Point72 Asset Management’s Steven Cohen just elevated the fund’s position in foundry specialist Taiwan Semiconductor Manufacturing.

Stephen Cohen is a billionaire hedge fund investor who is the CEO of Point72 Asset Management. While parsing Point72’s latest quarterly 13F filing, I came to one very clear conclusion. That said, Cohen is bullish on artificial intelligence (AI). In the quarter that ended in September, some of Point72’s larger purchases were “Magnificent Seven” stocks such as Nvidia, Alphabet, and Microsoft.

In fact, I think there are many benefits to owning big tech stocks as the AI story continues to unfold. But smart investors like Cohen know that many other opportunities are hiding in plain sight. Another recent purchase that really stood out to me was Point72’s investment in Taiwanese semiconductor manufacturing. (TSM -0.67%). During the third quarter, Cohen’s fund raised about 588,000 shares, increasing his stake by 95%.

Below, I outline why I view TSMC (as it is commonly known) as a once-in-a-decade opportunity for AI investors, and why I think now is a good time to follow Mr. Cohen’s lead.

What does TSMC actually do?

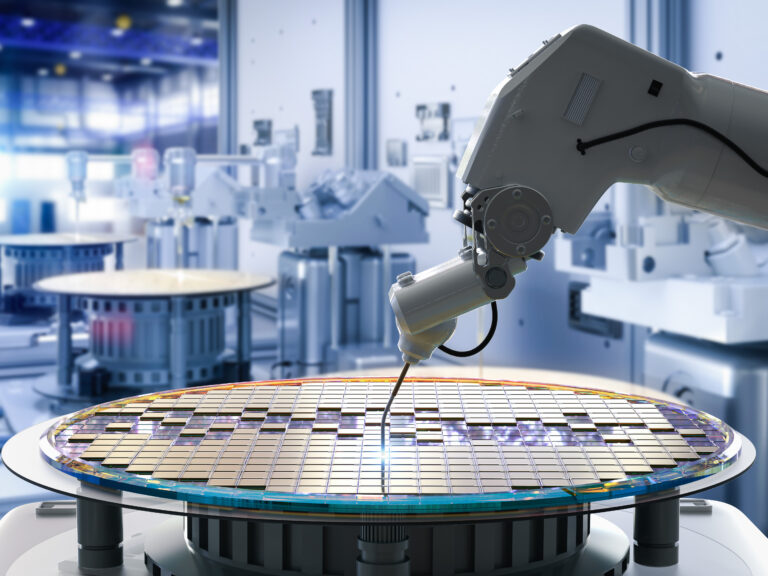

Semiconductor companies such as Nvidia and Advanced Micro Devices specialize in designing advanced chipware that powers countless generative AI applications and hardware devices around the world. But what many people don’t realize is that these companies outsource much of their manufacturing work.

This is where TSMC comes into play. Its foundry processes are frequently used by many of the world’s leading semiconductor companies. can’t believe it? Consider the fact that Nvidia, AMD, Amazon Web Services (AWS), Broadcom, Intel, Qualcomm, Sony, and others make equipment. The next decade looks incredibly bright for TSMC.

Image source: Getty Images.

Why the outlook is bullish for TSMC over the next few years

The AI market is huge, so it’s not enough to say that TSMC’s future is bright. Such a position is too vague and based on surface-level assumptions. Instead, we will detail two specific market opportunities that TSMC will dominate over the next decade.

Global semiconductor foundry market: According to Market.us, the global semiconductor foundry market will grow at an average annual rate of 8.5% from 2024 to 2033, ultimately reaching a value of $276 billion by the beginning of the next decade. predicted to reach scale. Currently, TSMC is estimated to own 62% of the global foundry market, with its next closest competitor, Samsung, reaching 13% of the market. With such a large lead, and many of the tailwinds discussed below, we believe TSMC is well-positioned to continue gaining incremental market share as the need for foundry services continues to grow. Global GPU Market: Fool.com contributor Keithen Drury recently made a great point that the graphics processing unit (GPU) use case is not very important for companies like TSMC. After all, as long as chip designers continue to innovate and bring out next-generation GPUs, it’s very likely that TSMC will be involved in the manufacturing process. As outlined in a previous article, the global GPU market size is expected to exceed $1.4 trillion by 2034.

Both Nvidia and AMD will bring new GPU architectures to the market over the next few years. Additionally, many of the Magnificent Seven companies have also begun developing their own chips in order to compete more closely with incumbents.

Given TSMC’s existing footprint in the foundry market, the fact that it already partners with many of the world’s leading chip businesses, and the tailwinds fueling the GPU market, I’m optimistic about the company’s prospects for continuing to generate strong growth over the long term. , remains as bullish as ever. carry.

Should you buy Taiwanese semiconductor stocks now?

As of this writing, TSMC’s forward price/earnings ratio (P/E) is 21.5 times. To put this into perspective, TSMC’s expected P/E ratio at this time last year was approximately 16.3 times. We’ve seen significant valuation expansion over the last year, and I think this move is justified. TSMC is a force to be reckoned with in the foundry space, and its diverse customer base points to even stronger growth in the coming years as demand for GPUs continues to soar.

In my eyes, TSMC is an attractive buy-and-hold opportunity for investors with a long-term view. I think now is the perfect time to follow Cohen’s lead and take action.

Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Adam Spatacco has held positions at Alphabet, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Intel, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: A January 2026 $395 long call on Microsoft, a January 2026 $405 short call on Microsoft, and a November 2024 $24 short call on Intel. The Motley Fool has a disclosure policy.