Adam Covissi, editor-in-chief of the Covissi Letter, argues that recession fears are overblown, despite rising volatility in ‘making money’.

Investors in the giant SPDR technology sector fund may be surprised to learn that until last week, its exposure to Nvidia was about four times that of Apple, despite their comparable market values.

The disparity was a big loss for shareholders of the $70 billion State Street Fund, as Apple stock outperformed Nvidia by 10 percentage points in the third quarter. And S&P Dow Jones Indices was forced to throw out its rulebook in light of the growing power of the biggest tech companies.

Ticker Security Last Change % AAPL APPLE INC. 232.90 +5.11 +2.24% MSFT MICROSOFT CORP. 430.30 +2.28 +0.53% NVDA NVIDIA CORP. 121.44 +0.04 +0.03% XLK TECHNOLOGY SELECT SECTOR SPDR ETF +0.6 6 +0.29%

The valuations of Apple, Microsoft, and Nvidia, the three largest U.S. companies by market capitalization, have soared to more than $3 trillion this year. Together, these companies account for more than 60% of the market value of the S&P 500’s information technology sector, which violates capital concentration rules that limit the largest companies’ total stake to 50%.

Over time, it has become clear that passive investing, or tracking an index, typically provides investors with the best returns while also limiting risk. But inconsistencies within the SPDR Fund, one of the world’s largest exchange-traded funds, show that it doesn’t always work the way investors expect. The rally in a handful of big tech stocks has changed the market in ways that few investors could have predicted even a decade ago.

ETF Report: FOXBUSINESS.COM

“The original rules basically worked fine and fairly for the life of these funds,” said Matthew Bartolini, head of Americas research for State Street’s SPDR ETF business. “What really brought this into the public lexicon was the rise of Nvidia. This is the first time we’ve had three stocks in the same sector with market capitalizations over $3 trillion.”

Will we return to the days when money was easy to obtain?

Under federal securities regulations, no more than 25% of a fund’s assets may be invested in a single stock, and the aggregate weight of companies that individually represent more than 5% of a fund’s assets cannot exceed 50%.

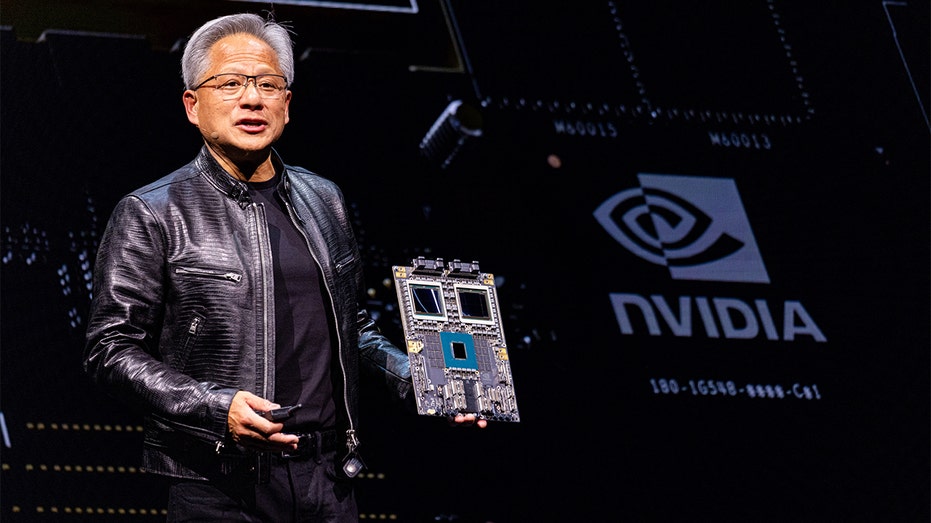

Jensen Huang, co-founder and CEO of Nvidia Corp., speaks in Taipei, Taiwan. (Annabelle Chee/Bloomberg via Getty Images/Getty Images)

To comply with the 50% rule, S&P has traditionally limited the minimum constituent weight to no more than 5% until the index falls below a concentration threshold.

For example, in early June, Microsoft and Apple each had about 22% weighting in the SPDR fund, which tracks the S&P tech sector index. Although the three companies had similar market capitalizations, NVIDIA’s weight was only 6%, so the 50% wall was not triggered.

The situation became especially volatile when it came time for the index’s rebalancing scheduled for June. At the time, Nvidia had just eclipsed Apple’s market capitalization. As a result, Nvidia’s weight jumped to about 21%, and Apple’s weight dropped to about 4.5%. Microsoft was the largest company in the US at the time, with a similar weight of around 21%.

An Apple Inc. sign at the company’s Fifth Avenue store on Wednesday, May 15, 2024 in New York, USA. Apple Inc. aims to revitalize its existing tablet lineup with the release of a new iPad Pro and larger iPad Air that focus on artificial intelligence. exhausted (Photographer: Michael Nagle/Bloomberg via Getty Images / Getty Images)

Index funds had to sell tens of billions of dollars of Apple stock and buy Nvidia stock instead. In the case of the SPDR fund, that amount accounted for about 15% of assets. Adding to the discrepancy, the fund’s next-largest stock, Broadcom, had roughly the same weight as Apple, even though Apple dwarfed the chipmaker’s market capitalization by about four times.

Morningstar analyst Zachary Evens said many investors in popular tech index funds were likely unaware of the discrepancy.

“Many investors will be surprised to see such a disproportionately low weighting for the No. 3 stock in the index,” Evens said. “And the people who knew were becoming increasingly frustrated.”

To address this issue, S&P changed its methodology to comply with the rules ahead of the September 20 rebalancing. The index provider reduced the weights of all three companies in proportion to their market capitalization until their combined composition in SPDR funds was less than 50%.

If the rules had not changed, the fund would again have made large swaps between Nvidia and Apple shares, as Apple would once again become the largest company in the United States, followed by Microsoft and then Nvidia.

The rise of other big companies like Alphabet, Meta Platforms and Amazon.com hasn’t been a problem for the SPDR fund. This is because these companies are not classified as high-tech companies by S&P. These stocks belong to the Communication Services and Consumer Discretionary groups.

Concentration issues are most evident in sector indices that provide concentrated exposure to investors. The tech-heavy Nasdaq 100 index underwent a special unscheduled rebalancing in July 2023 (the first since 2011) to ensure that its largest companies do not collectively account for more than 50% of the benchmark. .

This standard is in place to allow investment vehicles such as mutual funds and ETFs to maintain their status as regulated investment companies that can return profits to shareholders instead of being taxed like regular corporations. There is.

Email Jack Pitcher at jack.pitcher@wsj.com.