Nvidia executives and directors have sold about 11 million shares this year, totaling more than $1.8 billion. According to Bloomberg, this is the largest stock sale by a corporate executive in recent history, after adjusting for stock splits. Although this amount represents less than 0.045% of the company’s impressive total stock value, this news could put some downward pressure on Nvidia’s stock price, especially due to the delay of the Blackwell B200 GPU.

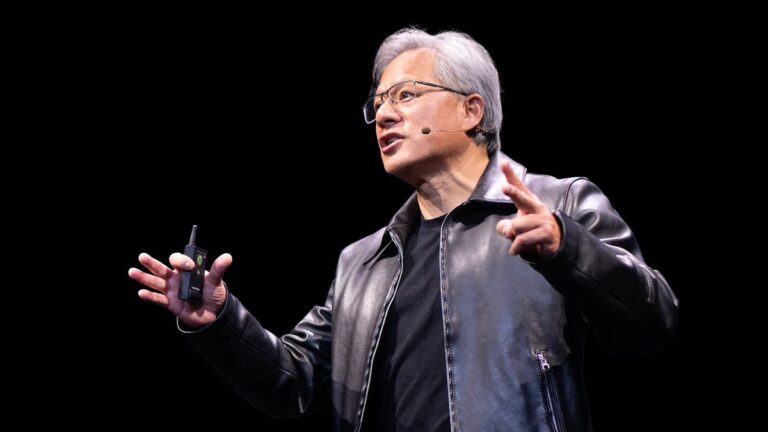

According to reports, NVIDIA CEO Jensen Huang recently sold 6 million shares based on a pre-arranged trading plan, regardless of what was happening in the company or the market. This movement is meant to happen. The sale netted Huang about $713 million, but he still owns more than $100 billion worth of NVIDIA stock.

Another major NVIDIA sale was carried out by NVIDIA board member Mark Stevens, who sold 1.6 million shares worth about $390 million through 2024. However, he has also filed to sell an additional 3 million shares, which could net him more than $731 million. Another board member, Tench Cox, also sold some of his shares earlier this year, netting him $525 million.

Nvidia was in the news earlier this year when the AI GPU rush sent its stock to an all-time high. This made the company overtake Apple, Microsoft and Google as the world’s most valuable company in late June. The market price has since corrected, and the stock price has fallen by about 10%. However, the company is still one of the most valuable companies in terms of market capitalization.

However, some believe that the company’s AI rating is overvalued and in a bubble, so the company’s rosy outlook may not last long. Even Goldman Sachs has doubts about whether its massive investments in hardware and AI training will pay off. AI is currently too expensive and unreliable, and the industry needs to generate at least $600 billion a year to break even.

These sales do not indicate that management expects Nvidia’s stock price to decline precipitously, particularly with respect to Mr. Huang’s pre-planned sale. The actions of some executives and directors are not indicative of the direction the company’s stock is headed. This doesn’t inspire confidence for investors looking to get into this stock, but the sales performance of NVIDIA’s upcoming Blackwell chips will give a better indication of what the market thinks about the company and AI in general. Probably.