Refresh

Nvidia smokes the rest of the Mag 7

The most commonly used benchmark for U.S. equity performance is the S&P 500. It’s up about 23% on a price basis so far this year. The riskier and growthier Nasdaq-100 – or the 100 largest non-financial companies in the Nasdaq Composite – has gained more than 25%, while the Nasdaq Composite itself is up almost 25%.

All of these indexes are weighted by market cap, which means the stocks with the largest market values have the greatest influence on the direction of the benchmark. As some of the largest companies in the world and monopolistic AI plays, the Magnificent 7 stocks are responsible for a good chunk of the bull market’s gains, and much of its buoyant sentiment.

Just have a look at the divergence between the market-cap-weighted S&P 500 and the equal-weight version of the S&P 500 – which treats every stock, well, equally – so far this year.

(Image credit: YCharts)

Nvidia has done more than any other stock to help lift the cap-weighted gauges to record high after record high. Indeed, as of this writing, NVDA is the second most valuable publicly traded company in the world again, behind only Apple.

In order to visualize Nvidia’s outperformance relative to the other Mag 7 names that it’s so happy to call its customers, we thought it would help to put all of their stocks’ YTD price performance on a single chart.

To that end, have a look below to get a sense of which Mag 7 stocks are helping the market the most this year.

(Image credit: YCharts)

– Dan Burrows

Why are Nvidia earnings so important?

Nvidia is the most dominant stock in the equities market, driving 20% of the S&P 500’s return over the past 12 months, says BofA Securities analyst Gonzalo Asis. He adds that the chipmaker “is expected to drive nearly 25% of the S&P 500’s earnings per share growth in the third quarter.”

The analyst says that clues in the options market show us just how important Nvidia earnings are for investors. Indeed, Asis notes that options contracts are currently pricing in more broad-market risk for NVDA earnings (implied move of 1.15%) than they are for the upcoming monthly jobs (implied move of roughly 1.05%) and Consumer Price Index (implied move of around 0.9%) reports.

– Karee Venema

Related content:

Analysts race to hike NVDA price targets

Wall Street analysts are busy updating their models ahead of Nvidia’s bellwether earnings report. This isn’t unusual. If there’s something striking about these revisions, it’s how fast analysts are hiking their price targets on the Magnificent 7 stock.

According to data from S&P Global Market Intelligence, as of November 15, analysts’ average price target stood at $159 for NVDA stock. That gave shares implied upside of about 13% over the next 12 months or so.

If investors respond to the potential for 13% price upside over the next year with a “big wow,” that’s understandable. After all, NVDA stock has tripled in 2024 so far alone. The Street forecasts average annual earnings growth of 35% for the next three to five years, and yet NVDA shares change hands at just 42 times expected earnings.

Mind you, this does not begin to scratch the surface of the bull case. NVDA gets a rare consensus recommendation of Strong Buy, per S&P Global Market Intelligence. It’s one of the Street’s top S&P 500 stocks to buy.

Surely analysts who are so bullish on a stock see more than 13% upside in the next year or so.

Don’t worry; they probably will soon enough.

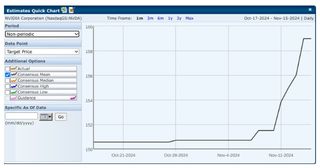

Indeed, they’re already updating their price targets at an accelerating rate. The Street’s average target price jumped 5% over the past week. Just have a look at the below chart.

(Image credit: S&P Global Market Intelligence)

Investors can expect more upward revisions to NVDA’s target price as we get closer to its earnings report. And we will certainly see a slew of updates once the NVDA print is in.

The bottom line: Take price targets with a grain of salt. Nvidia isn’t as popular as it is because it’s offering a 13% price return over the next year.

– Dan Burrows

About Elon’s xAI and Its $6 Billion Nvidia Chip Buy

According to a report from David Faber of CNBC, Elon Musk’s xAI is raising as much as $6 billion to buy 100,000 Nvidia chips.

“Sources told Faber that the funding, which should close early next week, is a combination of $5 billion expected from sovereign funds in the Middle East and $1 billion from other investors, some of whom may want to re-up their investments,” CNBC reports. The fresh raise values xAI, which Musk founded in September 2023, at $50 billion.

Bloomberg’s Ed Ludlow asks an interesting question on X, the social media platform formerly known as Twitter: “On the report that xAI is going to buy 100,000 NVDA chips… didn’t Elon Musk already say that?”

The world’s richest person did tease the transaction more than two weeks ago on X, retweeting an invitation from an insider to “Join the xAI compute team!” which itself was a retweet of ServeTheHome’s tweet touting its tour of the xAI Colossus AI Supercluster.

“Soon to become a 200k H100/H200 training cluster in a single building,” said Musk on October 28 of the facility in Memphis, Tennessee. The supercomputer is rumored to be support for Tesla’s (TSLA) Full Self Driving software.

“The money will be used to acquire 100,000 Nvidia chips, per sources familiar with the situation,” said CNBC on November 15. It seems “the money” – specifically, the $6 billion and where it’s coming from, not so much where it’s ultimately going – is indeed the story here.

Nvidia stock is down nearly 4% two hours ahead of Friday’s closing bell, giving back some of the lead it had built up recently in the global market capitalization rankings. This slump comes despite the fact that Wedbush Securities analyst Matt Bryson recently bumped his price target on NVDA from $138 to $160.

Tesla stock, meanwhile, is up nearly 3%, rising against the tide as the relationship between the electric vehicle maker’s CEO and President-elect Donald Trump appears to be paying off in particular ways, most notably around EV tax credits.

– David Dittman

Related content:

Should you buy Nvidia stock at current levels?

“To buy or not to buy?” is a question a lot of investors have about Nvidia stock ahead of the AI chipmaker’s November 20 fiscal third-quarter earnings release.

NVDA stock traded as high as $148.91 today (November 14), within 0.5% of the all-time high it hit intraday on November 8. Nvidia is the biggest company in the world based on market capitalization at $3.6 trillion, and there’s some distance developing between it and No. 2 Apple (APPL) as well as No. 3 Microsoft (MSFT).

NVDA has been defying conventional ideas about “valuation” for a while now. It’s also been defying conventional rules about big numbers, rising as rapidly as any company ever has up the market-cap ladder thanks to a steady stream of beat-and-raise quarterly reports.

Indeed, according to Anton Shilov of Tom’s Hardware, maybe you should consider yourself lucky to still have the opportunity to consider whether you should buy Nvidia at these levels.

“At Nvidia’s AI Summit in Tokyo this week,” Shilov writes, citing an original report in Fortune, “Jensen Huang, chief executive of Nvidia, and Masayoshi Son, the head of SoftBank, expressed regrets that the former did not privatize Nvidia a decade ago when the latter offered him money to do so.”

Huang and Son talked about privatization as well as a potential merger with Arm Limited, a move that was blocked by regulators in February 2022. Arm subsequently went public as Arm Holdings (ARM) in September 2023.

“Masa said, ‘Jensen, the market doesn’t understand the value of Nvidia. Your future is incredible,'” said Huang. “‘Your journey of suffering will continue for some time, so let me give you the money to buy Nvidia.’ He wanted to lend me money to buy Nvidia, all of it. Now I regret not taking it.”

So, “to buy or not to buy” Nvidia at $149…

– David Dittman

Wedbush girds for another beat-and-raise quarter

Nvidia heads into its November 20 earnings release as one of Wall Street’s top S&P 500 stocks to buy. On Thursday, Wedbush Securities analyst Matt Bryson helped explain why.

Bryson, who rates NVDA at Outperform (the equivalent of Buy), writes in a new note to clients that the pace-setting chipmaker has forced him to confront an age-old tongue twister: “How much sales acceleration can an accelerator accelerate if an accelerator can accelerate sales?”

What does that mean? Stocks move on surprises, be they to the upside or the downside. NVDA stock has tripled on a price basis over the past 52 weeks in part because it consistently delivers upside surprises on its top line. (Note that NVDA stock is also much more volatile than the broader market, but let’s not get into that right now.)

Will NVDA stock pop on its earnings report? That depends partly on delivering beat-and-raise revenue figures.

So, what’s the outlook for that, in Bryson’s view?

“NVDA has been consistent in delivering a revenue beat of approximately $2 billion, while guiding for $2 billion-plus in growth the past few quarters,” the analyst says. “We believe NVDA will likely at least modestly exceed the pattern of ‘just’ beating forecasts by approximately $2 billion, as we anticipate strength in Q3 AI spend by hyperscale customers, as well as continued solid growth at non-hyperscale accounts will boost FQ3 sales.”

There’s a lot more to it than that, but the bottom line is Bryson lifted his target price to $160, giving NVDA stock implied upside of 10% from current levels. For context, according to S&P Global Market Intelligence, the Street’s average price target stands at just $158.

If this member of the Magnificent 7 prints a big enough beat-and-raise on the top line, you can bet a lot of those NVDA price targets will be revised upwards.

– Dan Burrows

Will the Supreme Court allow a class action lawsuit against Nvidia to proceed?

Nvidia’s earnings announcement on November 20 is (probably) the Next Big Thing for stocks, investors and hardcore artificial intelligence nerds. (We’ll see whether Federal Reserve Chair Jerome Powell breaks stride this afternoon…)

Tech generally has been underperforming the broader market in recent months, but the AI story is still driving up share prices across sectors. And Nvidia’s hardware is supporting a lot of the buildout and the efficiencies end-users plan/hope to realize.

Making new high after new high, NVDA stock continues to reflect almost unanimous support among market participants as well as AI utilitarians.

It’s another kind of thing to appear before the U.S. Supreme Court, though, which is where lawyers for Jensen Huang’s juggernaut found themselves on Wednesday.

As Ronald Mann of ScotusBlog explains, a group of Nvidia shareholders has filed a proposed class action lawsuit under the 1995 Private Securities Litigation Reform Act alleging the company and key executives “made false and misleading statements about the extent to which use in crypto mining was propping up Nvidia’s chip sales.”

Following oral arguments on Wednesday, “The Supreme Court seemed inclined on Wednesday to allow a lawsuit accusing Nvidia, the giant maker of computer chips, of misrepresenting its reliance on the cryptocurrency mining industry in 2017 and 2018,” observes Adam Liptak of The New York Times.

And yet Nvidia still enjoys broader tailwinds: The 1995 law imposes a difficult burden on plaintiffs.

“The shareholders have a hard time showing that Huang spoke falsely when he made statements downplaying the share of NVIDIA chip sales attributable to crypto mining,” Mann writes. “The shareholders do not have any documents or statements that directly show any reason to think Huang knew what share of sales were made to crypto miners.”

NVDA stock was up nearly 1% an hour after Thursday’s opening bell, even as the three major equity indexes were in the red.

– David Dittman

David Dittman

Investing editor, Kiplinger.com

I am the former managing editor and chief investment strategist of Utility Forecaster and the former editorial director of Investing Daily, Charles Street Research, and Weiss Ratings. I am also a former stockbroker and have been working in financial media for more than 20 years.

This will mark Nvidia’s first time reporting as a Dow Jones constituent, with the semiconductor stock joining the 30-stock index back on November 8.

NVDA shares are well known for their post-earnings volatility, which could have an impact on the price-weighted Dow. Most recently, the stock sank more than 6% in August after its fiscal Q2 results and jumped 9% in May following its fiscal Q1 report.

However, as Dan Burrows, senior investing writer at Kiplinger.com, explains in his feature, “Nvidia Stock Is Joining the Dow. Is It Time to Buy?,” NVDA and its $3.6 trillion market valuation will likely have a larger impact on the cap-weighted S&P 500 and Nasdaq Composite.

Indeed, based on its current share price of roughly $150, “NVDA stock will be as important to the DJIA as, roughly, 3M (MMM),” he writes.

– Karee Venema

Increased AI spending will continue to benefit Nvidia, says UBS

UBS Global Research analyst Timothy Arcuri lifted his price target on Nvidia on November 10, to $185 from $150 – representing implied upside of more than 25% to current levels.

Arcuri expects the chipmaker to report strong results and guidance this time around, though he anticipates a decline in gross margin, to 73% from 75.1% in Q2.

The analyst believes that capital expenditures from large-scale data centers will continue to improve and he expects the gap between incremental hyperscaler spending and Nvidia’s incremental data center revenue to close over the next 12 months.

“On top of this, sovereign AI represents a major demand vector for NVDA (already worth more than $10 billion in calendar year 2024) with each of the large sovereigns (particularly in the Middle East) looking to us like their spending could approach that of a big U.S. hyperscaler over the next few years,” Arcuri adds. India, for one, unveiled a $1.2 billion budget for AI projects in March.

– Karee Venema

Karee Venema

Senior investing editor, Kiplinger.com

I am the senior investing editor at Kiplinger.com, having joined the publication in April 2021. I have over a decade of experience writing about the stock market and have covered corporate earnings reports and stock reactions over that time frame. In addition to weekly updates of the Kiplinger Earnings Calendar, I oversee a wide range of investing coverage, including content focused on equities, fixed income, mutual funds, exchange-traded funds (ETFs), commodities, currencies, macroeconomics and more.

Related content: