Nvidia (NASDAQ:NVDA) is facing some headwinds with delays in its Blackwell GPU architecture. However, the chip giant remains on track to increase shipments of its next-generation GPU platforms in the January quarter (FQ4).

This insight comes from JPMorgan’s Harlan Suhl, an analyst ranked in the top 1% of Street equity professionals, and Stewart, NVIDIA’s senior director of investor relations and strategic finance. He shared the latest information after an investor meeting with Mr. Stecker.

According to Stecker, initial production yield issues were resolved with a mask modification for the B200 GPU chip. Nvidia remains on track to ship “billions of dollars” worth of Blackwell GPU platforms in its fiscal fourth quarter (January quarter), with “continued strong growth” heading into calendar year 2025 .

Stecker also recommends not paying too much attention to the noise that is occurring regarding rack-scale portfolio changes. This is particularly relevant to recent reports regarding the discontinuation of the GB200 Dual Rack 36×2 NVL72 Rack Scale Solution. The company highlighted that the Blackwell GPU platform can support more than 100 different system configurations, including NVL72 and NVL36 solutions, compared to only 19 to 20 configurations with previous generation Hopper GPU platforms.

Stecker also spoke confidently about the “sustainability” of XPU (AI-enabled processing unit) infrastructure spending over the next few years. This is driven by GenAI and the exponential scaling of the underlying models, which requires increased training computing capacity. Nvidia is also focused on expanding the adoption of inference across markets, the early stages of enterprise and sovereign AI efforts, and the expansion of existing workloads such as data processing, databases, and analytics within traditional CPU-centric data center infrastructure. He emphasized a “strong push” toward acceleration. Overall, Nvidia estimates that supporting both new AI workloads and acceleration of existing AI workloads will require $500 billion in infrastructure investments annually.

Summarizing, Sur said, “We believe NVIDIA can continue to execute across all segments. As hyperscale customers continue to adopt GPU-accelerated deep learning to process large data sets, We expect it to grow significantly.”

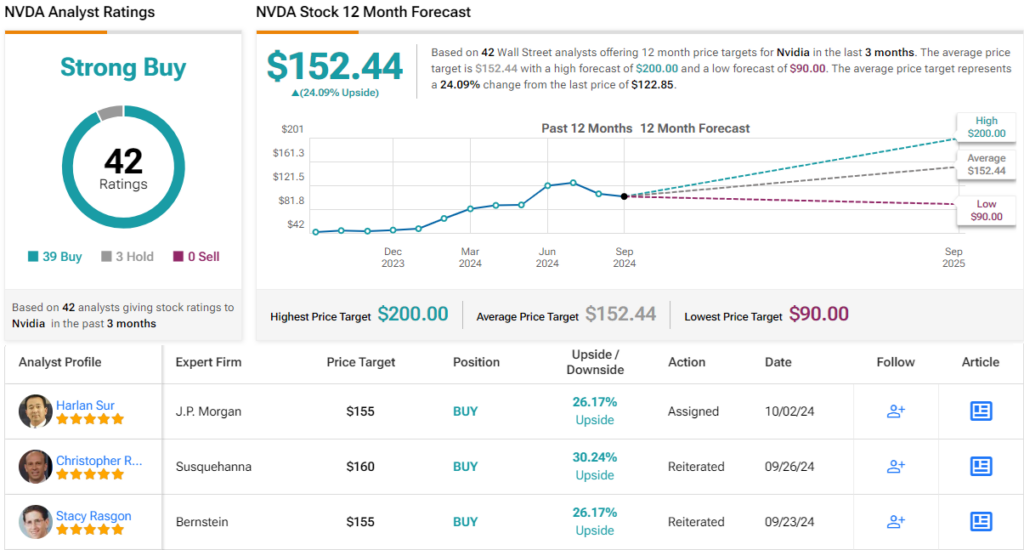

To this end, Sur rates NVDA stock Overweight (i.e. Buy) with a price target of $155, implying a 26% upside in the stock over the coming months. (Click here to see Sur’s track record)

It blends well with the general street sentiment. Analyst consensus rates the stock a Strong Buy, based on a lopsided mix of 39 Buys to 3 Holds. The average price target of $152.44 is only slightly below Sur’s target, implying a potential return of 24% over the next year. (See NVDA stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.