Meb Farber, Founder and Chief Investment Officer of Cambria Investment Management, looks at how investors position their portfolios and considers taxes from a “making money” perspective. Discuss new ETFs.

The top three performing exchange-traded funds in 2024 have one thing in common. That’s because each one is related to Nvidia, the AI superstock.

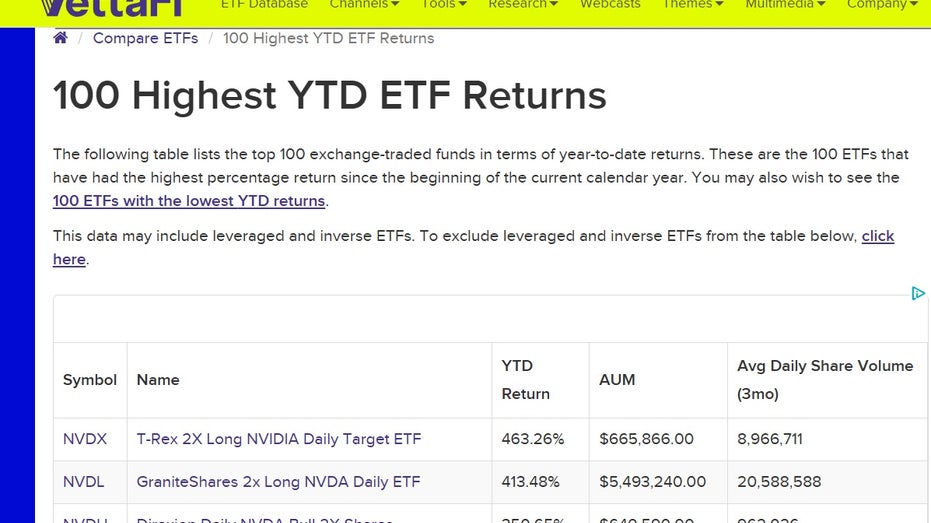

According to VettaFi, the T-Rex 2X Long NVIDIA Daily Target ETF and GraniteShares 2x Long NVDA Daily ETF each rose more than 400%, while the Direxion Daily NVDA Bull 2X Shares rose more than 350%.

3 Best Performance ETFs Linked to Nvidia in 2024 (Bettafi)

“NVDX, NVDL, and NVDU are 2x leveraged long bets on Nvidia that are typically used to capture short-term profits. You can double your profits (or losses) with Nvidia’s daily profits,” said Roxana Islam of VettaFi. Head of sector and industry research told FOX Business.

Ticker Security Last Change Change % NVDX ETF OPPORTUNITIES TR T REX 2X LONG NVIDIA DAILY 19.57 -0.30 -1.51% NVDL GRANITESHARES ETF TRUST 2X LONG NVDA DAILY ETF 80.58 -1.32 -1.61% NVDU DIREXION DAILY NVDA BULL 2X SHARES 130.04 -2.22 -1.68%

Nvidia stock is up more than 200%, and expectations are high for Wednesday’s results. Earnings per share are expected to rise nearly 90% to 75 cents, and revenue is expected to rise 83% to $33.16 billion.

Direxion managing director Ed Egilinsky told FOX Business that the company’s ETFs, such as NVDU, are aimed at nimble investors both large and small.

Ticker Security Last Change Change % NVDA NVIDIA CORP. 145.89 -1.12 -0.76%

“This gives us twice the return on NVIDIA common stock on any given day,” he said. “Leverage can work well if something is continually moving up the stairs in your direction. No joke. However, these instruments are designed as short-term trading instruments for active traders. You can’t just watch it.” Even though Nvidia is doing very well, most stocks are saying, “Forget it.” There is no tendency for it to rise to the same magnitude. ”

Bitcoin Whale ETF hits new high

A semiconductor chip mounted on a circuit board. (Reuters/Florence Lo/Illustration/Reuters)

If Nvidia disappoints Wall Street, you can use other ETFs to protect against a drop.

“There’s also an unlevered inverse short, which is exactly the opposite of what Nvidia does on a one-day basis for any given day. So if Nvidia goes down 5% tomorrow, 5 %, that is NVDD,” Egilinsky added.

Ticker Security Last Change Change % SOXL DIREXION SHARES ETF TRUST DAILY SEMICONDUCTOR BULL 3X 27.16 -0.66 -2.35% SOXS DIREXION SHARES ETF TRUST DIREXION DAILY SEMICONDUCTO 24.63 +0.66 +2.75%

Nvidia’s market capitalization exceeds $3.5 trillion, and its influence on the overall market and semiconductor sector is significant. Investors looking to capture the ups and downs of a basket of semiconductor stocks may use Direxion’s Daily Semiconductor Bull and Bear 3x Stock SOXL or SOXS, Egilinsky said.

The company also expects sales of $39 billion to $40 billion this quarter, which includes technology giant Blackwell Chips.

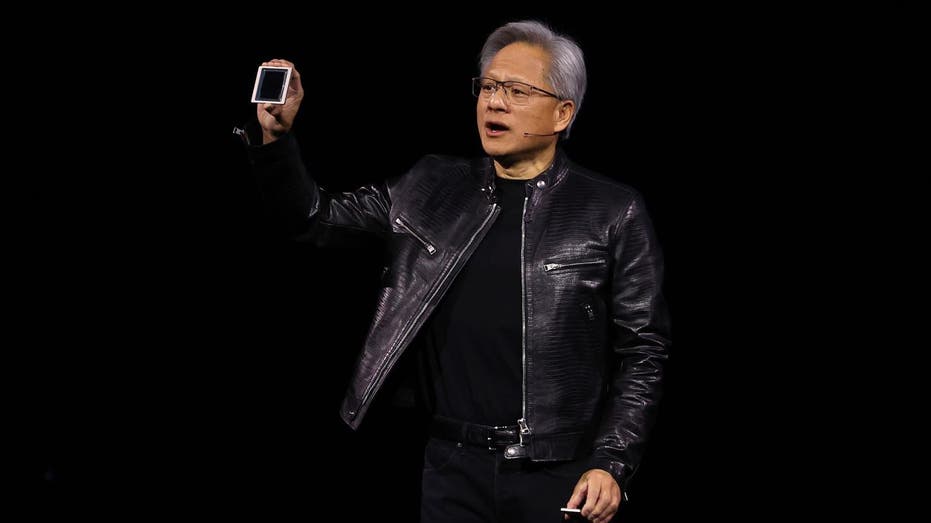

Nvidia CEO Jensen Huang delivered the keynote address at the Nvidia GTC Artificial Intelligence Conference on March 18 at the SAP Center in San Jose, California. (Justin Sullivan/Getty Images/Getty Images)

Nvidia’s chief financial officer, Colette Kress, told investors during last quarter’s earnings call about her expectations for these high-speed processing chips.

“Blackwell’s production ramp-up will begin in the fourth quarter and continue through fiscal year 2026. We expect Blackwell’s revenue to be in the billions of dollars in the fourth quarter,” Kress said.

CLICK HERE TO GET FOX BUSINESS ON THE GO

Nvidia CEO Jensen Huang speaks with FOX Business’ Liz Claman on “The Claman Countdown” Thursday at 3pm ET.