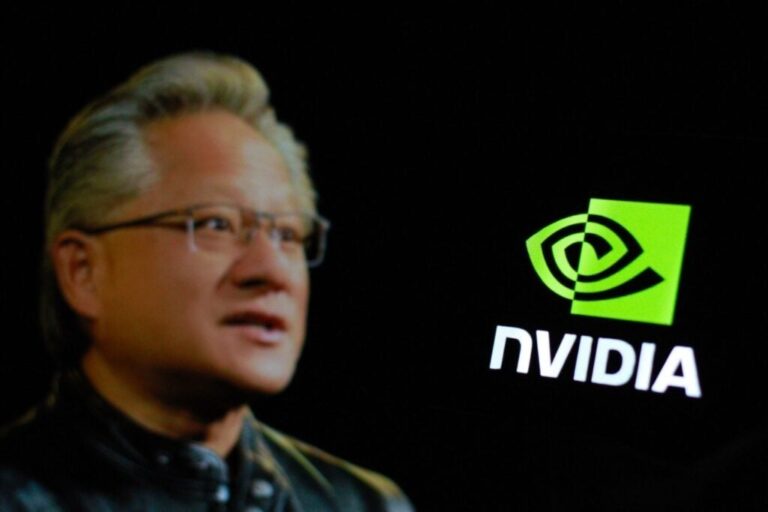

Nvidia Inc. NVDA CEO Jensen Huang said Wednesday he passed on the opportunity for SoftBank Group to take full ownership of the chipmaker, which was currently valued at $3.6 trillion at the time of its acquisition. SFTBF SFTBY Masayoshi Son offered financial support several years ago.

What happened: In a candid exchange at Nvidia’s AI Summit in Tokyo, Huang said Son told him about a decade ago that he thought the company was undervalued in the stock market at the time. , revealed that they approached him with an offer to finance a full acquisition of Nvidia.

“I now regret not bringing you up,” Mr. Hwang told Mr. Song during a public conversation. “That was a great idea.”

After discussing SoftBank’s early withdrawal from Nvidia’s investment, the conversation subsided when Son playfully pretended to cry on Huang’s shoulder. “You can cry with me,” Huang joked. “Can you imagine what would happen if you were the largest shareholder now?”

SEE ALSO: Cathie Wood profits from Rocket Lab’s 28% jump in $9 million stock sale, but expands her bet on flying cars

Why it matters: Nvidia’s impressive rise is being fueled by the artificial intelligence boom, and the company’s chips play a key role in powering AI technology. The company’s stock has soared nearly 200% this year alone, making Mr. Hwang’s net worth $128 billion, making him the 11th richest person in the world, according to the Bloomberg Billionaires Index.

The discussion preceded the announcement of a new partnership between Nvidia and SoftBank to develop Japan’s most powerful AI supercomputer, marking a significant progress in expanding Japan’s AI infrastructure.

Son, who ranks 133rd on the Bloomberg Wealth Index with a $15.9 billion fortune, has seen his wealth increase by more than $5 billion this year compared to what would have happened if SoftBank had maintained its previous investment in Nvidia. It looks inferior.

Read next:

Image via Shutterstock

Disclaimer: This content was created in part using AI tools, and reviewed and published by editors at Benzinga.

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.