Chip stocks have been in the spotlight for a while now, and that’s not surprising given how important the sector is to the biggest trend right now: AI.

However, not all semiconductor stocks have enjoyed the AI-driven bull market, with some stocks overwhelming the market as a whole and others lagging far behind.

On the other hand, the current state of the industry also shows that not all companies are thriving to the same degree. That’s the conclusion reached by KeyBanc’s John Bing, an analyst ranked in the top 2% of street stock experts, who said, “Quarterly supply chain survey results were mixed.” There is.

As such, Vin is reevaluating the outlook for several companies operating in this space, including industry giants Nvidia (NASDAQ: NVDA) and Intel (NASDAQ: INTC), with one far better than the other. I decided that it would provide an opportunity.

Vinh’s insights can help you better understand how both are currently positioned. To add more color, we also opened the TipRanks database to see if other Street analysts have a similar view. Let’s dive in.

Nvidia

No current conversation about the state of the chip industry would be complete without mentioning Nvidia. The company was a well-known GPU manufacturer primarily aimed at the gaming market, so it was hardly a minnow until the AI opportunity presented itself. But a new AI-driven paradigm has lifted the company to the fringes of the world’s most valuable companies. In fact, aside from Apple, Nvidia’s market capitalization of $3.25 trillion is the largest in the world.

Although its products are based on innovative design and rigorous scientific development, by contrast, it’s pretty easy to explain why Nvidia has risen to the top. In other words, the company simply makes the best AI chips on the market, with around 80% share of the market.

Initially, the Street was shocked by the great strides the company had made on the back of a surge in demand for its products, but now it has become almost mandatory to hold a good exhibition every quarter.

The latest report on FQ2 was no different. Revenues rose 122.4% year over year to $30.04 billion, beating TheStreet’s forecast by $1.31 billion. On the other end of the equation, adj. EPS beat consensus by $0.04 at $0.68. And going forward, third-quarter sales are expected to reach $32.5 billion, plus or minus 2%, above the $31.75 billion expected by analysts.

If the company’s performance is impeccable, recent production delays for the company’s new Blackwell GPU architecture are bitter news and troubling concerns for investors.

However, after the recent check, KeyBanc’s John Vinh struck a positive tone and believes there are several reasons to support NVIDIA. Among them are: (January) contributes more than $7 billion in revenue. 2) Despite Blackwell’s increase in Q4, hopper (H100/H200) demand remains very strong, with F4Q hopper revenue expected to increase ~15% QoQ. 3) GB200 configurations will remain 60-70% of NVL72 in 2025, and data center revenue in 2025 is expected to exceed $200 billion. ”

“We believe NVDA remains uniquely positioned within the industry to benefit from long-term data center growth in AI/ML,” the 5-star analyst continued. “We believe the competitive risk is limited because the company’s CUDA software stack creates a significant barrier to entry, and we believe that NVDA will continue to support one of the fastest growing workloads in the cloud and enterprise. We expect them to continue to dominate.”

These comments support Bin’s Overweight (i.e. Buy) rating, and his $180 price target reflects approximately 36% one-year growth. (Click here to see Vinh’s track record)

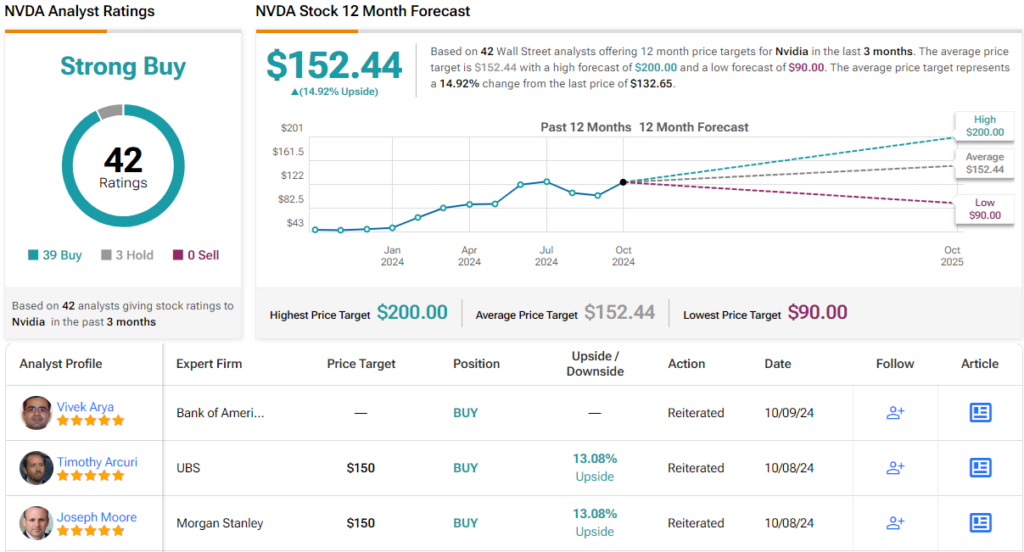

This is a controversial move on Wall Street, given that 39 other analysts joined his bulls, outperforming 3 Holds and all reaching a consensus rating of Strong Buy. It’s not the way you look at it. The average price target is $152.44, representing a 12-month return of approximately 15%. (See NVIDIA stock price forecast)

intel

And now I’m thinking about something completely different. So we’ll still be in the realm of chip stocks, but while Nvidia’s story is a triumphant one, Intel’s is a bit of a sad one, at least for now.

Things have gone rather pear-shaped for the struggling semiconductor giant, largely because the company has shot itself in the foot. Product delays due to manufacturing issues have led to a decline in market share, mismanagement and lack of innovation have caused the company to lose an edge over rivals, and Intel is also in a bad position in the AI chip market.

The company is now looking to pivot and once again become a force to be reckoned with in the industry, but the task at hand looks quite daunting, as evidenced by its second-quarter earnings release.

The company had revenue of $12.83 billion in the quarter, down 0.9% from a year ago and missing forecasters’ expectations by $150 million. In the bottom line, adjectives. EPS of $0.02 also missed estimates by $0.08.

That was bad enough, but third-quarter revenue is expected to be in the range of $12.5 billion to $13.5 billion, well short of the $14.39 billion that analysts had expected, and the outlook is also dire. It was.

If this amounts to Intel’s warning that things won’t get better anytime soon, Vin’s latest industry assessment appears to confirm that prediction is to the downside.

“Findings from Asia are negative,” the analyst said. “Results include: 1) Supply Chain and Latest Cloud Tracker results show INTC is losing significant market share in servers to AMD as Genoa instances increased by over 200% month over month; September; 2) Intel currently has a high market share in NVDA HGX-based AI servers, so the launch of Blackwell in 2025, especially GB200, will be a headwind for INTC. 3) Since Lunar Lake is a premium solution, the lack of cost-cutting AI CPUs targeting mass-market AI PCs may cause INTC to lose market share next year. 4) Feedback on INTC’s AI chip Gaudi 3. It has been disappointing and there is little demand or interest from customers.”

Quantifying his stance, Bin values INTC stock’s sector weight (i.e., neutral) at a fair value of $22, which is 5% lower than its current trading price.

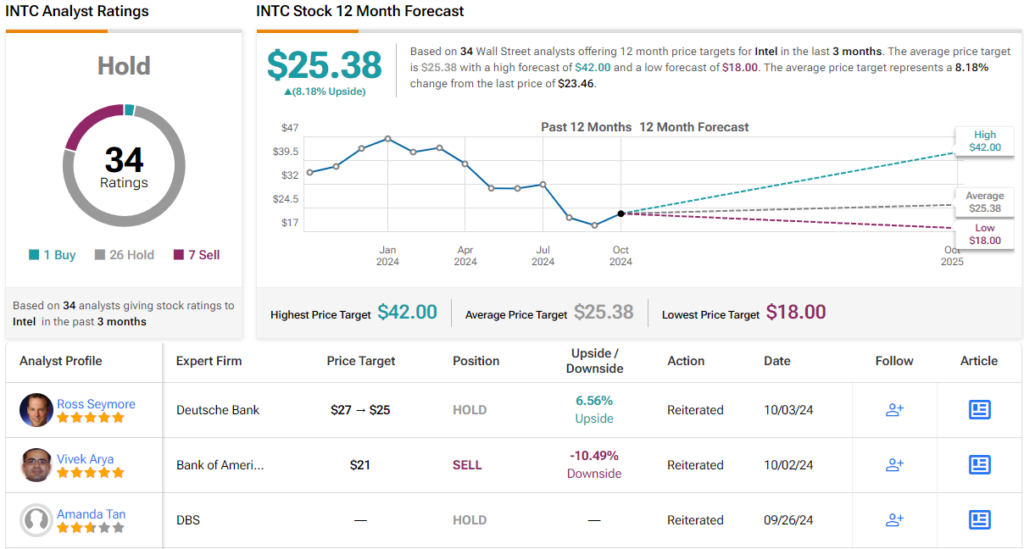

Most of Vinh’s colleagues believe his position is correct. The stock asserts a Hold consensus rating based on a combination of 26 Holds, 7 Sells, and 1 Solitary Buy. The average price target is $25.38, suggesting a potential return of 9% over the next year. (See INTC stock price forecast)

Top-class analyst John Bin’s judgment is clear. A great semiconductor stock to buy right now is Nvidia.

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.