Ever since ChatGPT was released towards the end of 2022 and the power of AI burst into the global consciousness, NVIDIA (NASDAQ:NVDA) has looked like an unstoppable force.

NVIDIA’s growth has skyrocketed dramatically, driven by a wave of megatech companies looking to drive innovation across a variety of sectors. This is evidenced by the company’s share price, which has soared 171% over the past year.

But one investor known as Blue Sea Research sees the surge as a warning sign, predicting that the AI leader could face a period of disruption in the near future.

“Despite NVIDIA’s growing market share, Wall Street may become increasingly cautious about whether the company can maintain its huge profits,” Bluesea said.

The investor cited a number of reasons for his pessimism, including Nvidia’s highly concentrated customer base, which accounts for nearly 50% of its revenue.

“The past few earnings rounds have not shown significant revenue or margin improvement from cloud providers, which may force cloud providers to rein in their AI spending,” the investor opined. Bluesea adds that reducing capital spending by these large scale companies will be a big problem for Nvidia.

Another pressing issue is Nvidia’s increasing competition with AMD, which Bluesea notes is expected to ship $5 billion worth of AI chips in 2024. “If AMD’s current growth trajectory continues into 2025, there could be significant headwinds to Nvidia’s margins,” they wrote. Investor.

Overall, Bluesea highlights a sharp contrast between bullish and bearish forecasts for fiscal year 2026, with the highest forecast being more than four times the lowest.

Investors are not convinced that the rosy numbers will materialize, and the potential returns are not worth the risks. “While the company faces significant headwinds, there is limited upside and the stock is a sell at current prices,” the investor summed up. (Click here to see Bluesea Research’s track record)

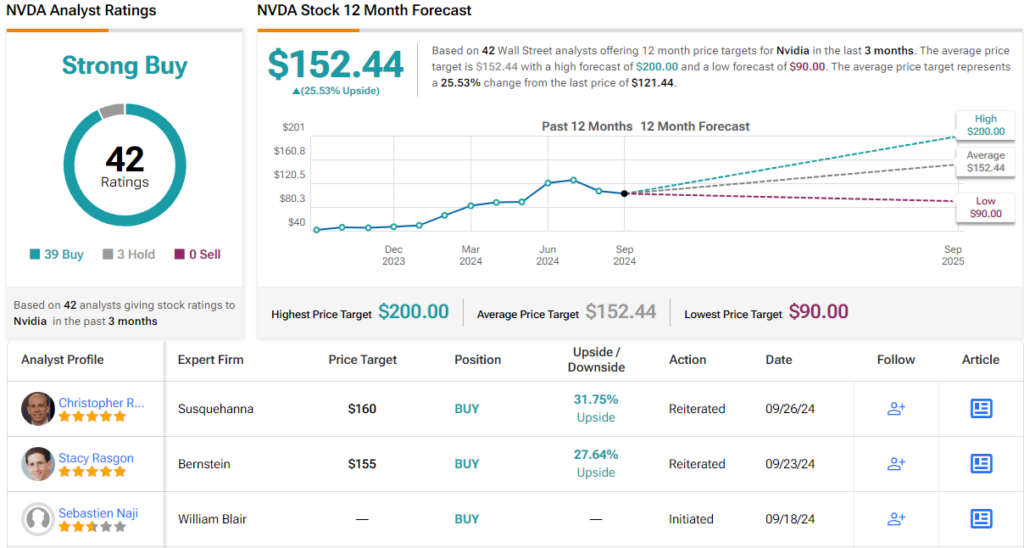

That said, Brucie’s cautious stance stands in contrast to broader market sentiment. Wall Street remains very optimistic about NVDA’s future, with NVDA’s consensus rating being a Strong Buy, with 39 Buy ratings and just 3 Holds. The company’s average 12-month price target is $152.44, implying stock price upside of 25.5% over the next 12 months. (See NVDA stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.