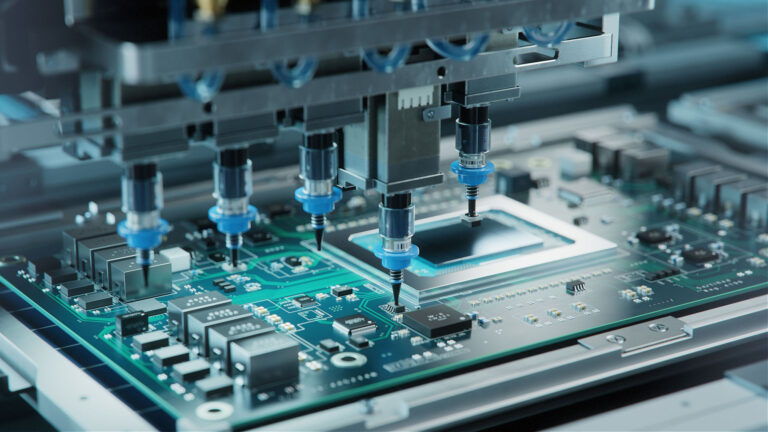

Marvell isn’t the first name that comes to mind for investors looking for new ways to participate in the artificial intelligence movement. It was there quietly the whole time. The company makes everything from data center switches to hard drive controllers to computer processors you may not have heard of, but you’ll definitely notice when they’re not there. The technology is used in 5G connected devices, cars, and perhaps most notably AI data centers, which increasingly require entire walls of motherboards to work together as one giant digital brain. I am.

For example, earlier this week the company announced its new Aquila DSP (digital signal processor), which can process 1.6 trillion bits of digital data per second. This power-efficient technology can be used in high-density data centers with up to 20 kilometers worth of interconnect wiring. That’s why technology market research firm Dell’Oro Group believes the market for this new type of data center processor will grow at an average annual rate of 200% over the next five years.

That’s just one of the technologies Marvel will develop. The company also announced a breakthrough design for its high-bandwidth memory (HBM) module earlier this week. This solution should provide AI platforms with 25% more computing power than comparable systems today, without taking up additional space. Mordor Intelligence believes this more developed global HBM market will grow at nearly 26% annually through 2029.

Indeed, Nvidia’s processors are the flagship. However, if artificial intelligence is to move into its next chapter, the technology these AI processors are connected to will also need to be next-generation. Marvell Technology is leading this under-the-radar attack.

Still bullish despite recent rally

For better or worse, Marvell’s growth prospects are increasingly being reflected in its stock price. The stock is up more than 200% since the end of 2022, and about half of that gain has been realized since mid-year, when the company’s research and development efforts and need for them gained attention.

It seems difficult to follow this huge rally, with the stock priced at a frothy 40 times next year’s expected earnings of $2.76 per share. But this is definitely one of those cases where some dip is a buying opportunity.

While these valuations seem very high compared to the broader market, that’s not how today’s storied growth stocks trade. Such stocks can hold or even command high premiums based on the company’s plausible earnings five or even 10 years from now, rather than next year’s expected earnings. be.

There is little doubt that Marvell Technologies is well-positioned to capture at least a fair share of the projected growth of the AI technology market. Benchmark analyst Cody Acree explains the company’s recent price target increase: “Marvel is one of only two custom silicon suppliers, along with Amazon and Google, providing competitive accelerators for NVDA GPUs to three of the industry’s largest hyperscale data center companies.” Marvell contracted with us to co-develop custom accelerators uniquely tailored to address specific AI workloads. ”

Mr. Ackley added the following to his bullish opinion: “After years of work, development, and qualification, these processors are now experiencing growing volume production revenues, and when combined with strong growth in the optical connectivity space, Marvell is said to be able to produce ‘significant momentum.’ . AI exceeded its FY25 and FY26 goals to generate $1.5 billion and $2.5 billion, respectively. ”

Data source: StockAnalysis.com. Graph by author.

He’s not the only bull. Despite the recent strong rally, the majority of the analyst community still rates Marvell stock as a strong buy.

If you like it, buy it now

Will billionaires, hedge funds, and other institutional investors one day get on board and add Marvell Technology to their portfolios? Maybe. Or maybe not. No one knows for sure.

Don’t be discouraged just because Marvel isn’t currently popular among investors in the proverbial “big money” class. Many of these savvy investors weren’t exactly on board with NVIDIA when it first started making noise, either. It may take some time for this crowd to find a new darling and convince themselves to take the plunge.

If you like the fundamental story and the long-term risk-reward scenario for this stock, buy it now, even if it’s near the record highs it recently reached.

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Suzanne Frey, an Alphabet executive, is a member of the Motley Fool’s board of directors. James Brumley holds a position at Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool recommends Marvell Technology. The Motley Fool has a disclosure policy.