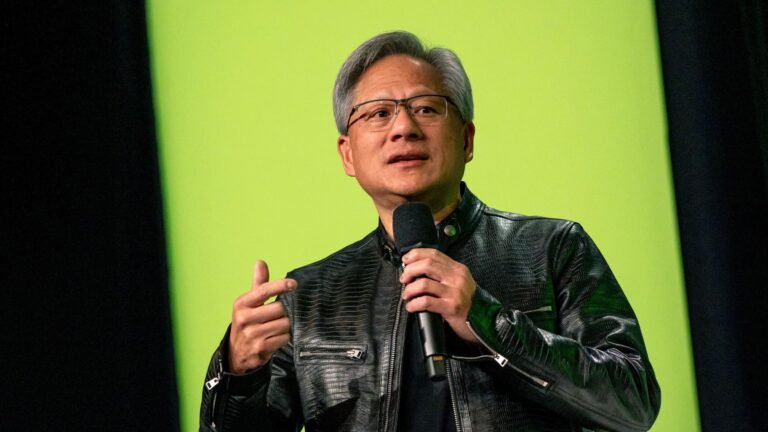

Click here for the Club Mailbag email address (investingclubmailbag@cnbc.com). Please direct your questions to Jim Cramer and his team of analysts. We cannot provide personal investment advice. We only consider more general questions about the investment process and stocks in your portfolio and related industries. This week’s question: On September 16, 2015, I purchased 125 shares of Nvidia stock as a speculative stock. I bought this book because I was watching “Mad Money” that week and Jim Cramer was so convincing that NVDA can/will do great things in the future. Jim recommended this as a strong “spec” stock. I currently own 5000 shares of NVDA (thanks to the 2021 and 2024 stock splits). I truly believe in Jensen Huang’s vision for Nvidia and feel strongly that the company will continue to enjoy great success for at least the next two years. People keep telling me to call the cashier and sell them Nvidia stock. My question for you is, should I keep holding on or should I sell some stocks to finance the house?My plan is to leave it until I hit $400 and then ring the cash register. is. What are your thoughts and recommendations? Thanks! ! — Lee S. from Florida. Congratulations on winning Monster. This is a great example of what can happen if you focus primarily on the multi-year fundamentals of a business rather than the day-to-day fluctuations in stock prices. It’s no secret that Nvidia, the popular artificial intelligence chip company, has experienced some pretty big losses since 2015, but the fluctuations are easily forgivable if you keep the long-term outlook in mind. It will look like this. It also shows the importance of taking risks from time to time. Of course, not all speculative strategies will yield results like Nvidia’s, but if you simply decide to own a diversified index fund (which may be the right move for some investors), this would give up all hope of achieving a Grand Slam like that. Now, with that in mind, this is a clear case of discipline and belief. As longtime followers of Jim Cramer know, our club’s belief is that discipline trumps belief. Not having made a profit since 2015 clearly goes against our approach of locking in profits along the way. Often, with stocks that have at least doubled, you want to take out as much money as you put in, and keep the rest in your “house money.” At least that’s our discipline. It may not be your thing. After all, every investor has to develop his own. As Jim likes to say, bulls and bears make money, but pigs get slaughtered. Leaving a successful position for nine years would generally be considered arrogant. However, it is undeniable that in this case the slaughterhouse could have been avoided. So can you say what you did was wrong? Not exactly. At the end of the day, you either make money or lose money. And with this bet on Nvidia, you paid off big. It looks like your faith paid off. That said, we would argue that your case, and a similar investment in Nvidia that began years before the generative AI boom, is an exception to this rule. Let’s be honest: Back in 2015, no one could predict with 100% certainty what NVIDIA would look like over the next 10 years. With the exception of perhaps co-founder and CEO Jensen Huang, the chipmaker has always maintained that it’s about more than video. game company. Investors like you who believed in his vision of Nvidia as an accelerated computing company and stuck with the stock deserve immense credit. But while there aren’t many companies in history that have achieved explosive growth like Nvidia, there are hundreds of speculative strategies that haven’t worked out. Our rules and discipline are designed and followed because we are focused on staying in the game. They’re meant to keep Nvidia wannabes from wiping us out before we have a chance to find Nvidia. So, while your conviction has been rewarded and we still maintain an “own it, don’t trade” view on stocks, we must abide by a set of rules. Discipline is more important than belief, and regular gains along the way can help you avoid the pitfalls of greed. Is there room for further upside for Nvidia stock? Absolutely. After all, we just raised our price target on Wednesday night following a better-than-expected earnings report. Nevertheless, long-term investing is as much about managing downside risk as it is about looking for upside potential. For quality companies like Nvidia, if you protect yourself from the negatives, the positives will take care of themselves. And while it’s not our base case, we can’t completely ignore potential headwinds for NVIDIA, even if some of the larger companies are out of control. AI is currently considered a national security issue, and the use of it to create it comes at the center of what could be a very heated dispute between the United States and China once President-elect Donald Trump takes office. Don’t forget that the semiconductors are located there. If something were to hit NVIDIA’s supply chain, most notably further Chinese aggression in Taiwan, it could have a major impact on the stock price. To be clear, this is not a default expectation, but we cannot act as if the probability is 0%. Even if a risk is not expected to materialize, it is still a risk that must be considered. This is an important reason to maintain a diverse portfolio. We recognize that Nvidia may be offering ideas that are contrary to your stated intention to hold your entire position until it reaches $400 per share. We also don’t know the rest of your financial situation. This is another important consideration in this type of situation. You may also need to consider tax implications, depending on the type of investment account the stock is in. We generally don’t think capital gains taxes are a reason to not record a profit, but it’s worth discussing with your tax advisor. . Our conclusion is that we rely on our own rules in such scenarios. They allowed us to stay in the game and helped us donate a lot of money to charity along the way. Nvidia is a stock everyone should own for the long term, but discipline is more important than belief. And when faced with a huge move to the upside, that discipline is about locking in some profits. (Jim Cramer’s Charitable Trust is long NVDA. See here for a complete list of stocks.) As a subscriber to Jim Cramer’s CNBC Investment Club, you will receive trade alerts before Jim makes a trade. I will receive it. After Jim sends a trade alert, he waits 45 minutes before buying or selling stocks in his charitable trust’s portfolio. If Jim talks about a stock on CNBC TV, he will issue a trade alert and then wait 72 hours before executing the trade. The above investment club information is subject to our Terms of Use and Privacy Policy, along with our disclaimer. No fiduciary duties or obligations exist or arise from your receipt of information provided in connection with the Investment Club. No specific results or benefits are guaranteed.

Subscribe to Updates

Subscribe to our newsletter and never miss our latest news

Subscribe my Newsletter for New Posts & tips Let's stay updated!

Related Posts

Add A Comment