Top Wall Street analysts are praising Nvidia (NVDA) stock as the stock trades at an all-time high of $135 on a split-adjusted basis.

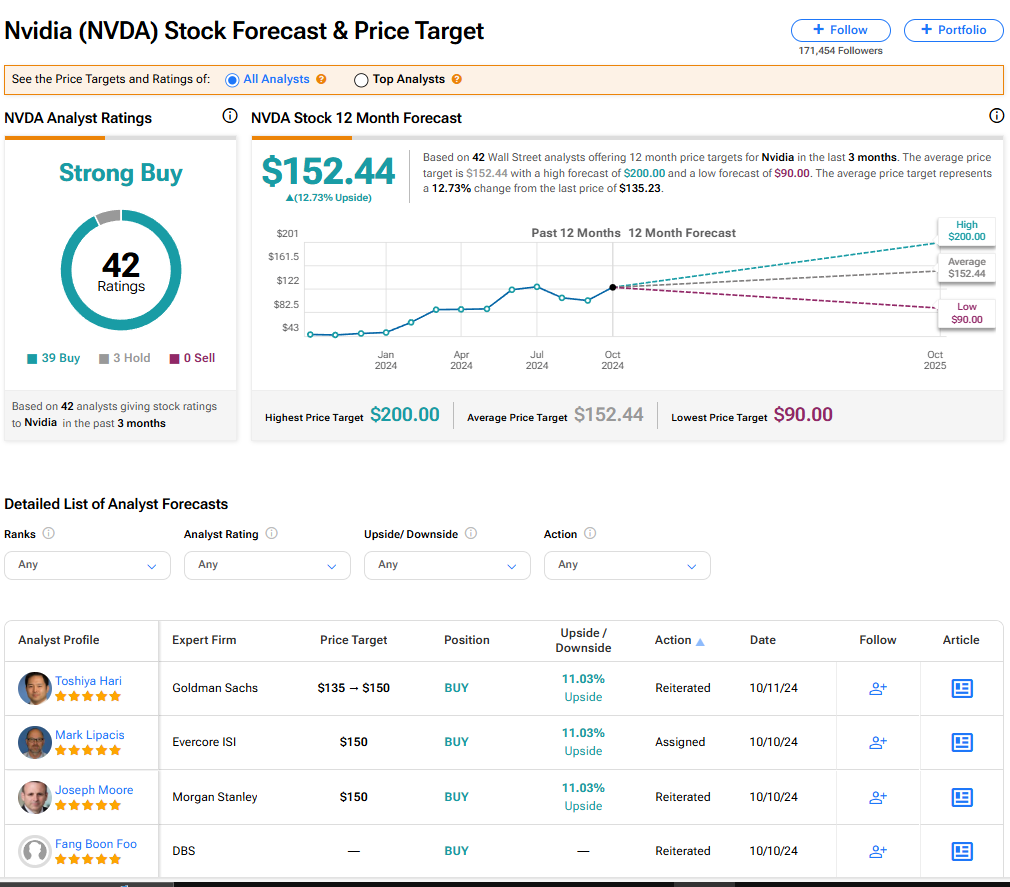

Toshiya Hari, a well-respected analyst at investment bank Goldman Sachs (GS), raised his price target for Nvidia stock from $135 to $150 and reiterated his rating on the stock as a “buy.” In a note to clients, Hari said he had a newfound appreciation for the chipmaker’s competitiveness after recently meeting with Nvidia CEO Jensen Huang.

Fellow Wall Street investment bank Morgan Stanley (MS) recently met with Mr. Huang and senior Nvidia executives and was similarly impressed by what they heard. Morgan Stanley analyst Joseph Moore called Nvidia a “top pick” and reiterated his buy rating and price target of $150 per share.

“Our view continues to be that NVIDIA is likely to actually gain AI processor share in 2025… Everything we’ve heard this week suggests that ),” he wrote.

High hopes for new Nvidia chips

Nvidia CEO Huang met with top Wall Street analysts ahead of the market launch of the company’s latest Blackwell microchip product line. These are Nvidia’s most powerful artificial intelligence (AI) processors to date, and expectations for them are sky-high. Morgan Stanley’s Moore said he expects Nvidia to generate “billions in revenue from Blackwell in the January quarter.”

High expectations and positive analyst notes led to a rise in NVDA stock. Since September 6th, the company’s stock has increased 32%, including a 6% increase over the past week. At $135.10 per share, Nvidia stock is currently trading near its all-time high. The company split its shares into 10-for-1 shares in June of this year.

Is NVDA stock a buy?

Nvidia stock has a consensus rating of “Strong Buy” among 42 Wall Street analysts. This rating is based on 39 buy recommendations and 3 hold recommendations made over the past three months. This stock does not have a sell rating. NVDA’s average price target of $152.44 implies an upside of 12.73% from the levels the stock is currently trading at.

Read more about analyst price targets for NVDA stock