Nvidia (NVDA) is expected to report third-quarter earnings next week and report 84.4% earnings growth. The company has frequently missed expectations over the past two years, and earnings season is typically the most volatile time for stock prices. If the tech giant continues to surprise, further upside is possible, but I don’t think it would be wise to buy ahead of the results. It’s like a gamble. I’m bullish on Nvidia in the long term given the positive trends in artificial intelligence (AI) and the first deliveries of Blackwell servers, but this is just my personal opinion.

What do analysts expect from Nvidia?

So what exactly are analysts predicting? Now, NVIDIA is scheduled to announce its financial results for the third quarter of 2025 after the market closes on November 20, 2024. Analysts expect normalized EPS of $0.74, GAAP EPS of $0.69 and revenue of $32.95 billion. The company has experienced multiple upward revisions to its EPS over the past 90 days, with 31 analysts raising their estimates and 6 lowering their estimates.

Based on these forecasts, Nvidia’s expected year-over-year EPS growth is an impressive 84.4%, reflecting continued strong performance in the AI chip and data center markets. The company’s earnings outlook remains positive, with analysts predicting steady EPS growth through fiscal 2026, although it will slow as the market matures.

Importantly, looking at recent history, we can expect to outperform NVDA’s performance. The company’s performance in recent quarters has been exceptional, consistently beating earnings expectations. The company’s revenue has shown impressive year-over-year growth, with triple-digit double-digit increases over the past four quarters. Additionally, Nvidia’s EPS has also consistently exceeded expectations, hitting the highest in the last seven quarters. This outperformance can also be attributed to the surge in demand for AI chips over the past two years.

Robust growth justifies NVDA’s premium valuation

Naturally, investors are willing to pay a premium to get this earnings growth, and I agree with that. The forward P/E ratio of 52.3x is significantly higher than the sector median of 25.3x, supporting this substantial premium. However, the price-to-earnings (PEG) ratio of 1.47 is more favorable, indicating that Nvidia’s valuation may be justified given its high growth rate. This PEG ratio is lower than the sector median of 1.98.

Additionally, while I acknowledge that NVIDIA may be trading relatively close to its historical fair value, I think these numbers infer that the stock has room for further expansion. . Of course, this partially depends on the company continuing to beat earnings expectations.

Focusing on EBITDA, the Santa Clara company’s forward EV/EBITDA ratio is 44.4x, which is significantly higher than the sector median of 15.5x. However, this metric is more favorable than the stock’s five-year average, which may indicate a strong relative value despite the high multiple.

Nvidia’s Blackwell accelerates potential stock price surge

Nvidia stock is up 2702% in five years, and of course AI and data center tailwinds are already priced in. But that doesn’t mean the underlying trends are undervalued. I believe there are many things that could drive NVIDIA’s stock price higher, but Blackwell is the main proponent.

The anticipated first shipments of Blackwell GPU servers have generated considerable excitement, with industry analysts citing similarities to early iPhones and their potential sales. This new platform is expected to drive significant demand as major cloud providers plan significant increases in capital spending in 2025.

According to a recent report, an AI server cabinet powered by Blackwell GPUs could cost between $2 million and $3 million and could generate more than $200 billion in annual revenue. Morgan Stanley (MS) expects Blackwell’s sales to be up to $10 billion in the fourth quarter of 2024.

Nvidia ecosystem powers Blackwell’s success

Another reason I’m bullish on Nvidia and Blackwell is their developed ecosystem. The expected success of Blackwell is due not only to its inference capabilities but also to Nvidia’s comprehensive approach that combines hardware, software and developer tools, creating a strong competitive moat that will be difficult for rivals to overcome. .

Additionally, collaborations with companies like Tesla (TSLA) and SoftBank highlight the company’s leadership. NVDA CEO Jensen Huang highlighted xAI’s ability to rapidly deploy a supercomputer cluster utilizing 100,000 H200 Blackwell GPUs in just 19 days. This reflects both the strong demand for the company’s products and the rapid growth of AI infrastructure across a variety of sectors.

Is Nvidia a good stock to buy now?

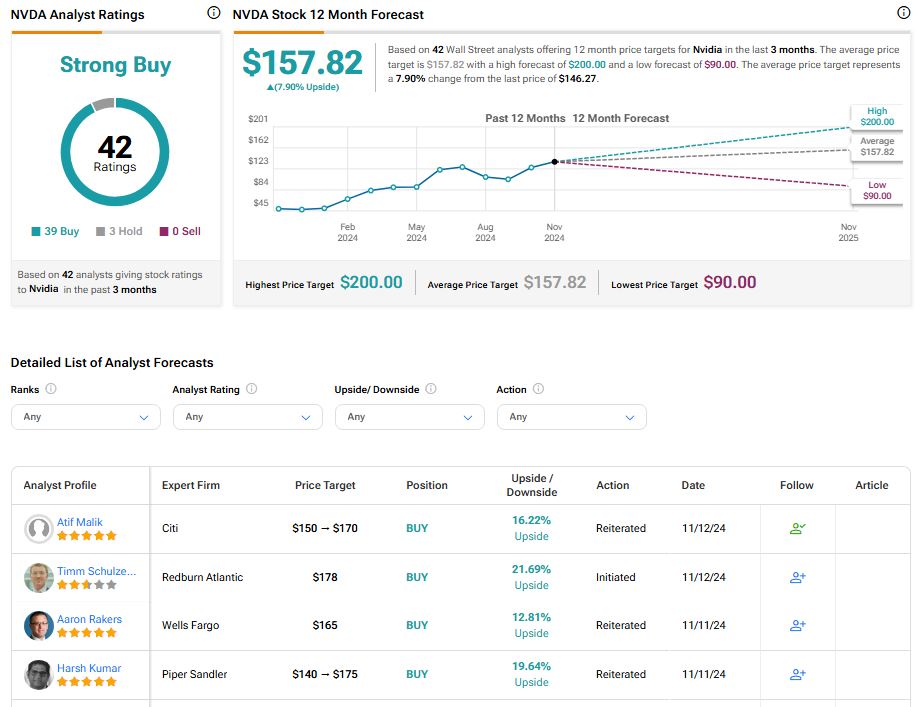

At TipRanks, NVDA is rated as a Strong Buy based on 39 Buy, 3 Hold, and 0 Sell ratings assigned by analysts over the past 3 months. NVDA’s average price target is $157.82, suggesting about 8% upside potential.

See more NVDA analyst reviews

Nvidia’s conclusion

Nvidia’s impressive growth and AI-driven momentum make it a strong long-term investment, but earnings season is often a volatile time for any stock, so it’s wise to buy before Q3 earnings. I don’t think so.

Despite this caution, I remain bullish on Nvidia’s long-term prospects, particularly the continued strength of its Blackwell GPU and AI sectors. Furthermore, over 90% of analysts rate the company’s stock as a “buy,” and investor confidence remains high.

disclosure