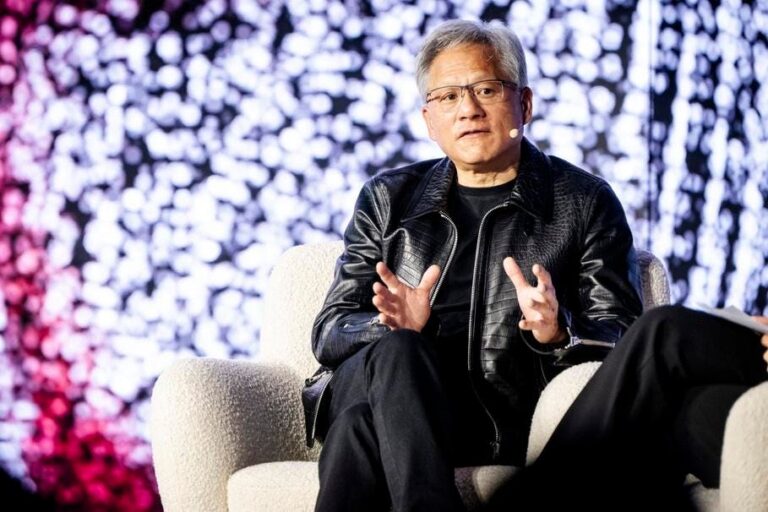

Nvidia CEO Jensen Huang speaks at Wilhelm supercomputer Gefion launch … (+)

Litzau Scanpics/AFP (via Getty Images)

Over the past three years, NVIDIA stock alone has created more value than the combined market capitalization of 250 S&P 500 companies. Let’s talk about 1%, specifically $3 trillion. But everyone knows that. The bigger question is: What’s next? Should you buy, sell, or hold Nvidia right now? Or should you look to other options like Intuitive Surgical, a robotic surgery company poised to revolutionize the medical field? It has the potential to increase ISRG’s stock price by 10x.

In our recent analysis, we argued for a variety of outcomes, including a path to $300 for Nvidia and a counterweight downside of $40 for Nvidia.

Nvidia stock history so far

NVDA’s stock price has increased more than 10 times from the $13 level in early January 2021 to around $140 now. In contrast, the S&P 500 index has risen by about 50% over the past four years. It was a turbulent situation, with the price-to-earnings ratio in 2021 being 125%, -50% in 2022, and 239% in 2023. The underperformance of NVDA stock and the S&P 500 in 2022 is particularly striking as a benchmark index. The return that year was -19%. Notably, Trefis’ High Quality Portfolio of 30 stocks has outperformed the S&P 500 every year over the same period. why is that? As a group, Headquarters portfolio stocks carried less risk and delivered better returns compared to the benchmark index. It’s not been a roller coaster ride, as evidenced by the performance metrics of our corporate portfolio.

Well, below are the facts and specific thoughts on how you should think about Nvidia in your portfolio.

3 undeniable facts about Nvidia

Nvidia is an arms supplier and the AI war is being waged against AI. AI is not just an input, it is a strategic input. Companies from apparel to the energy sector to pharmaceutical giants don’t just need it as a hygiene element, they need it to stay competitive. meaning? These Nvidia customers can’t afford to be price sensitive. Heady’s growth involves great fluctuations. Bubbles always contain water, or a nucleus, and air. Watching Nvidia fluctuate in your portfolio won’t be smooth

So what should I do?

Answer: Add Nvidia to your portfolio with an amount that allows you to take a 50% loss at any time along the way while assuming a 5x return in the long run. Yes, be willing to endure the short-term pain, the price you pay, for the long-term reward. This sounds easy in theory, but it’s far from easy in practice.

Below, we will explain the advantages and disadvantages in detail.

First of all, the bad thing is

The problem is that competition is increasing. AMD is not sitting idle. The company is doubling down on AI-focused GPUs, and claims its new Instinct MI300X chip outperforms Nvidia’s chip in several areas. Intel has also emerged as a competitor, gaining momentum with its low-cost AI chips. Additionally, major technology companies like Google, one of Nvidia’s biggest customers, are developing their own AI and machine learning silicon. With these rivals, Nvidia’s rapid revenue growth and Nvidia’s unusually high cash flow margins (more than 50% in recent quarters) may not be sustainable.

The underlying economics of the AI GPU market remain weak, and most of Nvidia’s customers remain unprofitable. why is that? Large language models are expensive to build and train, and can take a long time to become effective. VC firm Sequoia estimates that the AI industry spent $50 billion on Nvidia chips last year, and could exceed $100 billion when other costs are included. However, these investments have only generated about $3 billion in revenue, and few services other than ChatGPT have a large paying user base. We are probably in the “FOMO phase” of AI, where companies feel they have to invest in AI just because they have competitors. As shareholders seek higher returns, capital spending could cool, impacting companies like Nvidia.

Apart from this, large-scale AI adoption follows two stages. The first is a compute-intensive training phase. In this phase, AI models are built from large datasets, using GPUs to process data and tune model parameters. The second stage is the deployment stage. At this stage, the trained model is run in a real-world application, which typically requires less processing power, allowing companies to use less expensive hardware to run models in their day-to-day operations. The AI revolution only started about two years ago, and most companies are in the training phase, with demand likely to ease as they move toward low-power inference.

good and great

Nvidia has a head start in the AI market. And we have the foresight to not miss the first-mover advantage. The company has built a comprehensive ecosystem around its AI processors, including programming languages and software, allowing its products to lock in customers as they expand their AI investments. Nvidia’s extensive software stack, including CUDA, cuDNN, and TensorRT, not only improves performance but also simplifies AI development, making it increasingly difficult and costly for enterprises to switch to alternative platforms. Look at it this way. As companies deploy their AI initiatives, they spend time and resources training, tuning AI models, and integrating these tools into broader IT systems and workflows. This makes transitioning to a competitor more difficult and costly. This ecosystem could help protect Nvidia’s profits and could also boost software-related sales in the long run.

While early AI models introduced by OpenAI and others in 2022 were primarily text-based, models are becoming increasingly multimodal, capable of processing audio, images, video, and 3D content, and are Computing power and more GPU shipments are in demand. . Additionally, unlike a decade or so ago, when advances in computing power, especially processors, outpaced the development software that could take full advantage of these capabilities, in the AI era, machine learning’s demanding computational requirements demand is rapidly increasing. model. This trend is likely to continue strong demand for Nvidia.

Changes in U.S. monetary policy could also give Nvidia further momentum. The Fed’s 50 basis point cut, the first in nearly four years, brings the federal funds rate to 4.75% to 5%, leaving room for further cuts. Lower interest rates boost growth sectors such as high-tech by increasing the present value of future earnings. Lower interest rates are especially beneficial for Nvidia. why? Lower interest rates would reduce financing costs for large data center builders, potentially increasing capital spending in the sector and helping companies like Nvidia that sell GPUs for servers. . Additionally, the economics of the AI revolution remain complex given the high costs of model training and inference. Lower interest rates could improve the financial viability of these investments. See our analysis on other ways to profit from the Fed’s next move?

NVDA returns compared to Trefis enhanced portfolio

Trefis

Invest with a portfolio that outperforms the Trefis Market

View all price quotes for Trefis