Bellweather semiconductor company Nvidia is scheduled to report earnings after the market closes on Wednesday, and all of Wall Street wants to know whether there’s still room in the AI bull market.

Founder Jensen Huang will feel the pain of not delivering a strong quarterly report, but the pressure this time is not as great as it was in August. At the time, the fate of the entire stock market seemed to depend on his every word, following the acquisition of several big-name technology companies. Businesses were disappointed. At the time, Wedbush Securities’ Dan Ives went so far as to call Nvidia’s results “the most significant technology gain in years.”

But Mr. Huang is expected to continue setting the tone for the industry, as investors eagerly seek clues about the health of the generative artificial intelligence boom. Nvidia is the primary beneficiary of this wave of investment, as it supplies roughly 9 out of 10 AI training chips to data centers.

The company’s stock has tripled since the beginning of this year, while the tech-heavy Nasdaq Composite Index has risen by only a third over the same period.

“Tomorrow, we expect another surprise from the AI Jensen godfather that will throw jet fuel into this bull market engine,” Ives wrote on Tuesday, reaffirming his basic investment thesis. did. In his view, NVIDIA’s dominant market share effectively means it’s “the only game in town,” with more than $1 trillion in capital investment expected from customers. is.

But that doesn’t mean the hurdles haven’t been raised. Especially as Nvidia continues to update its results with simple comparisons to the previous year’s quarters before the AI generation boom.

Concerns that fast-growing next-generation AI investment will level off

As the vast amounts of fresh data needed to train large-scale language models appear to be drying up, the pace of innovation may be slowing and progress in neural networks starting to plateau. There is a growing debate surrounding this question.

Yann Lecun, Chief AI Scientist at Meta and one of the first luminaries in the field, says it’s not enough just to try to scale models with more chips that are more powerful and can process more data. , warned that only a paradigm shift would occur. approach is sufficient.

“LLM *doesn’t* reach human-level intelligence,” he posted on Threads last week. “We need a new architecture.”

OpenAI’s recent pace of product launches is often cited as an example. GPT-5 has yet to make an appearance nearly two full years after its predecessor launched in early 2023. Meanwhile, initial plans to commercially deploy Sora, an AI tool that generates videos from text, by the end of the year do not seem to have been finalized yet. This is especially true now that Chief Technology Officer Mira Murati has left the company.

If Nvidia’s customers see a lower return on investment and come to a similar conclusion, they may be more cautious with future orders.

Blackwell chip overheating

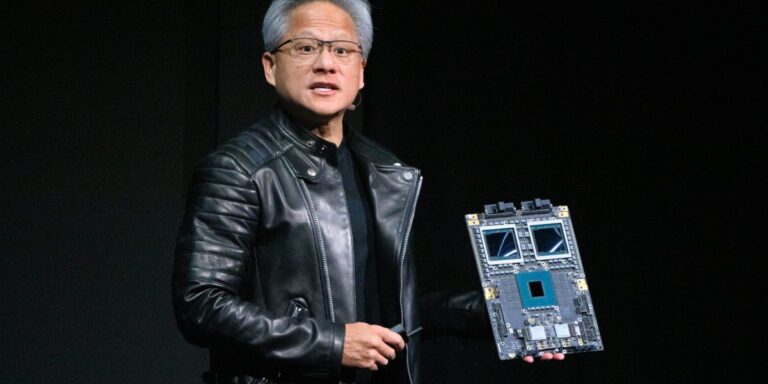

Second, NVIDIA itself is facing a lot of questions surrounding its latest generation of AI training chips called Blackwell. This is effectively two AI chips in one.

The decision to make Japan’s SoftBank, for example, Blackwell’s first customer raised a flag. A more obvious candidate was OpenAI, which received its first Hopper H200 in April. This was hand-delivered by Huang himself.

This unusual choice may be partially due to previous reports of design issues that have hindered deployment. Technology news site The Information revealed that Blackwell’s chips were overheating in server racks that had particularly high energy consumption requirements of about 120 kilowatts.

Nvidia acknowledges that this requires further adjustment for on-premises installations, and states that this is “normal and expected.”

However, analysts are not completely satisfied with this. “Investors should now add this to their list of questions,” Wells Fargo said in a research note published Sunday.

Importantly, Blackwell is not expected to impact Nvidia’s third-quarter financial results on Wednesday, but it could impact the company’s outlook.

That’s because Huang has promised that the company should already have billions of dollars in revenue in its current fourth quarter, which ends at the end of January.

Finally, another concern this time around, completely outside of Huang’s control, is the accounting issues behind Super Micro Computer, which sources Nvidia AI chips as part of its data center hardware business. be.

The company has been popular with investors since the beginning of this year, but a recent report by short seller Hindenburg Research raised fundamental questions about the company’s accounting practices. Last month, the auditor completely jumped ship. Supermicro announced Monday that it has hired BDO USA as its new auditor.

Mark Yusko, CEO and head of investments at Morgan Creek Capital, which manages $1.9 billion in assets, is managing Supermicro CEO Charles Liang’s company. He said he is nervous about Nvidia’s current valuation given the issues plaguing it.

“If they don’t have the ability to continue to be their third largest customer, what’s going to happen to their revenue growth and profit growth? We saw this in 2000 and 2001 with Nortel and Cisco.” Yusko told CNBC last week. “I’ll be a seller.”

Nearly half of Nvidia’s revenue comes from just four major customers, the company disclosed in August, creating concentration risks for chip suppliers.