Intel is now engaged in a high-risk, multi-year strategy to regain leadership with global implications that intertwine technology, national security and geopolitics, says Fortune writer Jeff Colvin. I’m thinking. But even with Intel’s struggles, as Dan Nystedt pointed out, the US remains the leader in the semiconductor industry, generating $264.6 billion in revenue in 2023 alone.

For decades, Intel has been a symbol of American semiconductor power. But make no mistake: Intel today is not the company it was 10 years ago. The company no longer leads in process technology and has more powerful competitors than ever before.

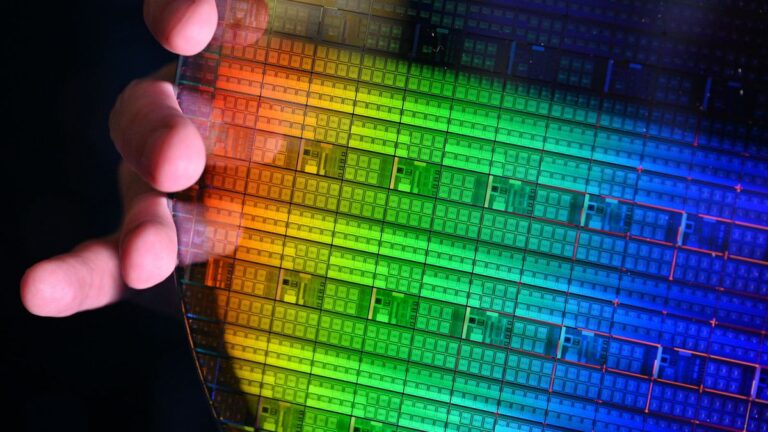

One of the most important semiconductor companies

According to World Semiconductor Trade Statistics (WSTS) and SIA estimates, global semiconductor sales increased from $139 billion in 2001 to $526.9 billion in 2023. Revenues for US-based semiconductor companies increased significantly from $71.1 billion in 2001 to $264.6 billion in 2023. As a result, U.S. semiconductor companies currently dominate the global market with a 50.2% share, according to the Semiconductor Industry Association (SIA). Competitors from other countries account for 7% to 15% of the market, and this distribution is expected to remain stable for some time.

Large U.S. companies such as Intel ($54.22 billion in 2023 revenue), Nvidia ($60.9 billion in 2024 revenue), and Qualcomm ($35.82 billion in 2023 revenue) account for the majority of U.S. chip revenue. (57%), the prosperity of these companies is essential to the country as a whole. Still, if Intel loses, other companies gain.

In 2023, the United States will export $52.7 billion in chips, making it the sixth largest export sector after refined oil, crude oil, aircraft, natural gas, and automobiles.

How Intel lost leadership while Nvidia and Qualcomm gained leadership

Intel has historically dominated the processor and PC markets and eventually established itself in servers as well. The company remains the world’s largest producer of CPUs for client computers and servers. But Intel has missed important market changes, particularly in processors for smartphones and tablets from the late 2000s to early 2010s, and processors for artificial intelligence from the late 2010s to early 2020s. This has allowed competitors such as Nvidia, MediaTek, and Qualcomm to emerge. Nvidia and Qualcomm currently have higher market capitalizations than Intel. Intel also lost leadership in process technology to TSMC, which has a high market capitalization and supplies products to companies such as AMD, Apple, Nvidia, and Qualcomm.

In response to the crisis, Intel’s board reappointed longtime veteran Pat Gelsinger, who left the company in 2008, as CEO for 2021. Mr. Gelsinger launched an ambitious and costly turnaround plan to restore Intel’s position at the forefront of the industry. His strategy was to develop advanced products, design cutting-edge process technology, and produce chips for third parties who would pay for increasingly expensive manufacturing processes and fabs. This required the company to invest tens of billions of dollars in factories. Of course, the economic burden associated with this recovery is enormous. Intel spends about $16 billion a year on new manufacturing capacity that doesn’t provide immediate benefits.

But while Intel lost out on smartphone SoCs and AI processors, Qualcomm and Nvidia capitalized on the rise of smartphones and artificial intelligence to make hundreds of billions of dollars in profits over the years. So did Apple, Broadcom, and to some extent AMD. These are all fabless companies, and while TSMC makes the majority of its chips in Taiwan, its profits are in the US Most of the chips sold around the world are designed in the US High performance and profits The majority of high rate processors are also designed in the United States.

Another factor driving the U.S. semiconductor industry is the advanced fab tools manufactured by companies such as Applied Materials, KLA, and Lam Research. No semiconductor factory in the world is equipped without the tools of these three companies. Only this year did ASML outsell Applied Materials, once the world’s No. 1 maker of chip-making tools.

Why advanced chip manufacturing matters

Of course there is a big pitfall. This allows chips to be manufactured at the most advanced nodes. Currently, only three companies manufacture chips using cutting-edge process technology: Intel, Samsung Foundry, and TSMC. These production nodes manufacture advanced chips such as Apple’s A17 Pro and Nvidia’s H100. Some may argue that Apple’s processors are used in consumer devices, but Apple’s processors are essential to Apple’s economy, and Apple is necessary to the U.S. economy. When it comes to Nvidia’s H100 GPU for AI and supercomputers, such processors are essential to the economy and national security.

Recognizing the strategic importance of semiconductor production in general, and chip manufacturing at the most advanced nodes in particular, the United States passed the CHIPS Act in 2022 to reduce dependence on foreign chips and strengthen domestic production. Intel received its largest subsidy package of nearly $20 billion in grants and loan guarantees to build new factories in Arizona and Ohio. Samsung Foundry and TSMC also received support to build a new factory in the US

One of the reasons the Biden administration decided to propose the CHIPS & Science Act is to revitalize the domestic semiconductor production industry. This decision also has geopolitical elements.

Under President Xi Jinping, China aims to become self-sufficient in semiconductor manufacturing by 2027 (though this is unlikely), while also considering the possibility of military occupation of Taiwan, home to TSMC. As noted in a Fortune report, such a move could disrupt global chip supply and put the United States and China in direct conflict over Taiwan’s semiconductor assets. That’s because U.S.-based companies AMD, Apple, Broadcom, Nvidia, and Qualcomm all depend on TSMC’s semiconductors. State-of-the-art manufacturing capabilities located in Taiwan.

Intel’s plans include starting production of chips in cutting-edge 18A process technology (1.8nm class) in 2025, months before TSMC starts manufacturing products in 2nm manufacturing process, thereby formalizing the process technology. This includes regaining leadership. Meanwhile, Intel faces stiff competition from TSMC and Samsung, which are also expanding their U.S. operations.

What happens if Intel fails?

If something happens to Intel and Pat Gelsinger’s turnaround plan doesn’t work out, will the U.S. semiconductor industry continue to be successful? Yes. However, the condition is that U.S. companies can produce chips in Taiwan and sell equipment to TSMC, UMC, Vanguard and other chip makers. Given the risks, the US government needs to ensure Intel’s long-term success.

The company’s future is currently uncertain, as its success depends on technological innovation, U.S. government support and the broader geopolitical landscape. For example, if the Chinese government orders its agencies to stop using PCs equipped with processors from foreign companies (such as AMD and Intel), this will directly affect U.S. chipmakers in general and Intel in particular.