Nvidia’s (NASDAQ:NVDA) meteoric rise to the top of both the stock market and the technology zeitgeist has been swift and ferocious. As a leading AI chip manufacturer, the company is playing a pivotal role in driving the AI revolution, and its key customers include some of the world’s top technology companies.

Since announcing ChatGPT in November 2022, Nvidia has demonstrated its dominance by delivering much better-than-expected earnings reports and consistently optimistic future forecasts.

Nvidia’s stock price soared 172% in 2024 alone, with CEO Jensen Huang fueling investor enthusiasm by highlighting “extraordinary demand” for Blackwell GPUs.

But this begs the question: How long can NVIDIA continue down this difficult path? For one top investor known by the pseudonym The Value Portfolio, past is not prologue when it comes to NVIDIA.

“NVIDIA needs strong growth to justify its valuation, and Blackwell can’t deliver that forever,” says the investor, who ranks in the top 1% of all equity pros on TipRanks. I am writing.

While acknowledging Nvidia’s incredible track record, the Value Portfolio does not envision any scenario in which Nvidia can reproduce the performance needed to justify a purchase at current prices.

“NVIDIA’s valuation requires it to double its growth over the past five years over the next eight years to match the returns of the S&P 500, creating a high growth hurdle,” the investor said. do.

The Value Portfolio cites several more reasons for doubt, including the small concentration of megascale companies that account for the majority of NVIDIA’s profits.

“If you have five customers driving your business and you need four times the revenue to justify your valuation and match the S&P 500, unless a new mega-cap tech company comes along with the same view, , those customers would have to order four times as much,” the investor explained.

Additionally, some of these megascalers are looking to build their own GPUs rather than being content with supporting Nvidia’s 75% margin, which significantly increases Nvidia’s pricing power. may decrease.

Adding to these concerns, the investor echoed a recent warning from Goldman Sachs that tempered its previously bullish forecast by pointing to doubts about the returns on AI investments.

As customers’ technology catches up and they realize that revenues are lower than expected, NVIDIA will suffer as well, making it a poor investment,” said Value, who rates NVIDIA stock as a sell. Portfolio concludes. (To see the Value Portfolio track record, click here)

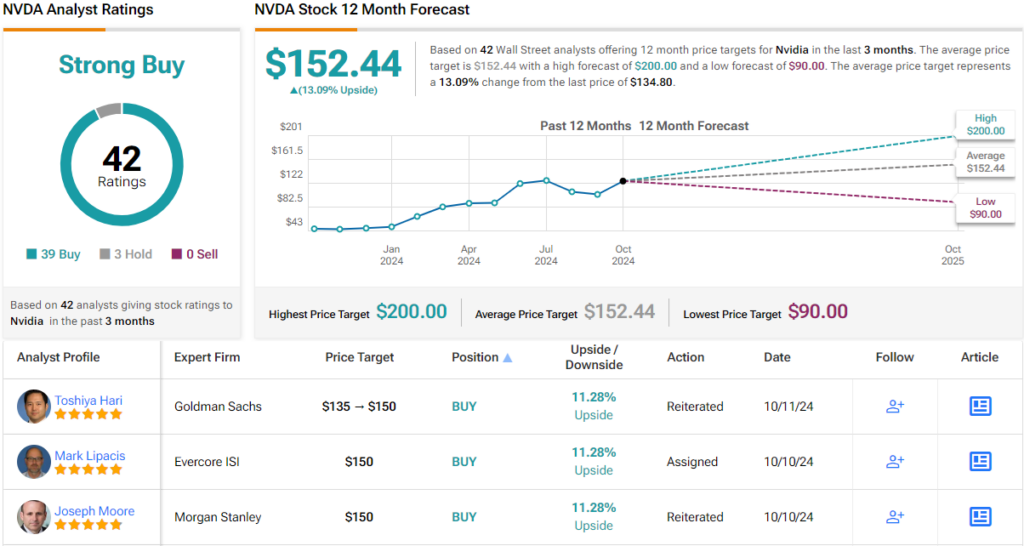

Despite this skepticism, value portfolios remain an outlier. The Wall Street consensus on Nvidia is overwhelmingly bullish, with a Strong Buy rating based on 39 Buy recommendations and just 3 Holds. The average 12-month price target is $152.44, suggesting 13% upside potential. (See NVDA stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.