top line

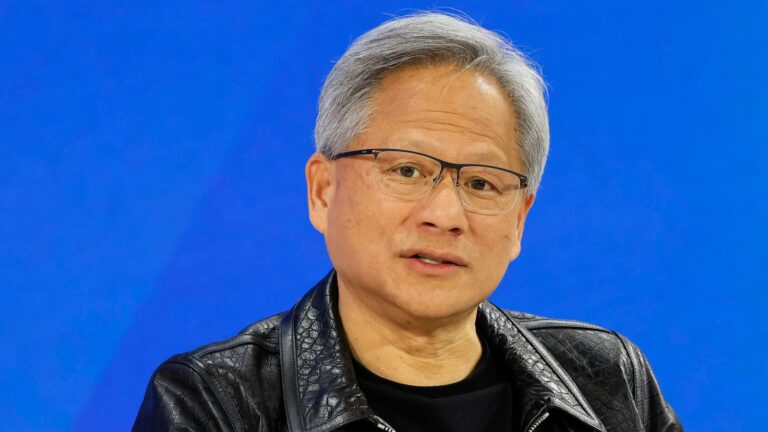

Jensen Huang’s net worth ballooned by more than $4 billion after Nvidia stock closed lower on Tuesday. Daily gains for the chipmaker, which recently became the world’s second-largest company, are adding to the fortunes of its chief executive.

The chipmaker’s chief executive recently completed the sale of millions of shares of the company’s stock.

Getty Images

important facts

NVIDIA stock rose more than 4% to close at $132.89, the company’s highest closing price since July 9 at $134.91.

Huang is NVIDIA’s largest shareholder with 75.4 million shares and an additional 786 million held through various trusts and partnerships, the company said in a regulatory filing last month. rose to $114.4 billion from $109.9 billion on Tuesday.

Nvidia’s stock price rose nearly 12% in October, a rise that added about $12.1 billion to Huang’s fortune.

Get Text Alerts for Forbes Breaking News: Start text message alerts to stay informed of the biggest stories shaping the day’s headlines. Send an “Alert” to (201) 335-0739 or sign up here.

big number

713 million dollars. That’s the value of the Nvidia stock Huang sold between June 14 and September 12, according to a recent Securities and Exchange Commission filing. The company previously revealed that Hwang planned to sell up to 6 million shares by March 31, 2025, a milestone he reached almost six months early.

forbes rating

Mr. Huang, 61, is the 11th richest person in the world with an estimated net worth of $116.2 billion, according to Forbes magazine’s Real-Time Rich List. Hwang’s wealth has increased by about $102 billion since 2019, when he was ranked 546th on the richest list.

Main background

With a market value of $3.2 trillion, Nvidia is the world’s second-largest company, behind Apple, which is valued at $3.4 trillion. Huang, who has served as CEO and president of NVIDIA since co-founding it in 1993, recently suggested that demand for the company’s AI products is “huge” and “insane.” . Nvidia, a company that designs custom AI technology for high-end applications, was once the world’s largest company, with its stock peaking at $140.76 in June, before falling to just over $102 in September.

Read more