Amid the AI boom, global semiconductor giants such as TSMC are working to expand CoWoS capacity. However, according to Chinese technology media ijiwei, China has recently seen a rapid increase in mergers and acquisitions in this field, and market demand for advanced packaging-related materials is also increasing.

ijiwei’s report points out that moving from traditional methods to more advanced chip packaging technologies, such as 2.5D and 3D IC packaging and system-in-package (SiP), requires a more complex process. Masu. As a result, demand for advanced packaging materials is increasing.

Meanwhile, demand for upstream materials is further accelerating due to the growing need for chips with powerful computing power, as well as the recovery of the semiconductor industry and the expansion of production capacity by leading advanced packaging companies. says Mr.

Less than 30% of China’s packaging materials are domestically produced

However, the report also shows that the key semiconductor materials market is still largely dominated by Japanese and Western companies. In China, it is said that only 15% of semiconductor materials are produced domestically, and less than 30% of packaging materials.

According to ijiwei, in order to strengthen the competitiveness of the domestic semiconductor materials sector, with favorable policy support, some major Chinese companies are actively entering the advanced packaging materials field through mergers and acquisitions.

Successive mergers and acquisitions

First, in late November, Jiangsu Huachengke New Materials announced plans to acquire Changzhou Huawei Electronics, which specializes in epoxy molding compounds, an important material for integrated circuit packaging.

According to the data shown on the Mtia website, Jiangsu Huahai Chengke New Materials has built a pilot production line and two large-scale production lines for epoxy plastic compounds at an international advanced level. Notably, the acquired company, Huawei Electronics, ranked third in the world by sales and fourth in sales revenue among epoxy molding materials companies in 2023, the ijiwei report added. There is. In addition, ijiwei said the company maintained its top position in China in terms of both sales volume and revenue.

Meanwhile, in early November, Huatai Chemical’s acquisition of POME added a major supplier to Huawei HiSilicon. The ijiwei report points out that POME produces polyimide (PI) materials that are essential for advanced semiconductor packaging, helping Huawei overcome packaging material bottleneck challenges. There is.

In October, Shenzhen’s Zhizheng agreed to acquire a 12.49% stake in Advanced Assembly Materials. According to ijiwei, AAMI ranked among the world’s top five lead frame suppliers in 2023 in terms of revenue. By the first half of 2024, the company’s revenue rose to fourth in the world and maintained its position as the top lead frame supplier in China.

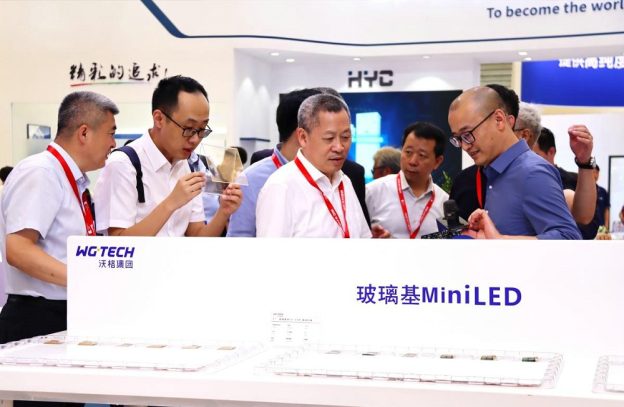

Meanwhile, WG Tech’s acquisition of TGVTECH in February reportedly added a glass-based chip panel-level packaging substrate maker to WG Tech’s portfolio. According to ijiwei, glass substrates are considered a key material for the next generation of advanced packaging technologies that are essential for AI chips.

According to ijiwei, in the aforementioned cases, either the acquired company holds top market share internationally or domestically, or its products address key bottleneck technologies and break foreign monopolies. That’s it.

Although China still lags relatively behind in the field of advanced packaging, continued advancements in 2.5D, 3D and other advances by local companies such as JCET and Huatian Technology have placed domestic manufacturers at the leading edge of the world. According to the report, packaging is expected to play an increasingly important role in the market.

read more

(Photo courtesy of TGV Tech)

This article quotes the following information: Ijiway and Mutia.

Next article

(News) A brief analysis on the current development of the LED All-in-One market