Taiwan Semiconductor Manufacturing Company (TSM) (TSMC) has been profitable throughout the year thanks to strong demand for NVDA products. With shares up nearly 77% year-to-date, this cheap high-flyer still has plenty of room to run.

Taiwan Semiconductor is a semiconductor contract manufacturing and design company and one of the largest players in the global foundry market. Companies such as Nvidia, Advanced Micro Devices (AMD), and Apple (AAPL) outsource chip manufacturing to Taiwan Semiconductor.

Despite the large rally in TSMC stock, I am bullish on TSMC stock due to its wide open moat, future growth prospects, and current valuation.

Taiwan Semiconductor is the best in the industry

I’m bullish on the stock mainly because Taiwan Semiconductor has a huge outer moat. This is the best in the industry. Don’t take that away from me. Let’s borrow the words of legendary value investor Warren Buffett, who coined the term “economic moat.” At Berkshire’s 2023 Annual Meeting, Buffett said, and I quote, “Taiwan Semiconductor is one of the most well-managed and important companies in the world…and their rival in the chip industry.” There are no companies that do.”

As a result, this wide moat has allowed TSMC to dramatically gain market share over the past decade. The company’s revenue has increased 14.3% on a TTM basis over the past 10 years, from $24 billion to $70.5 billion. According to Counterpoint Research, TSMC commands 62% market share of the global foundry market as of Q2 2024. Given the use cases for generative AI, we don’t expect TSMC to become irrelevant anytime soon.

Moreover, if TSMC can maintain this market share over the next 10 years, its sales could expand significantly. Credence Research estimates that the global foundry market will be worth $124.3 billion in 2023 and is expected to reach $172.4 billion by 2032. If TSMC’s market share remains stable at 60%, as it has for the past seven quarters, the company’s revenue could exceed $100 by 2032. Billion.

TSM has a lot of promise

I like to consider companies based on several criteria, one of which is whether there is a multi-year growth opportunity, and TSMC has that. AI only became popular two years ago, and we must recognize that this technology is a key enabler of many structural changes that are yet to be identified. What is clear is that semiconductor companies are racing to develop powerful processors that will enable machines to improve human life, and TSMC is their go-to manufacturer.

Additionally, TSMC, like ASML (ASML), is on the cusp of a cyclical upturn in the semiconductor industry, also at an inflection point. TSMC’s just-released August sales figures show a 33% year-over-year increase in consolidated revenue, which shows just how important it is to the industry right now. The world is so focused on LLM right now that it’s not even considering the role TSMC’s chips could play in autonomous driving, gene editing, cancer detection, and many other use cases.

Furthermore, I would like to point out that TSMC is highly profitable and has room for further expansion of profit margins. The company’s TTM operating margin currently stands at 42%, down from around 50% in 2022. With unit economics improving and customers earning higher profits, I believe TSMC can increase prices and expand margins. Analysts at Morgan Stanley (MS) predict that the company’s gross profit margin will rise to 60% between 2028 and 2030 (from the current TTM gross profit margin of 53.3%) as production increases at overseas factories. I’m predicting.

TSM stock is still cheap

Finally, I believe TSMC is one of the best ideas right now because of its cheap valuation. The company trades like a former growth company, trading at a forward P/E of 20 times. This is not expensive for a company that is currently a key player in achieving almost all high growth. Wall Street analysts expect profits to rise 27% this year and a similar increase next year. I don’t like to predict the future too much, but I don’t see TSMC having a hard time sustaining double-digit profit growth over the next few years.

Furthermore, TSMC’s current market capitalization is $784 billion, indicating that investors expect TSMC to earn $37 billion annually. Considering the company’s TTM net income is around $30 billion, it’s hard to see how this number can’t be achieved. If it generates these profits while the industry is in recovery mode, it should generate significantly larger profits once business starts booming again.

Analyst views on TSM stock

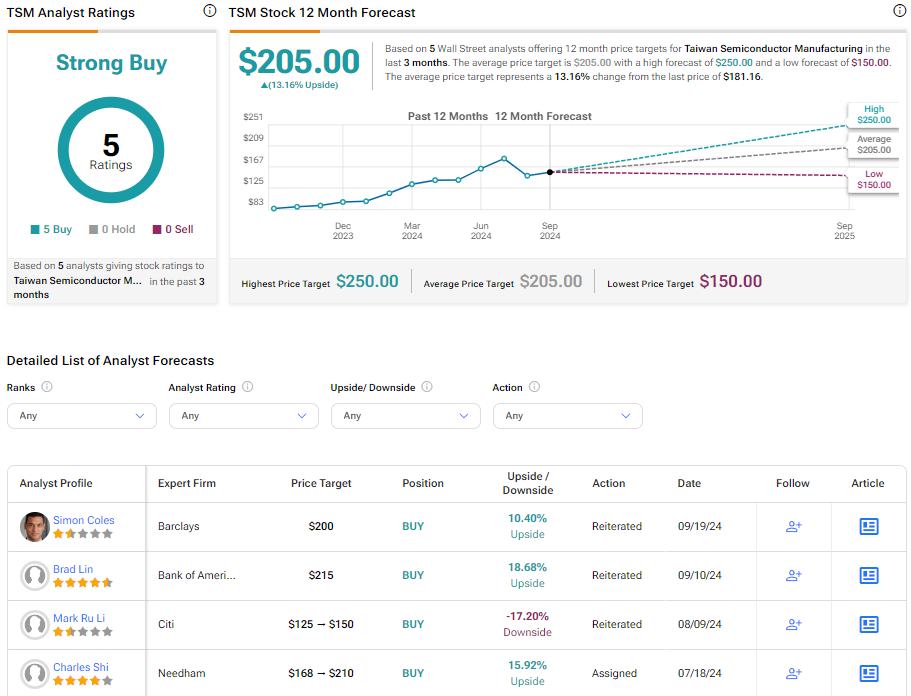

On the Street, TSM stock has a consensus rating of Strong Buy, based on 5 unanimous buy recommendations. The average price target of $205 represents an upside of 13.16% from current levels.

See more TSM analyst reviews

conclusion

As chip companies like Nvidia race to push cutting-edge GPUs to market to power many AI use cases, TSMC is well-positioned to soar higher. The company is a main player in the AI investment trend and has a lot of room for profit growth thanks to its huge moat. As AI evolves beyond LLM and its applications in autonomous driving and healthcare gain traction, TSMC’s potential has yet to be fully explored. So TSMC is not a deal, it’s a name we own for the long term, and it’s currently on sale.

disclosure

Disclaimer