Nvidia (NASDAQ:NVDA) is the name Wall Street is waiting for as the third quarter earnings season comes to a close. The semiconductor giant is scheduled to announce its October quarter (FQ3) results this Wednesday (November 20), and all eyes are on the company’s performance to see if it can maintain its impressive growth trajectory.

Don’t miss our Black Friday offers:

Rick Schaefer, a top analyst at Oppenheimer and ranked 11th among thousands of Wall Street experts, is also looking forward to strong information and guidance. “We believe continued CSP/enterprise demand for AI accelerators will lead to positive third quarter (October) results and fourth quarter (January) outlook,” Schaefer commented.

With H200 leading the way, data centers, which account for 87% of revenue, should increase 97% year-over-year and 9% sequentially. Blackwell’s gains began in the fourth quarter, and Schaefer expects “stronger increases” in the first quarter, contributing low to mid-single-digit billions of dollars in the quarter.

Networking (representing 14% of DC) is expected to grow 9% QoQ (+60% YoY) in Q3. Spectrum-X Ethernet (switches, DPUs) is “shipping in volume” and is expected to contribute “billions of dollars” in revenue within a year.

Looking ahead to 2025, our discussions with investors indicate that the buy-side is considering 5-6 million GPUs for next year. Product configuration for CY25 is expected to lean toward “drop-in” HGX modules and air-cooled NVL36 GB200 racks. These options are designed to “best fit” your current data center infrastructure while addressing the challenges of liquid cooling.

When it comes to gaming, which until recently was Nvidia’s main cash cow led by discrete PC GPUs, Schaefer expects 6% year-over-year growth and 6% growth thereafter.

Given the positive outlook, Schaefer has now raised his 2024/25/26E EPS estimates from $2.80/$3.77/$4.51 to $2.85/$4.16/$5.04, respectively.

Although the stock is up an impressive 183% year-to-date, far outpacing the SOX index’s 17% gain, Schaefer argues that Nvidia stock remains attractively priced.

“NVDA trades at 29x our CY26E, while the five-year average is 37x,” said the 5-star analyst. “With one of the best GM/OM profiles in the group, NVDA is the purest scale effort for AI proliferation. Sustained structural growth led by DC/AI as accelerator connections increase. The core of NVDA’s established DC/AI ecosystem is GenAI. We are a long-term buyer.”

So while Schaefer rates NVDA stock an Outperform (i.e. Buy), his new price target of $175 (up from $150) leaves room for a 12-month return of about 25%. I’m leaving it. (Click here to see Schaefer’s track record)

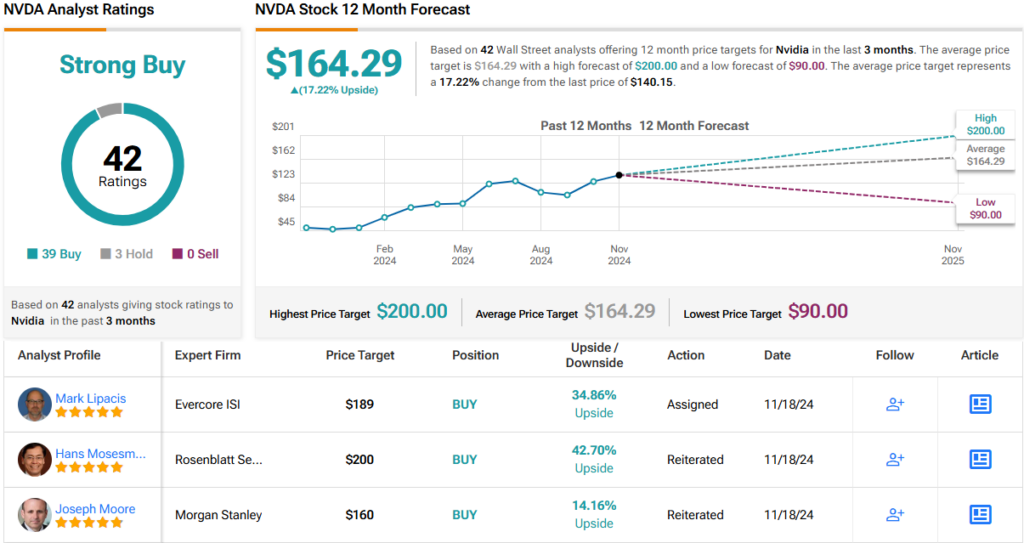

Others on the street love NVDA, too. The stock claims a consensus rating of “Strong Buy” based on 39 Buys to 3 Holds. The average price target is $164.29, implying ~17% one-year upside. (See NVDA stock valuation)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.